Imagine this: you’re retired, enjoying a beautiful sunset from your porch, with no worries about money. Thanks to smart Ohio retirement tax strategies, your retirement income is flowing smoothly, and you’re confident you have enough to enjoy your ideal lifestyle.

This dream can be your reality! Keep reading to discover strategies can help you keep more of your hard-earned money and make the most of your retirement in the Buckeye State.

Be sure to consult with your tax professional before taking action with these concepts.

Article Key Takeaways

- Social Security is untaxed by Ohio, but pre-tax retirement accounts and most pensions are taxable. Be sure to factor in your property and sales taxes.

- Prioritize your after-tax accounts early and consider Roth conversions. Use low-income years to fill your tax bracket and leverage tax-free accounts.

- Ohio’s tax credits and property tax relief programs may reduce your annual tax burden and improve your cash flow.

What to Know About Ohio Taxing Your Retirement Income

When it comes to retirement income tax planning, knowing what’s taxed and what’s tax exempt is the first step. From there, you can explore tax breaks and strategies that can make a big difference in how far your money goes.

Retirees in Ohio are exempt from paying Ohio income taxes on the following sources of income:

- Social Security benefits

- Certain railroad retirement benefits

- Military retirement pay

These retirement income sources are still subject to Ohio income taxes:

- Income from non-military pensions or profit sharing accounts

- Distributions from pre-tax retirement accounts including your 401(k), Traditional IRA, TSP, 403b, or 457

Understanding Ohio’s Tax Structure for Retirees

Once you’ve figured out if your income sources are taxable in Ohio, the next step is to estimate what you’ll have to pay.

Income Tax in Ohio

Ohio’s income tax brackets are based on your “adjusted gross income.” This is different than how your federal income taxes are calculated.

According to the Ohio Department of Taxation, your state income tax brackets are the same whether you are working or retired:

| Ohio Taxable Income (As of 2024) | Rate |

| $0 – $26,050 | 0% of Ohio taxable nonbusiness income |

| $26,051 – $100,000 | $360.69 + 2.75% of excess over $26,050 |

| $100,001 + | $2,394.32 + 3.50% of excess over $100,000 |

For example, if you file your taxes as Married filing jointly and have an adjusted gross income of $120,000, you will be in Ohio’s 3.50% state income tax bracket.

Local Income Tax in Ohio

As a retiree if you don’t have earned income, you likely won’t need to worry about this. However, if you are employed in retirement, you may have to pay local income taxes to your city on your wage income.

City income tax rates tend to range between 0-3% with some municipalities having no local income tax. These taxes don’t apply to your pension, retirement account income, or Social Security benefits.

For example, Dayton has a local income tax rate of 2.5%, while Cincinnati has a rate of 1.8%. If you are a retiree with part-time income or rental properties in these cities, you should factor in these local taxes.

Property Tax in Ohio

Even if you pay off your mortgage before you retire, you will still have to pay property taxes. According to SmartAsset, Ohio’s average property tax rate is approximately 1.41%, which is above the national average.

The good news is that this rate is offset by Ohio’s low cost of housing. Ohio’s median home price in 2024 is approximately $235,000, well below the national median of $412,000.

Sales Tax in Ohio

Another consideration that impacts how far your retirement income goes is how much you will need to budget for sales taxes.

According to the Tax Foundation, Ohio has a 5.75% state sales tax. When you include local sales tax in Ohio, the combined state and local sales tax is approximately 7.24%.

Certain common items are exempt from sales tax in Ohio including:

- Groceries (Does not include alcoholic beverages, dietary supplements, soft drinks, or tobacco)

- Prescription Drugs

- Newspapers

Inheritance & Estate Tax in Ohio

Great news for retirees in Ohio: The estate tax in Ohio was repealed on January 1, 2013! This means that your family will not have to pay any estate or inheritance taxes to Ohio if you pass away. Federal taxes may still apply if you’ve accumulated a very large estate.

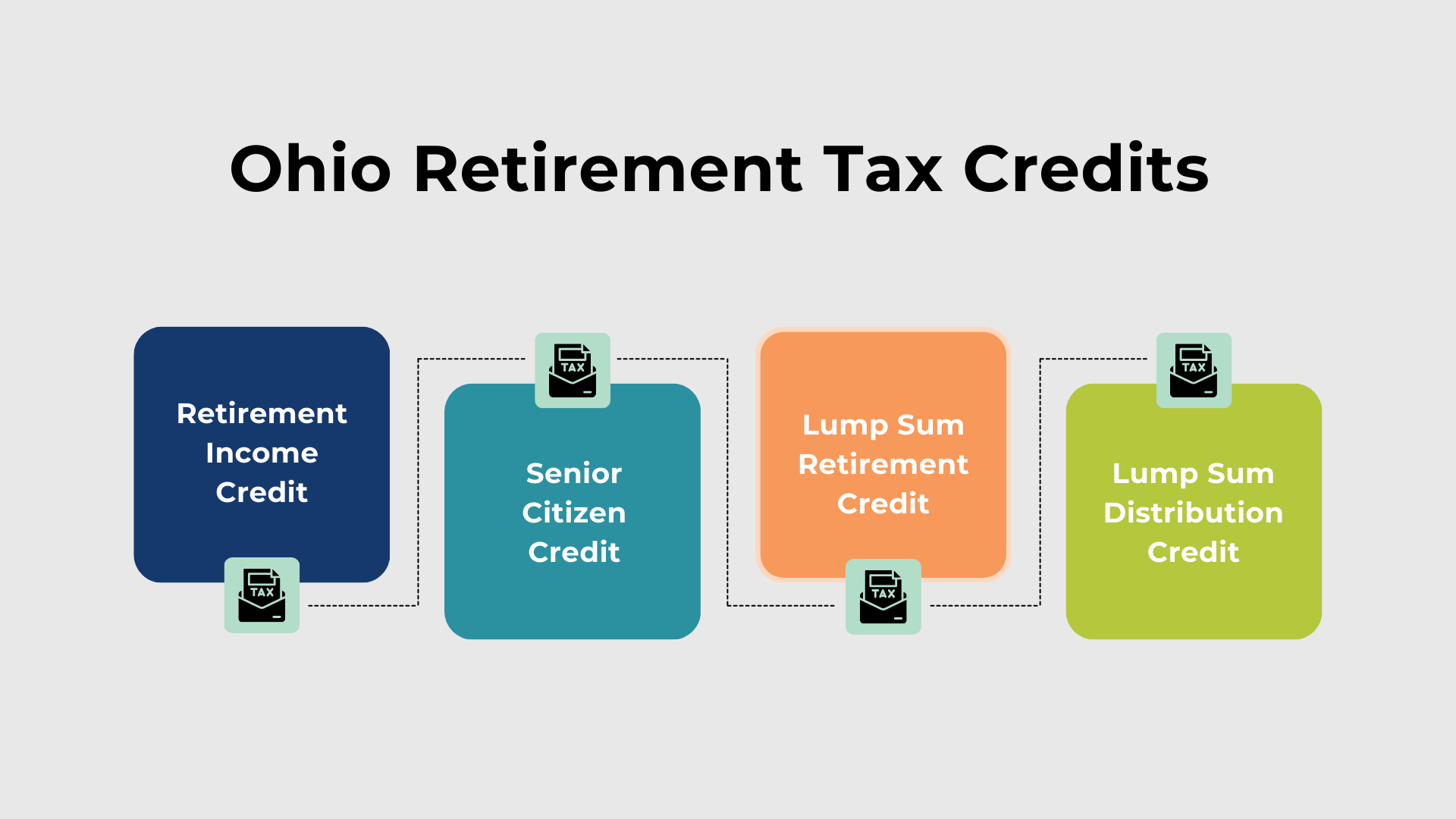

Ohio Retirement Tax Credits

Ohio offers a few tax credits designed specifically for retirees. Below we will discuss the main ones, because these may lighten your tax burden. It’s important that you consult your tax professional if you think you might qualify for any of these tax credits.

Retirement Income Credit

If your Ohio modified adjusted gross income (MAGI) is less than $100,000, you may qualify for this tax credit. It’s based on the total amount of retirement income you’re receiving.

According to the Ohio Department of Taxation, in 2024:

| Retirement Income Included in Ohio Adjusted Gross Income | Retirement Credit Amount |

| $500 or less | $0 |

| $501 to $1,500 | $25 |

| $1,501 to $3,000 | $50 |

| $3,001 to $5,000 | $80 |

| $5,001 to $8,000 | $130 |

| Over $8,000 | $200 |

If you’re receiving certain pension payments or distributions from retirement accounts, this credit might help offset those income taxes on your Ohio tax return.

Senior Citizen Credit

If you’re 65 or older and your MAGI is less than $100,000, you may be eligible for a $50 tax credit. It’s not a huge amount, but every little bit helps. This credit is also available to be claimed on the Ohio school district income tax return.

If you claim the Lump Sum Distribution Credit (we’ll talk about that shortly), you can’t claim the Senior Citizen Credit in the same or any future years, except for on the school district tax return.

Lump Sum Retirement Credit

If you receive a one-time distribution from a retirement account or maybe you decide to cash out a pension or a profit-sharing plan, you might want to claim the Lump Sum Retirement Credit. It can help reduce the tax burden created by that distribution.

According to the Ohio Department of Taxation, here’s how the basic calculation works:

- Use the annuity tables to figure out your remaining life expectancy (Table provided on worksheet)

- Divide the lump-sum amount included in your Ohio AGI by your life expectancy to get your “annual income”

- Check the Retirement Income Credit table for the credit amount that matches your annualized income (Table provided on worksheet)

- Multiply that amount by your life expectancy to calculate your total credit

It’s a little complicated, but it may result in significant savings. Just keep in mind that claiming this credit means you won’t qualify for the Retirement Income Credit both now and in the future.

Lump Sum Distribution Credit

If you’re 65 or older and received a one-time retirement distribution, you might qualify for this credit instead of the Senior Citizen Credit.

According to the Ohio Department of Taxation, here’s how the basic calculation works:

- Multiply your remaining life expectancy by $50 (Table provided on worksheet)

- The credit maxes out at $1,000

However, like the Lump Sum Retirement Credit, claiming this one means you can’t take the Senior Citizen Credit both now or in the future.

Property Tax Relief Programs for Seniors in Ohio

Property taxes are another big expense in retirement, but Ohio has programs to help you manage these costs.

The Homestead Exemption

If you’re 65 or older and meet the low-income or disability requirements, you could qualify for a reduction in the taxable value of your home, which can ultimately lower your property taxes.

Qualifying individuals can exempt up to $25,000 of the market value of their home from all local property taxes.

Be sure to consult your tax professional if you think you might qualify for this exemption and visit the link above for instructions on how to apply.

How to Optimize Retirement Account Withdrawals in Ohio

Strategic retirement account withdrawals can help you save on taxes.

- Taxable Before Tax-Deferred: Sometimes it can also be helpful to distribute income from your after-tax (brokerage) accounts before you begin living on your tax deferred accounts. After-tax accounts may be taxed at long-term capital gains rates instead of ordinary income tax rates.This strategy also allows you to benefit from a longer period of compounding on your tax-deferred accounts.

- Fill Up Your Current Bracket: If you’re in a lower tax bracket early in retirement, consider pulling more or converting your pre-tax accounts like your Traditional IRA or 401(k) to Roth. This might help you avoid a higher tax bracket later when required minimum distributions (RMDs) kick in.

- Use Tax Free Income Sources: Another great tool for balancing your tax burden is your Roth IRA and your Heath Savings Account (HSA). Roth IRA withdrawals are typically tax-free in retirement. Health Savings Account (HSA) distributions are also tax-free if used for unreimbursed qualified medical expenses.

Other Tax Strategies to Consider

Beyond income tax planning, here are a few more concepts to keep the IRS from taking more than their fair share:

- Bunching Deductions: Itemized deductions, like medical expenses exceeding 7.5% of your adjusted gross income, can potentially reduce your taxable income. Combine eligible medical expenses or charitable donations in one year to maximize your itemized deductions.

- Tax-Loss Harvesting: This involves selling investments inside your taxable brokerage account that have lost value and using those losses to offset your capital gains. This can be a valuable tool for managing your taxes in retirement, especially if you have a significant amount of capital gains.

- Charitable Qualified Distributions: Qualified charitable distributions (QCDs) from your IRA or 401(k) may lower your taxable income when you have to take RMDs (Required Minimum Distributions).

- Gifting Highly Appreciated Securities: Instead of giving cash, you can donate stocks, bonds, or mutual funds that have significantly increased in value from your taxable brokerage account. This allows you to avoid paying capital gains taxes on the appreciation, and you may also be able to deduct the full market value of the securities as a charitable contribution.

Why Retirement Tax Strategies Are Important

Every dollar you save on taxes is a dollar you can spend on what really matters to you. Tax planning can help you align your money with goals like traveling, spoiling your grandkids, or enjoying your ideal retirement.

And let’s be honest: no one wants to leave the IRS a tip!

Overall Takeaways

As a retiree in Ohio, you can feel confident that with the right approach to tax planning, it’s possible to minimize your tax burden and make the most of your retirement savings.

Keep in mind that tax planning isn’t just about lowering your taxes in any single year, instead it’s about paying less taxes over the course of your life. The key is to plan ahead to take advantage of credits, income exemptions, retirement account types, conversion approaches, and the best withdrawal strategies available.

Frequently Asked Questions (FAQs)

Is Ohio tax-friendly for retirees?

It depends. Your social security benefits aren’t taxed, and there are several state tax breaks and credits for retirees, but other retirement income is subject to state taxes. You will also pay Ohio’s property taxes and sales tax.

What income is not taxable in Ohio?

Social security benefits, certain railroad retirement benefits, and most military pensions are exempt from Ohio’s state income taxes. Like most states, Ohio also doesn’t tax qualifying distributions from Roth IRAs, 529s, and Health Savings Accounts (HSAs).

Make the Most of Your Ohio Retirement with Stage Ready Financial Planning

When it comes to tax planning in retirement, there’s no one-size-fits-all approach. That’s where we come in in coordination with your CPA or tax professional. Let’s work together to create a plan that keeps more of your money in your pocket and helps you enjoy your ideal retirement. Schedule your intro call today!

About the Author

Joseph A. Eck, CFP®, is a financial planner with a passion for helping individuals and families navigate the complexities of retirement planning. He specializes in developing personalized strategies that optimize retirement income and minimize tax liabilities. With years of experience in the financial services industry, Joseph is dedicated to empowering his clients to achieve their financial goals and enjoy a secure and fulfilling retirement. He is committed to staying up-to-date on the latest tax laws and regulations to provide his clients with the most informed and effective guidance. Click here to learn more about Joseph.

Article References

-

Ohio Department of Taxation. (2024). Annual Tax Rates. Retrieved from https://tax.ohio.gov/individual/resources/annual-tax-rates

-

SmartAsset. (2024). Ohio Property Tax Calculator. Retrieved from https://smartasset.com/taxes/ohio-property-tax-calculator

-

Tax Foundation. (2024). State and Local Sales Tax Rates in 2024. Retrieved from https://taxfoundation.org/location/ohio/

-

Ohio Department of Taxation. (2023). Estate Tax. Retrieved from https://tax.ohio.gov/professional/estate

-

Ohio Department of Taxation. (n.d.). Income & Retirement Income FAQs. Retrieved from https://tax.ohio.gov/help-center/faqs/income-retirement-income

-

Ohio Department of Taxation. (2023). IT 1040 and SD 100 Instruction Booklet. Retrieved from https://dam.assets.ohio.gov/image/upload/tax.ohio.gov/forms/ohio_individual/individual/2023/it1040-sd100-instructionbooklet.pdf

-

Ohio Department of Taxation. (2022). IT 1040 and SD 100 Instruction Booklet. Retrieved from https://dam.assets.ohio.gov/image/upload/tax.ohio.gov/forms/ohio_individual/individual/2022/it1040-sd100-instruction-booklet.pdf

-

Ohio Department of Taxation. (n.d.). Real Property Tax – Homestead Means Testing FAQs. Retrieved from https://tax.ohio.gov/help-center/faqs/real-property-tax-homestead-means-testing/real-property-tax–homestead-means-testing

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.