What is the real cost of living in Dayton? This guide explores how local prices will impact your retirement budget in 2026.

If you value affordability in retirement, Dayton, OH has some real financial perks. In this article, we will explore how Dayton’s housing advantages can free up your savings for the things you really want in retirement.

Key Takeaways

- Housing is Dayton’s “Superpower”: With median home prices up to 37% lower than the national median and significantly more affordable than Cincinnati or Columbus, Dayton allows retirees to keep more of their $750k+ nest egg working in the market rather than tied up in real estate.

- A Massive Win in State Taxes: Ohio moves to a flat 2.75% state income tax in 2026. Since the state doesn’t tax Social Security, Dayton is highly tax-efficient for IRA and pension holders.

- Affordability Without Sacrifice: While healthcare costs sit slightly above the national average, Dayton’s significantly lower electricity rates (21% below average) and manageable transportation costs create a “lifestyle surplus” for travel, hobbies, and family.

Dayton’s Cost of Living at a Glance

What is the real cost of living in Dayton, Ohio?

As of 2026, the Dayton cost of living remains approximately 3% to 7% below the national average. While healthcare costs are slightly higher, the primary financial advantage for retirees is housing. Dayton’s November 2025 median home sale price is approximately $259,900, representing a 37% discount compared to the national median.

Dayton vs. the National Average

If you are planning a retirement budget, the specific details matter more than the broad averages:

- Housing: Dayton’s housing costs are notably lower than the national average. Depending on the source, they sit 16% to 25.2% lower. When comparing recent median sale prices, Dayton’s housing market offers a better deal, between 30-40% cheaper than the national median.

- Groceries: Everyday food costs for cooking at home appear to be coming in at approximately 0.8% to 2% lower than the national average, depending on the source. This means that the cost of groceries is basically the same as the national average.

- Healthcare: The Dayton cost of healthcare has been reported 14% to 15.1% higher than the national average. The good news is that the presence of multiple local networks creates shopping options for those who value quality care.

Housing: Dayton’s Biggest Advantage

Affordable housing is Dayton’s primary financial driver because mortgages are usually a household’s largest bill. Lower costs create a strong advantage for those on fixed incomes and increase your chances of entering retirement with a fully paid-off home.

Home Prices and Ownership Costs

Dayton, Ohio’s housing market provides some great value compared to other major cities.

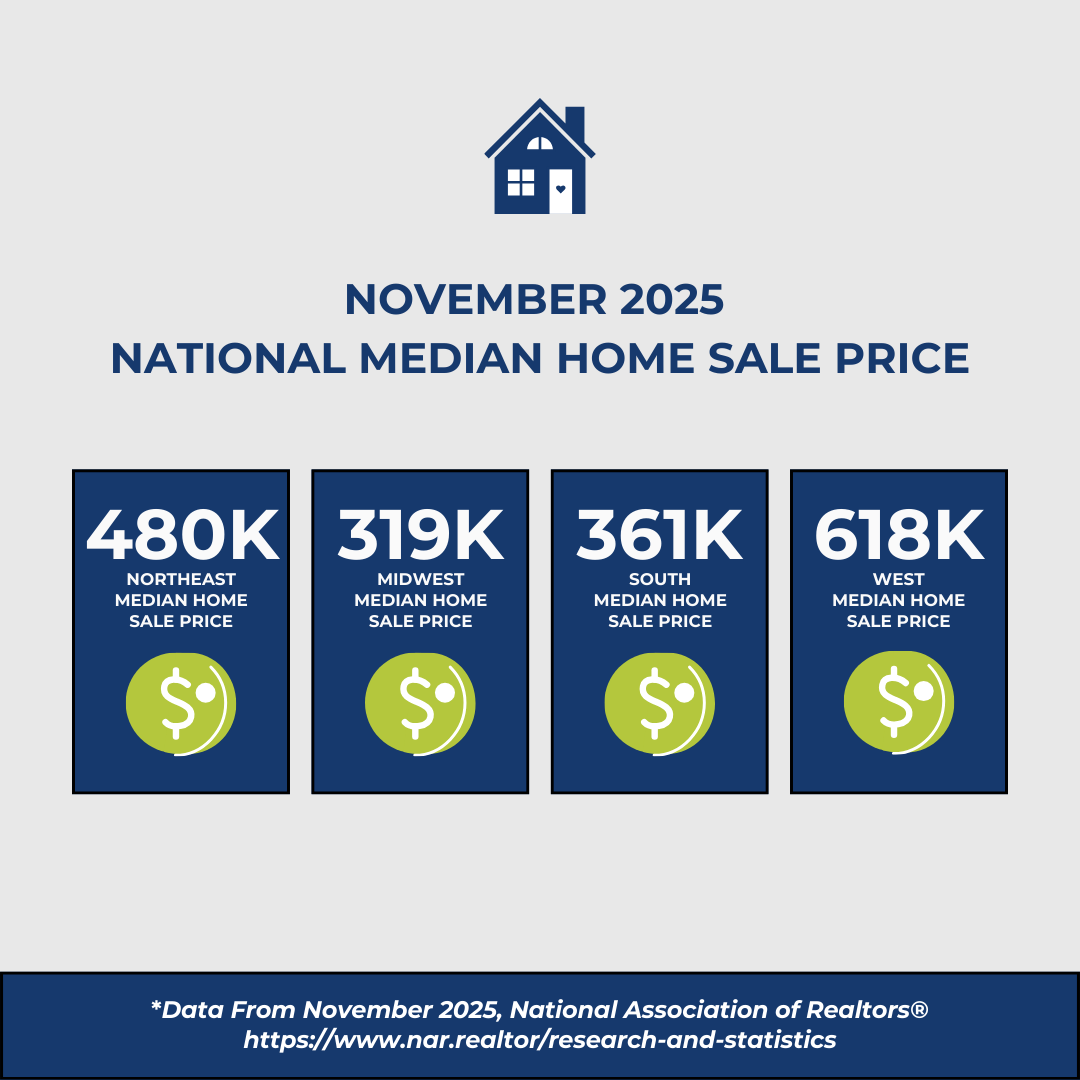

- According to the National Association of Realtors, the median home sale price in the U.S. as of November 2025 was approximately $409,200. This number reflects that the median sale price of a home in the northeast was $480,800, $319,400 in the midwest, $361,000 in the south, and $618,900 in the west.

- In contrast, the Dayton Board of Realtors cites that the median home sale price for the region was $259,900 as of November 2025. This difference amounts to a 37% discount compared to the national average. The average sale price for this same period was $297,596.

- Dayton’s median sale price also beats other nearby cities when comparing November 2025 data, with Cincinnati coming in at $320,000, Indianapolis coming in at $312,000, and Columbus coming in at $325,000.

Low housing costs provide major relief for Dayton retirees. This is especially true for couples with $750,000 to $1,000,000 in savings. Buying a home or carrying a small mortgage is much easier here than the national average, freeing up your savings for daily expenses and fun.

Variation Within The Dayton Metropolitan Area

Like any city, Dayton, Ohio’s housing market depends on where you choose to live. Areas like Dayton proper or Kettering offer noticeable value, while some communities like Oakwood, Bellbrook, and Springboro fall closer to national median and average prices.

| Dayton Community | Average 2024 Sale Price | Median 2024 Sale Price |

| Beavercreek | $358,794 | $333,250 |

| Bellbrook | $447,277 | $406,500 |

| Centerville | $355,478 | $331,962 |

| Dayton (City) | $128,543 | $122,000 |

| Kettering | $248,528 | $229,500 |

| Oakwood | $459,640 | $400,000 |

| Springboro | $513,470 | $434,325 |

*The following chart reflects 2024 median and average sale price data by Dayton RealtorsⓇ.

Rental Market Snapshot

If you prefer to rent in retirement, Dayton, OH is still an affordable choice. According to research by Apartments.com, the average rent in Dayton, OH, is around $977 per month. This is noticeably lower than the national average rent of $1,623, making renting in Dayton, OH about 39% more affordable than the U.S. average.

Daily Living Costs: Utilities, Transportation, and Groceries

While housing is Dayton’s headliner for savings compared to the national average, it’s important to budget for everything else.

Utilities and Home Expenses

Dayton, OH’s utility expenses show mixed results compared to national averages. Data from RentCafe reports that overall utilities are about 9% higher than the national average when including telecommunication and water services. However, authoritative data on electricity is encouraging for the Dayton area:

- The average residential electric bill in Dayton, OH appears to be about $100.98 based on using 898 kWh per month.

- The average residential electricity rate in Dayton, OH appears to be 11.24 cents per kWh, which is 21% lower than the national average rate of 16.24 cents per kWh.

Part of what may be pulling Dayton’s electricity costs down is the use of Ohio’s Energy Choice program, which allows residents to opt into using different electricity providers based on budget needs. This means that you have more control over your electricity costs as a Dayton, Ohio resident.

Transportation

Most people in the Dayton, Ohio area rely on personal vehicles rather than public transit. Transportation expenses in Dayton, OH, are generally close to the national average. The average gasoline price per gallon appears to be around $3.03 compared to the national average of $3.15.

For those that do use public transportation, Dayton RTA rates as of January 2026 are as follows:

| Per Trip | Daily Max | Monthly Max | |

| Regular (13+) | $2.40 | $5.50 | $70.00 |

| Reduced | $1.20 | $2.75 | $35.00 |

Traffic is manageable, leading to shorter commutes than in many major cities, which means savings on gas and vehicle wear-and-tear. The main highways in the Dayton area include I-675, I-35, I-75, and I-70, however most residents in the Dayton metro can commute without needing to access a major highway.

Groceries and Everyday Goods

You can expect grocery costs in Dayton, OH to be pretty close to the national averages. Data from RentCafe cites that costs average .80% lower than the national average. This of course varies based on what you purchase at the store.

For example, RentCafe reports that potatoes, lettuce, and sugar cost slightly more than the national average while potato chips, hamburger, and peaches cost slightly less.

Healthcare Access and Costs in Dayton, Ohio

Healthcare is a top-of-mind concern for most retirees. As noted earlier, the cost of healthcare in Dayton, OH is generally reported as 14% to 15.1% higher than the national average. According to a study by RentCafe and the Council for Community and Economic Research (C2ER), the average Doctor’s visit in Dayton costs $179.23 in 2025 and the average dental visit costs 145.88.

Local Medical Networks

The Dayton, Ohio area features a few major medical networks and hospitals, offering access to quality care and specialized services. Access to multiple health systems can be a competitive marketplace benefit for local retirees. Major medical networks and facilities include:

- Premier Health

- Kettering Health

- Dayton Children’s Hospital

- Dayton VA Medical Center

- UC Health (Satellite Locations)

Healthcare Affordability for Retirees

Managing healthcare costs in retirement is less about location and more about proper insurance coverage. If you are over 65, your Medicare strategy and supplement plan selection are far more important than a regional cost of living index, even if the national average is lower. If you aren’t 65 yet, plans available on the ACA Marketplace in Ohio (often offered by companies like UnitedHealthcare, Anthem, and local providers like Medical Mutual, Ambetter, and Caresource) can be affordable if you are willing to have a high-deductible plan.

Taxes and Retirement Finances

Understanding your tax picture is one of the more complex parts of retirement planning. Recent shifts in our state income tax laws might mean thousands of dollars in savings and a win for the cost of living in Dayton, Ohio.

Ohio’s Tax Landscape for Retirees

Ohio has recently adopted some income tax reforms that will be highly beneficial to retirement savers. In addition to state income tax not being applicable to your Social Security benefits, the following changes have been set in motion:

- Flat Tax Reform: The state is phasing down its non-business income tax to a flat rate of 2.75% starting in tax year 2026.

- 2025 Tax Year: The top marginal rate is reduced to 3.125% from 3.50% on income over $100,000, while the middle rate remains at 2.75%, with a bottom tax rate of 0% for income below $26,050.

- 2026 Tax Year: The state income tax rate will be a flat 2.75% for all non-business taxable income above $26,050.

This dramatic simplification and reduction is a major win for those with higher retirement income from sources like pensions and IRAs, as it significantly reduces the state average tax burden.

Property and Local Taxes in Dayton

While Ohio’s income tax is becoming even more favorable, the local tax picture remains an area for planning.

- Local Income Tax: Many cities and towns in the Dayton, OH metro area have a municipal income tax between 0-3%. The good news for retirees is that Social Security income and income from federally qualified retirement plans (like 401(k)s and IRAs) are generally NOT taxable at the local level. If you have other employment income, such as a small average salary from a part-time job or rental property, you may be required to file and pay the local tax.

- Property Tax Relief: Montgomery County offers several tax reduction programs that can provide some savings for income eligible senior citizens, including the Homestead Exemption Program and the Owner Occupancy Credit. These programs can further reduce the Dayton cost of home ownership, making our cost of living even better.

For more information on the tax landscape for retirees in Ohio, check out our recent blog: “Ohio Retirement Tax Strategies to Optimize Your Budget”

Lifestyle, Recreation, and Quality of Life

Affordable Cost of Living Meets Enjoyment

Dayton, Ohio offers a strong cultural scene including museums (Dayton Art Institute), theaters (Benjamin & Marian Schuster Performing Arts Center), professional sports (MiLB Dayton Dragons), and a revitalizing downtown without the high prices of larger metropolitan areas. The combination of low housing costs and manageable transportation expenses allows for a high quality of life in other areas of your budget.

How Far Retirement Dollars Go in Dayton

Imagine a couple with a $60,000 retirement income. Because Dayton, Ohio’s housing costs are so much lower than the national average, a significant portion of that income, which might be consumed by a mortgage or high rent is freed up.

When your housing costs are nearly 20%-40% below the national average, that means a more comfortable retirement and less financial stress. For example, according to Nasdaq.com and GoBankingRates, the national average retirement household (age 65+) spends around $57,818/yr, or about $5,000/mo. However, in Ohio as a whole, the average salary for a retiree is only $53,308/yr.

For more information on how much you’ll need to budget for retirement in Ohio, check out our recent blog: “How Much Do You Need to Retire Comfortably in Ohio? A Budget-Based Guide”

Final Thoughts: Why Retirees Are Choosing Dayton

Dayton, Ohio’s low cost of living is not a secret. It’s a place where your money is simply a tool that enables the lifestyle you’ve always wanted, rather than a problem you constantly have to solve.

You’ve worked hard to save at least $750,000. Now it’s time to make sure those dollars work just as hard for you. A successful retirement in Dayton, OH is one where you aren’t just surviving, you’re thriving.

Want Help Making the Most of Your Dayton Retirement? Contact Stage Ready Financial Planning for a Personalized Consultation

You’ve reviewed the numbers, and the financial advantage of retiring in Dayton, OH is strong. But researching the cost of living is only part of the battle. The other part is making sure your savings, investments, and tax strategy are all working together to maximize your opportunity here.

At Stage Ready Financial Planning, we specialize in building retirement plans for individuals and couples just like you in Southern Ohio, providing the confidence that your retirement is set up correctly and your money will last.

Schedule your complimentary intro call today!

Frequently Asked Questions (FAQs)

Is Dayton, Ohio an affordable place to live in 2025?

Yes, Dayton, Ohio is consistently ranked as an extremely affordable place to live with close access to other major cities. Our overall cost of living is commonly reported to be 3% to 7% lower than the national average, however the discount may be even greater. The most significant savings come from Dayton’s extremely low housing costs making it easier to get by on a living wage.

How much does it cost to buy or rent a home in Dayton?

The median sale price for a home in the Dayton, OH metro area was approximately $259,900 as of November 2025, while the average rent in Dayton, OH, is around $977 per month. Housing is Dayton’s biggest advantage, with costs noticeably lower than the national average.

How does Dayton’s cost of living compare to cities like Cincinnati or Columbus?

While a complete comparison wasn’t included in this article, Dayton, OH generally has a lower cost of living than both Cincinnati and Columbus, primarily due to more affordable housing costs. For example, Dayton’s median sale price of $259,900 as of November 2025 data was lower than Cincinnati coming in at $320,000 and Columbus coming in at $325,000.

What local taxes should retirees consider when living in Dayton?

Most Dayton, OH area cities have a local income tax, but Social Security Benefits and income from qualified retirement plans (like IRAs/401(k)s) are NOT taxable at the local level. You may still be required to file a local return for any earned income in retirement coming from part-time work or owning rental properties.

On the state income tax level, Ohio doesn’t tax Social Security Benefits and it’s upcoming flat state average income tax will also be beneficial starting for tax year 2026. Retirees should also look into property tax relief programs like the Homestead Exemption and the Owner Occupancy Credit.

For more information on the tax landscape for retirees in Ohio, check out our recent blog: “Ohio Retirement Tax Strategies to Optimize Your Budget”

About the Author

Joseph A. Eck, CFP®, is the founder and lead advisor at Stage Ready Financial Planning, a fee-only RIA based in Dayton, Ohio. With over 10 years of experience in wealth management, Joseph specializes in helping southern Ohio retirees with at least $750,000 in investable assets navigate the “red zone” of retirement. As a Certified Financial Planner® professional, he is dedicated to providing transparent, fiduciary advice that helps clients minimize taxes under Ohio’s evolving laws. When he isn’t helping neighbors in Kettering and Centerville optimize their retirement, Joseph is an active member of the Dayton community, embodying the same humble, hard-working ethos as the clients he serves. Click here to learn more about Joseph.

Article References

- Apartments.com. “Cost of Living in Dayton OH – Apartments.com.” Accessed December 15, 2025. https://www.apartments.com/cost-of-living/dayton-oh/

- RentCafe. “Cost of Living in Dayton, OH 2025.” Accessed December 15, 2025. https://www.rentcafe.com/cost-of-living-calculator/us/oh/dayton/

- Apartments.com. “Average Rent in Dayton, OH – Latest Rent Prices by Neighborhood.” Accessed December 15, 2025. https://www.apartments.com/rent-market-trends/dayton-oh/

- RentCafe. “Average Rent in Dayton, OH: 2025 Rent Prices by Neighborhood.” Accessed December 15, 2025. https://www.rentcafe.com/average-rent-market-trends/us/oh/dayton/

- PowerOutage.us. “Compare Dayton, OH electricity rates and plans (December 2025).” Accessed December 15, 2025. https://poweroutage.us/electricity-rates/oh/dayton

- Ohio Legislative Service Commission (LSC). “Bill Analysis (S.B. 3).” Accessed December 15, 2025. https://www.legislature.ohio.gov/download?key=24427

- ITR Foundation. “Ohio’s New 2.75% Flat Tax Puts Pressure on Other States.” Accessed December 15, 2025. https://itrfoundation.org/ohios-new-2-75-flat-tax-puts-pressure-on-other-states/

- Policy Matters Ohio. “Flat income tax puts Ohio among top 5 states for millionaire tax cuts.” Accessed December 15, 2025. https://policymattersohio.org/news/2025/10/16/flat-income-tax-puts-ohio-among-top-5-states-for-millionaire-tax-cuts/

- Montgomery County, OH Official Website. “Tax Reduction Programs.” Accessed December 15, 2025. https://www.mcohio.org/665/Tax-Reduction-Programs

- Dayton Realtors. “Local Market Update for November 2025.” Accessed December 15, 2025. https://daytonrealtors.org/housing-data/

- National Association of Realtors. “Existing-Home Sales Rose 0.5% in November.” Accessed December 15, 2025. https://www.nar.realtor/newsroom/nar-existing-home-sales-report-shows-0-5-increase-in-november

- Council for Community and Economic Research. “COLI Index Data 2025.” Accessed December 15, 2025. https://www.coli.org/

- Cincinnati Area Board of Realtors. “November 2025 Market Report.” Accessed December 15, 2025. https://cincyrealtoralliance.com/

- MIBOR Realtor Association. “Central Indiana Market Insights.” Accessed December 15, 2025. https://www.mibor.com/buyers-sellers/market-insights/

- Columbus Realtors. “Central Ohio Housing Report November 2025.” Accessed December 15, 2025. https://columbusrealtors.com/

- Nasdaq. “6 Reasons You Need at Least $635k Plus Social Security to Retire in Ohio.” Accessed December 15, 2025. https://www.nasdaq.com/articles/6-reasons-you-need-least-635k-plus-social-security-retire-ohio

Community Resources

- Energy Choice Ohio. “Compare Electric and Natural Gas Rates.” Accessed December 15, 2025. https://energychoice.ohio.gov/

- Greater Dayton RTA. “Fares and Pass Prices January 2026.” Accessed December 15, 2025. https://www.iriderta.org/pay/fares

- Ohio Department of Taxation. “Individual Income Tax Rates for Tax Years 2025-2026.” Accessed December 15, 2025. https://tax.ohio.gov/individual/file-now/annual-tax-rates

- Montgomery County Auditor. “Homestead and Senior Property Tax FAQ.” Accessed December 15, 2025. https://tax.ohio.gov/help-center/faqs/real-property-tax-homestead-means-testing/real-property-tax–homestead-means-testing

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.