You’ve worked hard to save for retirement, and now it’s time to start using your money…but how much will taxes take? If you’re over 50 and thinking about withdrawing from your retirement accounts, understanding your 401(k) withdrawal tax rate is important.

Without a plan, you could end up paying more to the IRS than necessary. But with the right strategies, you can keep more of your savings and enjoy your retirement income. This article breaks down how 401(k) withdrawals are taxed and how your investment distributions impact your federal and state tax rates. We will also discuss strategies to help you avoid a surprise tax bill.

Article Key Takeaways

- Understand How Taxes Impact Your 401(k) Withdrawals: Learn how federal and state taxes apply to your distributions and why your income level matters.

- Know the Rules to Avoid Penalties: Avoid early withdrawal penalties and learn about exceptions for medical expenses, emergencies, and rollovers.

- Strategize for a Tax-Efficient Retirement: Plan withdrawals wisely to stay in lower tax brackets and optimize your income.

Understanding How 401(k) Withdrawals Are Taxed

Withdrawals from your pre-tax 401(k) are subject to federal and sometimes state income taxes. This is because pre-tax 401(k) contributions are made with untaxed income, meaning the dollars haven’t been taxed yet.

If you made Roth or after-tax contributions to your 401(k), you may be able to make potentially tax-free withdrawals. This works because Roth or after-tax 401(k) contributions are already taxed.

What Is the Tax Rate on 401(k) Withdrawals?

The federal tax rate on your 401(k) withdrawals depends on your taxable income at the time of the distribution. Since 401(k) contributions are often made using pre-tax income, your withdrawals will likely be taxed just like any other income you earn.

Your withdrawal tax rate depends on your total income, including investments, Social Security, and pensions. The higher your taxable income, the higher your income tax rate might be.

According to the IRS, here are the 2025 federal tax brackets for those who file their return as Married Filing Jointly:

| MFJ Taxable Income | Tax Rate |

| $0 to $23,850 | 10% |

| $23,851 to $96,950 | 12% |

| $96,951 to $206,700 | 22% |

| $206,701 to $394,600 | 24% |

| $394,601 to $501,050 | 32% |

| $501,051 to $751,600 | 35% |

| Over $751,600 | 37% |

Example: In 2025 A married couple, both age 62, have an adjusted gross income (AGI) of $100,000. Filing jointly, they take the $30,000 standard deduction, leaving them with $70,000 in taxable income, placing them in the 12% tax bracket.

If they withdraw $34,000 from their 401(k)s, their taxable income rises to $104,000, pushing a portion of their income into the 22% tax bracket.

Important Note: Only the portion above $96,950 (the 12% bracket limit for 2025) is taxed at 22%. Their first $96,950 remains taxed at lower rates.

When Do You Pay Taxes on 401(k) Withdrawals?

You will owe federal and potentially state income taxes on your pre-tax 401(k) withdrawals for the calendar year that you take money out. Your 401(k) custodian will report your distributions to the Internal Revenue Service (IRS) and at year end. You will receive a 1099-R the following spring that displays your distributions along with any taxes withheld.

Most 401(k) distributions require 20% federal tax withholding, and some states also have minimum withholding rules. When you choose to take money out of your 401(k), you will likely have the ability to withhold more taxes than these required minimums.

If you’ve withheld enough federal and state income taxes from your 401(k) distributions to cover the tax liability, then you might not owe anything more come the following April. If you under withhold, you might owe additional taxes or underpayment penalties.

What Are Required Minimum Distributions (RMDs)?

Required minimum distributions (RMDs) are distributions that you have to take from your pre-tax retirement accounts as you get older. They are designed by the IRS to make sure that your retirement savings are eventually used rather than left to grow tax-deferred indefinitely.

The SECURE 2.0 Act changed the age that your RMDs need to start. According to the IRS, once you reach age 73, you must begin taking required minimum distributions (RMDs) from your pre-tax 401(k) or any pre-tax retirement account.

- Your first RMD must be taken by April 1st of the year following the year you turn 73.

- All subsequent RMDs are due by December 31st each year.

- In 2033, the RMD age is set to increase to 75 under current laws.

How Are My RMDs Calculated?

Each year, your RMD is determined by dividing your prior year-end retirement account balance by a life expectancy factor found in the IRS Uniform Lifetime Table. The larger your balance and the lower your life expectancy factor, the higher your required withdrawal.

You can use the IRS RMD Worksheet or an online RMD calculator to estimate your required distribution.

Are There Penalties for Missing RMDs?

RMDs are taxed at your ordinary income tax rate, just like any other 401(k) withdrawal. If you fail to take your full RMD, the IRS imposes a penalty of 25% of the amount not withdrawn. This penalty is on top of the income tax due on your missed RMD.

Are There Any Exceptions to RMDs?

- Still Working: If you are still employed and participating in your current employer’s 401(k), you might be able to delay RMDs from that plan but not from your other retirement accounts.

- Roth 401(k) RMD Rule Change: Roth 401(k)s are no longer subject to RMDs, aligning them with Roth IRAs.

RMDs force you to claim additional taxable income, which could push you into a higher tax bracket. Later in the article, we’ll discuss strategies to manage RMDs, including strategic withdrawals, Roth conversions, and Qualified Charitable Distributions (QCDs).

What Is the Early Withdrawal Penalty for a 401(k)?

If you withdraw funds from your 401(k) before the age of 59.5, you may face a 10% early withdrawal penalty in addition to the income taxes you owe for the distribution. The IRS penalty discourages early withdrawals, as they can significantly reduce your retirement savings over time.

According to the IRS, there are exceptions where you can avoid the penalty. Here are a few common examples:

- Rollovers: Transfers from one retirement plan directly to another retirement plan within 60 days typically avoids taxes and the 10% penalty.

- Disability: If you become permanently disabled, you may take early withdrawals without the penalty.

- Personal Emergency Expense: 401(k) plans now allow one penalty-free withdrawal per year for personal emergency expenses. The amount is up to the lesser of $1,000 or the vested account balance over $1,000.

- Medical Expenses: Withdrawals used to cover medical expenses that exceed 7.5% of your adjusted gross income (AGI) may avoid the penalty.

- Early Separation from Employment: If you leave your job between age 55 and 59.5, you may be able to take 401(k) withdrawals without a penalty. Federal and state taxes will still apply. This exception does not apply to IRAs.

- Qualified Domestic Relations Order (QDRO): If the withdrawal is made due to a divorce settlement, the penalty may be waived.

- Birth or Adoption of a Child: You may withdraw up to $5,000 penalty-free for birth or adoption expenses.

Important Note: Even if an exception applies, you may still owe federal and state income taxes on your withdrawal. Always check with your tax professional before taking distributions.

How Do State Taxes Affect Your 401(k) Withdrawal?

Your 401(k) withdrawal may incur federal and state taxes depending on where you live. Some states have an income tax and some don’t. Additionally, there are states with an income tax that don’t tax retirement income.

The following chart outlines how different states tax 401(k) withdrawals::

| States With No Income Tax | Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming, New Hampshire |

| States With An Income Tax That Don’t Tax Retirement Income | Illinois, Iowa, Mississippi, Pennsylvania |

| States With An Income Tax That Tax Retirement Income | All Others |

Example: Lets say you are already in the 22% federal tax bracket and your state has an income tax of 3.5% on retirement income. If you withdraw an additional $10,000 from your 401(k) and it doesn’t push you into another tax bracket, you would owe:

- Federal tax: $2,200 (22% of $10,000)

- State tax: $350 (3.5% of $10,000)

- Total taxes due for this withdrawal: $2,550 (or 25.5%)

How Do Ohio State Taxes Affect Your 401(k) Withdrawal?

In Ohio, the state tax rate on all income, including 401(k) withdrawals follows a progressive system. Ohio determines your tax bracket based on your adjusted gross income.

Here’s a quick breakdown of the current Ohio state tax brackets:

| Adjusted Gross Income | Ohio State Tax Rate |

| $0 – $26,050 | 0% |

| $26,051 – $100,000 | $360.69 + 2.75% of excess over $26,050 |

| $100,000 + | $2,394.32 + 3.50% of excess over $100,000 |

Example: A married couple who are both age 62 have an adjusted gross income of $90,000 placing them in the 2.75% Ohio tax bracket. If they file jointly and take the $30,000 federal standard deduction, they would have taxable income of approximately $60,000. This places them in the 12% federal tax bracket.

Withdrawing $44,000 more would raise their taxable income to $104,000 and adjusted gross income to $134,000. This would move them into the 22% federal tax bracket and the 3.50% Ohio tax bracket. This means a portion of their new income will be taxed at higher rates, increasing their overall tax bill.

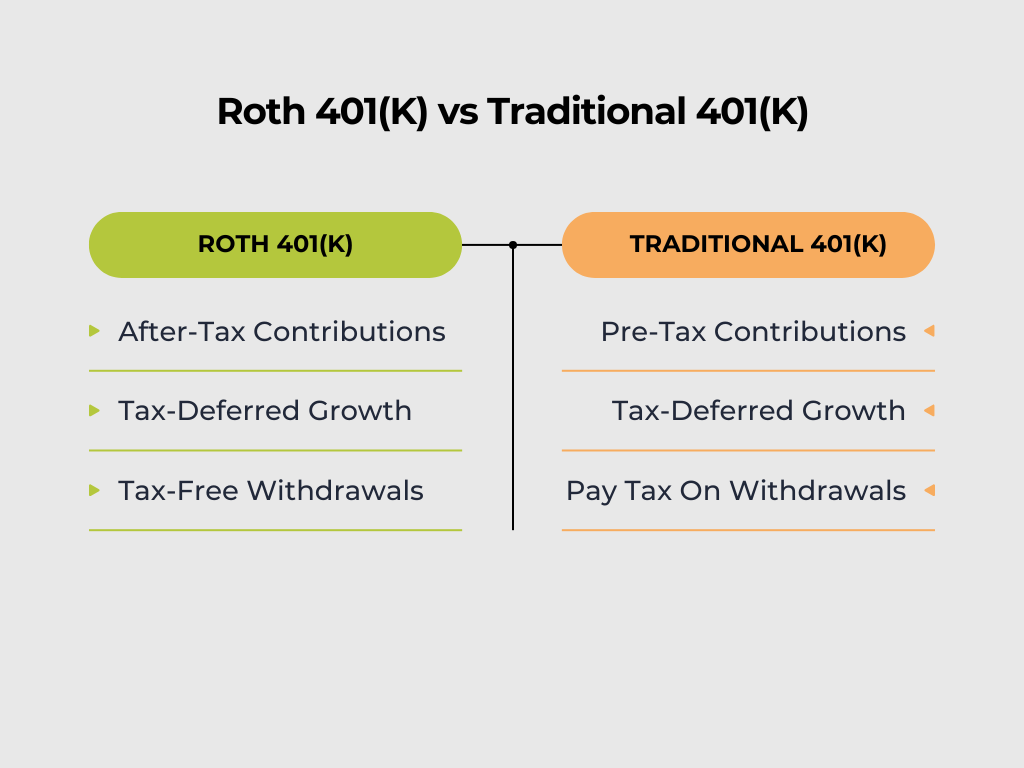

Roth 401(k) vs. Traditional 401(k)

A Roth 401(k) and Traditional 401(k) differ significantly in their tax treatment. The following tax rules also apply to Traditional IRAs and Roth IRAs respectively.

- Roth 401(k): Contributions are made with after-tax dollars. This means you likely won’t pay income taxes on your distributions provided you meet the requirements.

- Traditional 401(k): Contributions are made with pre-tax income. You will pay federal and possibly state income taxes when you withdraw any dollars in retirement.

How to Minimize Taxes on 401(k) Withdrawals

There are some strategies to help reduce the tax burden of your 401(k) withdrawals. Be sure to consult with your financial planner and tax professional before trying any of the following:

- Roth Conversions: You may be able to convert your pre-tax 401(k) or IRA dollars into Roth dollars. Roth 401(k) and Roth IRA contributions grow tax-deferred, with withdrawals generally tax-free if the account is over five years old and you’re 59.5 or older. You must pay the taxes on the amount you convert in the year you complete the conversion.

- Strategic Withdrawals: You might want to consider withdrawing funds in a way that minimizes your taxable income, helping you avoid higher tax brackets. Some common withdrawal strategies include:

- Trying to avoid moving into the next tax bracket or IRMAA Medicare premium tax bracket

- Distributing more income early in retirement to reduce RMD tax impacts at age 73

- Qualified Charitable Distributions (QCDs): In 2025, the IRS allows you to transfer up to $108,000 of your RMD directly from your 401(k) or IRA to a charity. This allows you to avoid paying taxes on that amount of your RMD and support your favorite causes.

How to Plan Your 401(k) Withdrawals for Retirement

Planning your 401(k) withdrawals and your expected tax bill is an important part of ensuring a smooth transition into retirement.

The basic steps:

- Calculate Your Income Need: The first step is to determine how much retirement income you need to support your ideal life. Start with building a clear budget based on your real spending history and then including things like increased healthcare, lifestyle, and travel costs.

- Include Fixed Income: The next step is to determine how much fixed income you will have from sources like Social Security and pensions. This will help you assess how much additional money is needed from your 401(k) or IRAs to hit your income goal.

- Determine Your Tax Withholding: Work with your financial planner and tax professional to determine the amount of federal and state income tax you should withhold.

Consult with a Retirement Professional

A professional can help you minimize retirement taxes while maximizing your income. Consider working with a financial planner AND a tax professional to help you create a well rounded strategy.

Discover How Stage Ready Financial Planning Helps You Retire with Confidence

At Stage Ready Financial Planning, we specialize in helping clients in Dayton & Southwest, Ohio make informed decisions about their 401(k) withdrawals. We’ll guide you through tax planning, RMDs, and more to ensure you retire with confidence. Contact us today to learn how we can help!

FAQs

How much do you pay in taxes for a 401(k) withdrawal?

The amount you will owe in taxes depends on your federal and state tax bracket. Your 401(k) withdrawals may be subject to federal income tax and potentially state income tax depending on where you live.

How do I avoid a 20% tax on 401(k) withdrawal?

A mandatory 20% withholding often applies if you’re taking an early or lump 401(k) withdrawal. You might be able to avoid this by rolling your 401(k) to an IRA. Be sure to consult a tax professional about your specific situation.

How do I calculate 401(k) early withdrawal taxes?

When withdrawing prior to age 59.5 from a 401(k), income taxes will apply as well as potentially a 10% penalty unless you qualify for an exception. Working with a tax and financial professional can help you calculate how much to expect to pay in taxes.

About the Author

Joseph A. Eck, CFP®, is a financial planner passionate about helping retirement savers achieve their financial goals and reduce their lifetime tax liability. With years of experience in tax planning and retirement planning, Joseph provides personalized guidance and support to clients in Dayton and Southwest Ohio. He believes that everyone deserves to feel confident living their ideal retirement. Click here to learn more about Joseph.

Article References

- https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025

- https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

- https://www.irs.gov/publications/p590b

- https://www.irs.gov/retirement-plans/plan-participant-employee/required-minimum-distribution-worksheets

- https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-exceptions-to-tax-on-early-distributions

- https://tax.ohio.gov/individual/resources/annual-tax-rates

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.