Why Avoiding 401(k) Mistakes Matters

If you’re reading this, you’ve likely spent decades saving for a comfortable retirement. You’re past the early years of just trying to put something away. Now you want to make sure your retirement savings are set up correctly so you can live the life you’ve earned.

If you are like many retirement savers over 50 in Southern Ohio, your 401(k) is probably the single largest part of your retirement savings. While previous generations saved for retirement through employer pension plans, today your employer sponsored retirement plan is likely a 401(k). Your employer likely isn’t providing you an automatic income stream when you retire. That’s why it’s so important to use your 401(k) correctly to help you achieve your goals.

Unfortunately, simple 401(k) mistakes can cost you tens or even hundreds of thousands of dollars over the course of your life. At Stage Ready Financial Planning, we know that fixing issues with your 401(k) usually means stopping the “leaks” in your bucket to give your savings the best chance to grow.

In this article, we will discuss the top 401(k) issues that can derail an otherwise solid investment strategy. Think of this as your retirement plan preventative maintenance checklist.

Key Takeaways

- Don’t Pass Up “Free Money”: The single biggest 401(k) mistake is missing out on your employer’s full matching contribution. This is a 100% immediate return on your investment that you can’t get anywhere else. Always consider contributing the minimum percentage required to get 100% of your employer match.

- Consolidation is Retirement Clarity: Having multiple old 401(k) accounts scattered across former employers makes it hard to manage your overall investment strategy and could leave your money uninvested or out of alignment with your goals. Consider consolidating old 401(k)s into a single Rollover IRA or your current plan for peace of mind and simplified management.

- Your Tax Bracket Matters Now and Later: As you approach retirement, you’re likely in your peak earning years. Decide if a pre-tax contribution (lowering your current tax bill) or a Roth contribution (tax-free withdrawals later) is best for you by estimating whether your tax rate will be lower or higher in retirement.

What Are 12 Common 401(k) Mistakes Every Retirement Saver Should Avoid?

1. Not Contributing Enough to Get Your Full Employer Match

This is probably the most common mistake you can make with your 401(k). If your employer offers to match your contributions up to a certain percentage, that employer match is essentially free money.

- The Risk: If your employer match is 50% of your contribution up to 6% of your salary, and you only contribute 4%, you are forfeiting the match on the last 2% you could have contributed. If your salary is $100,000, 50% of that last 2% would be $1,000 in free money from your employer that you are giving up.

- The Fix: Log into your plan or speak to your HR and confirm you are contributing at least the minimum percentage required to get 100% of your available employer match. Your match might change from year to year, so be sure to review your 401(k) rules each year in open enrollment season.

2. Forgetting about Old 401(k) Accounts

It’s easy to change jobs and forget about your former employer’s plan. This can create a few big problems:

- The Risk: Shocking estimates suggest there are over 32 million forgotten 401(k) retirement accounts in the U.S. totaling over 2 trillion dollars. Your money could be sitting there, uninvested, or in a low-return money market fund or stable value fund. Even if you have kept track of your old 401(k) plans, having retirement accounts scattered all over makes it hard to see your retirement picture clearly. You also run an estate planning risk if your old 401(k) accounts have outdated beneficiaries.

- The Fix: Consider consolidating your old employer’s plan into a single Rollover IRA or your new employer’s plan, using a direct, trustee-to-trustee transfer to avoid income taxes and penalties. Be sure that your rollover doesn’t sit in a stable value fund when the money arrives. You’ll need to make sure it’s invested according to your asset allocation goals. Also, take a moment to review and update your beneficiary designations for this and all other retirement accounts.

3. Cashing Out When You Change Jobs

When you leave a job, you might receive paperwork that gives you the option to take a 401(k) cash distribution. As a best practice, consider not taking the cash unless it is an absolute, last-resort emergency.

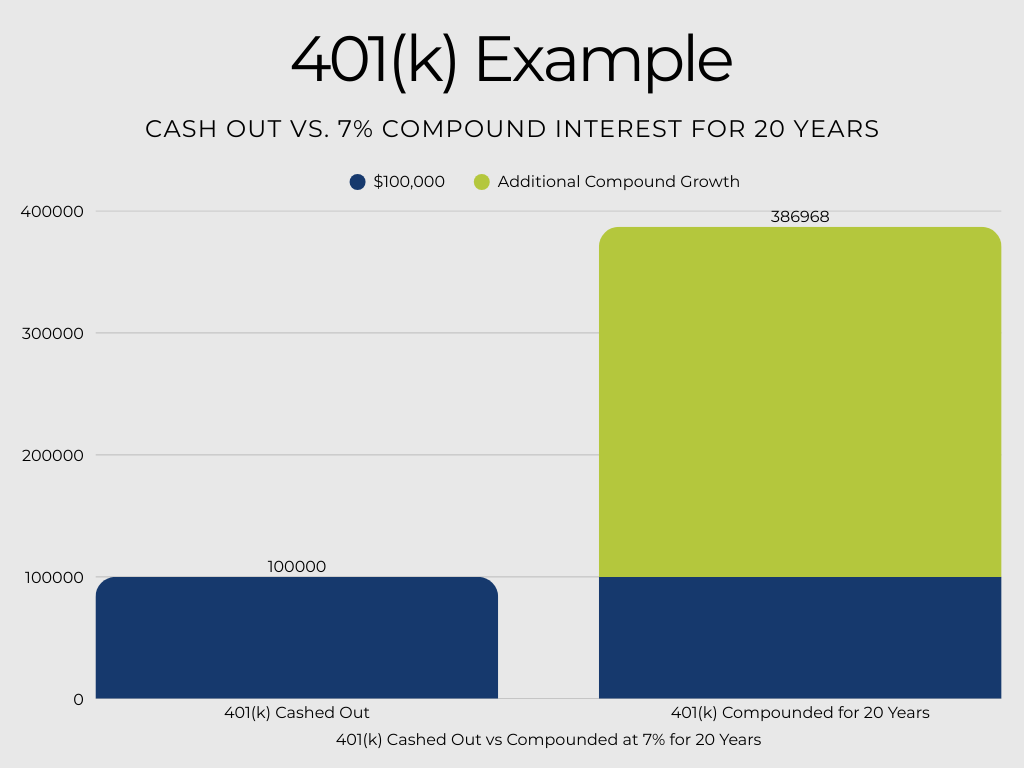

- The Risk: If you take a cash distribution before age 59.5, you’ll immediately owe ordinary income tax on the entire amount, plus a 10% early withdrawal penalty. Your savings could instantly shrink on top of the fact that you’d give up future compounding. As an example, a $100,000 401(k) cash out today would cost taxes and potential penalties. You’d also forgo the ability for your $100,000 to compound to $386,968 if it earned an average of 7% annually for 20 years with no further contributions, illustrating the huge cost of lost compounding over time.

*Example figures in gross dollars and are hypothetical based on compound interest calculation

- The Fix: Consider rolling your money over to an IRA or your new employer’s plan instead of taking a cash distribution. These are tax-free, penalty-free ways to keep your retirement money working for you.

4. Taking a 401(k) Loan or Early Withdrawal

A 401(k) loan might seem like a helpful fix to cover an unexpected expense, but it comes with risks.

- The Risk: If you leave your job while your loan is outstanding, you typically have to pay the full balance back immediately. If you can’t afford to repay the loan when it’s due, it becomes a permanent taxable withdrawal. This triggers taxes and the 10% penalty if you are under age 59.5.

- The Fix: Treat your 401(k) as your long-term retirement savings vehicle instead of a short-term cash resource. Explore other options first, including using cash, or potentially a home equity line of credit (HELOC).

5. Ignoring Your Vesting Schedule

Your vesting schedule determines when your employer-matched contributions become yours to take if you retire or leave your job.

- The Risk: Many retirement plans use vesting schedules to encourage employees to stay. If you leave or retire before you are 100% vested, you forfeit a portion of the free money your employer contributed.

There are two common types of vesting, cliff and graded. Cliff vesting features an immediate full vesting of your employer match once you hit a certain year, typically up to your 3rd year of employment. Alternatively, graded vesting gradually increases your vesting ownership the longer you are employed. The chart below shows examples of how each would work.

| Employment Year | Cliff | Graded |

| 1 | 0% | 0% |

| 2 | 0% | 20% |

| 3 | 100% | 40% |

| 4 | 100% | 60% |

| 5 | 100% | 80% |

| 6 | 100% | 100% |

- The Fix: Know and understand your employer’s plan vesting schedule. If you are considering a job change, planning around this schedule can help you decide on the right timing to maximize the money you keep.

6. Over-Investing in Company Stock

Putting too much of your 401(k) money into your employer’s stock can be risky as you are relying on the value of one company to carry your retirement investment returns.

- The Risk: If your company faces a downturn, you risk losing both your job and a significant portion of your retirement savings at the same time.

- The Fix: Most experts, including research from Morningstar recommend keeping your company stock investment below 10% of your total account value. Consider directing the majority of your new contributions to diversified mutual funds or index funds within your employer’s plan that align with your overall asset allocation goals.

7. Picking High-Earning Funds Without Paying Attention to Asset Allocation

It’s tempting to look at a fund with a great performance record and put a large amount of your 401(k) money into it. While seeking strong returns is smart, focusing solely on past fund performance without an asset allocation plan can lead to a heavy concentration of risk.

- The Risk: It’s tempting to pick the highest earning fund in your 401(k) plan when choosing your investments. If you ignore your overall investment strategy, you could end up with 80% or more of your retirement savings invested in a single asset class (like U.S. large company stocks). When that market segment hits a downturn, your entire portfolio suffers disproportionately, which could be problematic near retirement.

- The Fix: Your asset allocation, the diversified mix of stocks, bonds, and cash is the driver of your portfolio’s long-term performance. This is because asset classes will vary each year in performance. Having a healthy mix of assets can protect you from unnecessary concentration risk. Instead of just chasing returns, consider focusing on maintaining a balanced allocation that fits your stage of life and retirement goals.

8. Not Reviewing and Rebalancing Your Portfolio

Varied market performance can knock your target allocation out of whack over time.

- The Risk: As an example, If your stocks have performed better than bonds for a few years, your portfolio may now have a much heavier allocation to stocks than you intended, making it riskier than you realize. This can become problematic as you approach needing to spend your money in retirement.

- The Fix: Consider a review and potential rebalance at least once a year. This will probably involve selling some high-performing assets and using that money to buy under-performing assets to get back to your original, intended risk mix. For more information on when and how to rebalance your investments, check out our recent article: “Should You Rebalance Your Portfolio Before or During Retirement? Timing & Tips You Need”

9. Ignoring Fees and Expense Ratios

You can’t control the stock market, but you can control what you pay for holding your investments. High expense ratios can silently eat away at your savings.

- The Risk: A traditional mutual fund with an expense ratio that is 1% higher than another can cost you tens of thousands of dollars over the decades through lost compounding. Also, some 401(k)s charge separate administrative or recordkeeping fees not reflected in the expense ratio, quietly eating into your retirement savings. Unlike paying an advisor for advice, these recordkeeping fees offer no noticeable value in return.

- The Fix: Compare the expense ratios of the funds available in your plan. When possible, choose the lowest-cost options, especially broad-based index funds, if performance and asset class are similar. ETFs tend to have lower fund expenses than traditional mutual funds, however be sure to select investments that align with your overall asset allocation goals.

10. Ignoring the Mandatory 20% Withholding on 401(k) Withdrawals

When you take a distribution from your 401(k) instead of a direct rollover to an IRA, your plan administrator is required by federal law to withhold 20% for income tax (per IRS rules). That 20% may exceed your federal income tax bracket in retirement.

- The Risk: This mandatory 20% withholding may not be the only income tax owed. If your bracket exceeds 20%, then you may owe more plus a 10% penalty if you are under age 59.5. This mandatory withholding can complicate retirement income planning, but it’s not the only factor that limits your flexibility.

- The Fix: Consider requesting a direct rollover (or trustee-to-trustee transfer) when moving funds. This helps you avoid the 20% withholding entirely. If your plan allows it, you can take an in-service distribution after age 59.5 while still working to roll money into an IRA. This strategy provides more control and flexibility for tax planning, allowing you to execute Roth conversions and potentially lower your future income tax bill. If you expect to be in a lower tax bracket in retirement, then you might want to roll your 401(k) to an IRA to have more flexibility when it comes to tax withholding on your income. For more information on the tax rates of 401(k) withdrawals, check out our recent article: “What Is the 401(k) Withdrawal Tax Rate? FAQs and More”

11. Ignoring Your Current Tax Bracket When Choosing Contribution Types

As a retirement saver over 50, you may be in your peak and income tax bracket today. Failing to consider this when making your contribution tax type can cost you significant tax savings.

- The Risk: If you are in a high income tax bracket and choosing to make Roth 401(k) (after-tax contributions), this means you may be passing up a valuable tax deduction. When you retire, you could be paying a lower tax rate on those dollars instead by taking income or executing Roth conversions.

- The Fix: Consider using pre tax 401(k) contributions to lower your current tax bill if you expect your retirement tax bracket to be lower than your current income tax bracket. Use Roth 401(k) contributions if you are pretty confident that your tax rate will be higher in retirement, or have early retirement goals.

12. Emotional Mistakes During Market Volatility

When the market gets rough, your gut instinct might be to sell your investments to stop the bleeding. These moments can be scary to navigate.

- The Risk: This scenario is the classic investment mistake of selling low and then trying to buy back high after the market recovers, turning a short-term fluctuation into a permanent loss.

- The Fix: When the market gets rough, the best action for a long-term retirement saver is often to hold steady and keep contributing. Your contributions are benefiting with lower share prices, allowing you to purchase more shares. If you feel like you need to do something, a portfolio rebalance to your target asset allocation during market dips can be helpful. It allows you to sell overperforming investments and reinvest the proceeds in underperforming assets during the dip.

How to Build Good 401(k) Habits

Building good habits is often easier than trying to fix mistakes later in life.

- Automate Your Increase: Set up an auto-increase feature to boost your contribution rate by 1% each year. You won’t even notice a difference in your paycheck, but it can significantly increase your future retirement savings.

- Automate Your Rebalances: It’s likely that your 401(k) plan has an auto rebalance feature. If you aren’t using a target date fund, this feature will automatically rebalance your account to your preferred investment mix at set intervals, keeping your account inline with your goals.

- Schedule Periodic Reviews: Add a recurring calendar reminder to review your 401(k) investments and contribution rate at least once a year. Your plan will likely make changes to the investment offerings over time. A scheduled review will allow you to make sure you are set up correctly as your choices change.

- Document The Big Picture: Keep a clear balance sheet that includes all of your retirement accounts and their asset allocation details. You should also keep a list of your 401(k) login information, primary and contingent beneficiary designations, and trusted contact details.

How a Financial Advisor Can Help You

If your head is spinning after reading this list, you don’t have to evaluate your 401(k) alone. A fee-only financial advisor, particularly one who focuses on retirement planning, can help you avoid these 401(k) mistakes. For example, at Stage Ready Financial Planning, we help our clients review their entire portfolio and the specific rules of their employer’s plan to maximize their employer match.

A great financial advisor can help you:

- Confirm Your Trajectory: They can help you create a comprehensive plan that shows you, with clear numbers, if you are on track to successfully retire to live your ideal lifestyle.

- Optimize Your Investments: They will help you review your entire portfolio, including your 401(k), IRAs, and other accounts to make sure your overall asset allocation aligns with your goals and risk tolerance.

- Develop a Tax Planning Strategy: Great financial planners will help you utilize tax-advantaged retirement plans, like the Roth 401(k) or IRA, and create a thoughtful savings and withdrawal strategy for retirement to help you potentially pay less in taxes over your lifetime. This strategy often includes coordinating your 401(k) withdrawal timing with your Social Security claiming decisions.

Take the Guesswork Out of Your 401(k) and Retirement Plan. Contact Stage Ready Financial Planning for Personalized Guidance

When you’ve saved well over the course of your career, the last thing you want is nagging doubt about whether you’ve made a costly investment mistake near retirement. If you are over 50, your 401(k) is too important for guesswork. We know you want to pay less in taxes and feel confident that your investments are set up correctly to support the retirement lifestyle you’ve hoped for.

At Stage Ready Financial Planning, we specialize in providing that retirement clarity and peace of mind. We will help you look at your entire financial picture. We’ll explore everything from your old employer’s plan to your current investment mix and future tax bill to ensure your overall plan is ready for the long run. We believe every retirement saver deserves a clear roadmap for a successful retirement.

Schedule your intro call today!

Frequently Asked Questions (FAQs)

What happens if I don’t contribute enough to get my employer’s full match?

You are basically declining free money from your employer. For example, if your employer match is 50% of your contribution up to 6% of your salary, and you only contribute 4%, you are forfeiting the match on the last 2% you could have contributed. If your salary is $100,000, 50% of that last 2% would be $1,000 in free money from your employer that you are foregoing.

Another way to think about this is by comparing it to your hourly earnings. In the previous example, if you earn $100,000 and let’s assume 2,000 working hours per year, your hourly rate would be approximately $50. So if you give up $1,000 in employer retirement match dollars, you are giving up 20 hours worth of extra income.

Can I have both a traditional and a Roth 401(k) at the same time?

Yes, if your employer’s plan offers both contribution options, you can contribute to both a Traditional (pre tax contributions) and a Roth (after tax contributions) 401(k) simultaneously, up to the annual IRS limit. For 2026, this would be $24,500 plus $8,000 in catch-up contributions if you are over age 50 as of the latest IRS announcements. Many 401(k) plans today allow both types of contributions in a single account.

It’s also worth noting that the 401(k) limits apply to each employer plan you participate in. This means that if you have more than one job, you could contribute the full amount to both plans in a calendar year. Theoretically, you could be contributing pre-tax dollars in one plan and Roth dollars in the other.

How often should I rebalance my 401(k) investments?

For most retirement savers, an annual rebalance is enough to make sure your investments are in line with your risk tolerance and time horizon. Rebalancing means bringing your portfolio back to your target asset allocation and can often be automated inside a 401(k) plan. For more information on rebalancing your 401(k), check out our recent article: “Should You Rebalance Your Portfolio Before or During Retirement? Timing & Tips You Need”

What’s the difference between a 401(k) and an IRA for retirement savings?

A 401(k) is an employer sponsored retirement plan, meaning you can only contribute through your workplace. An IRA (Individual Retirement Account) is a personal account you set up on your own through most banks and investment companies.

401(k)s have higher contribution limits (For 2026, $24,500 plus $8,000 catch-up if you are over age 50) and may offer an employer match. IRAs usually offer more investment choices and distribution flexibility but have a lower contribution limit in 2026 of $7,500 plus a catch up of $1,100 if you are over age 50.

Does Ohio tax 401(k) withdrawals or retirement income?

Ohio taxes most retirement income, including withdrawals from your pre-tax 401(k) and traditional IRA distributions, as ordinary income tax. However, Social Security benefits are fully exempt from state taxation, and Ohio offers a tax credit for certain retirement income for residents. For more information on how Ohio taxes your retirement income, check out our article: “What Is the 401(k) Withdrawal Tax Rate? FAQs and More.”

Are 401(k) employer matches taxed in Ohio?

The money your employer contributes to your 401(k) is usually in pre-tax dollars and grows tax-deferred. You will pay tax on those matched funds (and their growth) when you withdraw them in retirement. Some employer plans allow you to choose for your match to be contributed as Roth. However, this means you will pay tax on your employer’s contributions just like you earned extra income.

About The Author

Joseph A. Eck, CFP®, is the owner and lead financial advisor at Stage Ready Financial Planning, a fee-only Registered Investment Advisor based in Dayton, Ohio. He’s dedicated to helping retirement savers like you, especially those over 50 who have saved at least $750,000, achieve peace of mind by creating clear, actionable retirement plans. With a down-to-earth approach, Joseph provides personalized guidance on topics like avoiding common 401(k) mistakes, optimizing investment allocations, and building a retirement strategy to pay less in taxes.

Article References

- Investopedia. “$2 Trillion Left in 401(k)s Shows You Can Forget Money.” Accessed November 17, 2025. https://www.investopedia.com/usd2-trillion-left-in-401-k-s-shows-you-can-forget-money-11824199

- Internal Revenue Service (IRS). “401(k) Limit Increases to $24,500 for 2026; IRA Limit Increases to $7,500.” Accessed November 17, 2025. https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

- Internal Revenue Service (IRS). “Retirement Topics – Vesting.” Accessed November 17, 2025. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-vesting

- Morningstar. “Is It Ever a Good Idea to Hold Company Stock in Your 401(k)?” Accessed November 17, 2025. https://www.morningstar.com/retirement/is-it-ever-good-idea-hold-company-stock-401k

- BlackRock. “Return Map.” Accessed November 17, 2025. https://www.blackrock.com/corporate/insights/blackrock-investment-institute/interactive-charts/return-map

- Internal Revenue Service (IRS). “Retirement Plan and IRA Required Minimum Distributions (RMDs) FAQs.” Accessed November 17, 2025. https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

- U.S. Department of Labor (DOL). “Understanding Retirement Plan Fees and Expenses.” Accessed November 17, 2025. https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/retirement-plan-fees-expenses.pdf

- Vanguard. “How America Saves 2024: An Early Preview.” Accessed November 17, 2025. https://workplace.vanguard.com/content/dam/inst/iig-transformation/insights/pdf/2024/How_America_Saves_2024_Early_Preview.pdf

- Internal Revenue Service (IRS). “Rollovers of Retirement Plan and IRA Distributions.” Accessed November 17, 2025. https://www.irs.gov/retirement-plans/plan-participant-employee/rollovers-of-retirement-plan-and-ira-distributions

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.