In your working years, your financial goal was pretty clear: save for the future. Now that you’ve retired, the challenge is figuring out how to keep what you’ve built. Without effective retirement tax strategies, a significant chunk of your retirement savings could be eaten up by taxes.

Being tax efficient means making sure your retirement income lasts as long as you do for the things you actually want to spend it on. For many retirees in Dayton, the transition from a steady paycheck to living off investments can feel overwhelming. In this article, we will discuss ideas to shield your taxable income from unnecessary “tax drag” so that you can spend it on the things that really matter.

Key Takeaways

- The New “Senior Bonus” Opportunity: Under new tax laws, certain married couples over 65 in Dayton can now shield significantly more income, up to $47,500, from federal taxes using the enhanced standard deduction.

- Strategic Withdrawal Sequencing: Pulling from brokerage accounts before IRAs might help you leverage the 0% capital gains rate (available for income under $98,900), potentially saving thousands in “tax drag.”

- Medicare IRMAA Surcharges: Just one dollar of extra income over the $218,000 MAGI threshold (for MFJ) can trigger almost $2,000 in annual Medicare premium surcharges, making precise income management important.

Why Tax Planning Matters in Retirement

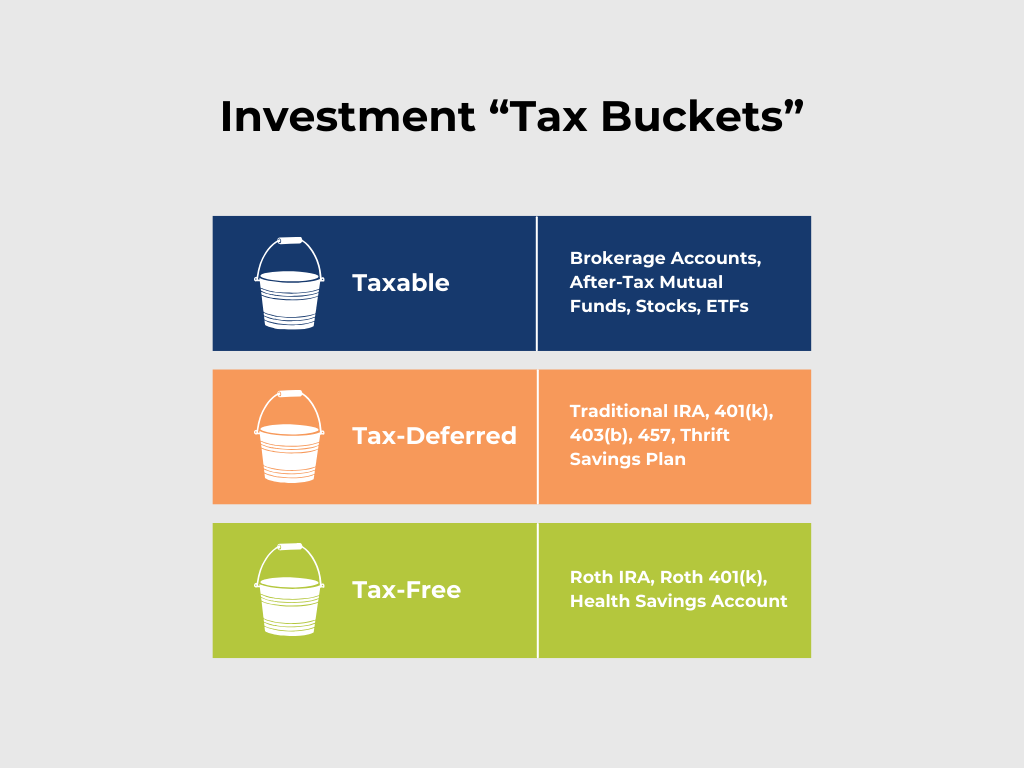

In retirement, you become your own HR and payroll person. You decide which “buckets” of money to pull from and when. If you don’t have a solid plan, you might accidentally push yourself into a higher tax bracket or trigger penalties that could have been avoided.

What Are the Consequences of No Tax Strategy in Retirement?

Ignoring your overall tax picture when taking retirement distributions can lead to paying much more in federal income tax and state income tax than you have to. You might create higher Medicare premiums or lose out on valuable credits for state and local taxes simply because your withdrawals weren’t timed right.

Without an efficient income strategy, you could also unexpectedly cause up to 85% of your Social Security benefits to become taxable at the federal level instead of 0% or 50%.

What Are 10 Tax Strategies Retirees Should Use?

Retirement tax planning isn’t about finding loopholes or making extreme moves. It’s about understanding a handful of proven strategies and using them intentionally over time. Below are ten practical tax strategies retirees commonly use to reduce unnecessary taxes and create more predictable income:

- Understand How Different Accounts Are Taxed

- Sequence Your Withdrawals Wisely

- Take Advantage of Roth Conversions in the Early Years of Retirement

- Manage Your Required Minimum Distributions (RMDs)

- Use Qualified Charitable Distributions (QCDs)

- Maximize Capital Gains Brackets

- Leverage your Health Savings Account (HSA)

- Watch for Medicare Premium Surcharges (IRMAA)

- Consider Ohio-Specific Tax Breaks

- Revisit Your Tax Strategy Annually

1. Understand How Different Accounts Are Taxed

Your invested savings are typically in one of three “buckets”: taxable accounts (like a brokerage account), tax deferred accounts (pre-tax, like a 401(k) or IRA), and tax-free accounts (like a Roth IRA or HSA).

Knowing which bucket you are reaching into is the first step in controlling your tax bill.

- Tax Savings Spotlight: A Dayton couple, both age 67, earns $50,000 in pension income. They decide to withdraw $100,000 from a tax-deferred 401(k) in 2026. Their adjusted gross income will be approximately $150,000 and they’ll pay ordinary income tax on every dollar they withdraw.

- The Math: In 2026, the standard deduction for a married couple is $32,200. If both are over 65, they can claim the existing extra standard deduction of $1,650 each, plus a new $6,000 “Senior Bonus” per person ($12,000 total if they have an MAGI below $150,000), shielding up to $47,500 from federal income tax.

After subtracting their deductions, they have taxable income of approximately $102,500, placing them in the 22% tax bracket. Alternatively, taking that same $100,000 distribution from a Roth IRA could have resulted in an AGI of approximately $2,500 instead, meaning they would pay almost no federal income tax and save thousands of dollars.

Read more: What Is the 401(k) Withdrawal Tax Rate?

2. Sequence Your Withdrawals Wisely

The “sequence” of your withdrawals is the order in which you use your various tax buckets. By carefully timing when you use your brokerage account or IRA, you might be able to stay in a lower tax bracket longer than if you just pulled from one account at a time.

- Tax Savings Spotlight: A retired Dayton couple with no other income needs $80,000 for living expenses. They choose to sell investments from a brokerage account rather than withdrawing from a traditional IRA.

- The Math: For 2026, married couples pay 0% on capital gains if their taxable income is below $98,900. By spending $80,000 from brokerage accounts with $20,000 in long-term capital gains, they pay $0 in federal tax. Had they taken that $80,000 from an IRA, it would be taxed as ordinary income, costing them thousands more even after standard deductions.

3. Take Advantage of Roth Conversions in the Early Years of Retirement

A Roth conversion allows you to move money from your tax deferred IRA to a Roth IRA, hopefully while you are in a lower tax bracket. You’ll pay the tax today so that the money and its future growth can be withdrawn tax-free later. A Roth conversion allows you to set yourself up for lower taxes down the road.

- Tax Savings Spotlight: A Dayton couple retires at age 62. They have no Social Security income yet and their living expenses are covered by cash savings, leaving them in a very low tax bracket.

- The Math: With the help of their tax professional, they choose to convert $50,000 from a traditional IRA to a Roth IRA. By paying 12% in their lower tax bracket ($6,000) now, they avoid a projected 22% rate ($11,000) later when RMDs and Social Security would have pushed them into a higher tax bracket. Example potential savings: $5,000.

Read more: What Is a Roth Conversion & Is It Right for You?

4. Manage Your Required Minimum Distributions (RMDs)

Required minimum distributions (RMDs) are IRS mandated withdrawals from your pre-tax accounts. These start at age 73 or 75, depending on your birth year. If you ignore them, these forced withdrawals can act like a tax surprise, bumping your income up and putting you in a higher bracket.

- Tax Savings Spotlight: A retiree is projected to have a starting mandatory $40,000 RMD in a few years, which they don’t actually need for spending but will be forced to pay taxes on.

- The Math: By using their early retirement “gap years” to reduce the pre-tax account balance through smaller annual withdrawals or conversions, they lower that future RMD to $20,000. This keeps the couple in the 12% bracket ($24,801–$100,800) instead of jumping to 22%. Example potential savings: $2,000 in ordinary income taxes that year.

5. Use Qualified Charitable Distributions (QCDs)

If you give to your local church or charity, a QCD lets you donate directly from your IRA to that organization. This move is a win-win because the donation counts toward your RMD. Since it isn’t taxable income, you can give pre-tax dollars without itemizing.

- Tax Savings Spotlight: A charitably inclined Dayton couple is forced to take a $10,000 RMD they don’t need. They choose to send it directly to their favorite non-profit via a QCD.

- The Math: Because a QCD doesn’t count as ordinary income, it never appears on their tax return. By avoiding the $10,000 in taxable income, the couple saves $2,200 in federal income tax (assuming a 22% bracket) while still fulfilling their RMD requirement.

Read more: How Can Retirees Minimize RMD Taxes? 5 Strategies for You to Consider

6. Maximize Capital Gains Brackets

Long-term capital gains are the profits from selling investments you’ve held for more than a year. The IRS rewards this patience with tiered rates of 0%, 15%, or 20%. For some retirees, selling assets strategically can allow them to realize gains without paying a single dollar in federal tax.

| Filing Status in 2026 | LTCG 0% Rate | LTCG 15% Rate | LTCG 20% Rate |

| MFJ | $0 – $98,900 | $98,901 – $613,700 | $613,700+ |

| Single | $0 – $49,450 | $49,451 – $545,500 | $545,500+ |

*Tax Year 2026

- Tax Savings Spotlight: A Dayton couple filing jointly has $60,000 of pension and Social Security income. They decide to sell stock to diversify their portfolio.

- The Math: Since their total taxable income is well below the $98,900 threshold for the 0% rate, they sell stock with a $10,000 gain and pay $0 in long-term capital gains tax. If they had waited until RMDs increased their income, that same sale would likely have cost them $1,500 (at the 15% rate).

7. Leverage your Health Savings Account (HSA)

Health Savings Accounts (HSAs) are great because they offer a tax deduction for your contributions, tax-deferred growth, and tax-free withdrawals (as long as they’re for medical bills).

- Tax Savings Spotlight: A retiree needs to pay a $15,000 bill for a medical procedure. They have funds available in both an HSA and a traditional IRA.

- The Math: A $15,000 qualified medical expense paid from an HSA costs exactly $15,000. To pay that same bill from an IRA while in the 22% tax bracket, the retiree would have to distribute $19,230 to cover the federal income tax. Example potential savings: $4,230+.

8. Watch for Medicare Premium Surcharges (IRMAA)

If you make too much money, your future Medicare premiums could increase by an Income-Related Monthly Adjustment Amount (IRMAA). This surcharge is based on your modified adjusted gross income (MAGI) from two years prior.

| MFJ MAGI in 2024 | Single MAGI in 2024 | 2026 Medicare Part B IRMAA | 2026 Medicare Part D IRMAA |

| $218,000 or less | $109,000 or less | – | – |

| $218,001 – $274,000 | $109,001 – $137,000 | $81.20 | $14.50 |

| $274,001 – $342,000 | $137,001 – $171,000 | $202.90 | $37.50 |

| $342,001 – $410,000 | $171,001 – $205,000 | $324.60 | $60.40 |

| $410,001 – $749,999 | $205,001 – $499,999 | $446.30 | $83.30 |

| $750,000 or more | $500,000 or more | $487.00 | $91.00 |

* https://www.cms.gov/newsroom/fact-sheets/2026-medicare-parts-b-premiums-deductibles

- Tax Savings Spotlight: A Dayton couple is reviewing their 2024 income, which determines their 2026 Medicare premiums.

- The Math: If a couple’s joint MAGI was $218,001 in 2024, they will both pay a surcharge of $81.20/month for Part B in 2026. Alternatively, if they had used a Roth IRA for more of their 2024 income, the couple might have saved $1,948.80 in future Medicare premium charges.

9. Consider Ohio-Specific Tax Breaks

Ohio completely exempts Social Security benefits from state tax and offers some credits for retirees that can directly lower your income tax bill.

- Tax Savings Spotlight: A retired couple in Dayton has a total income of $95,000 from pensions and IRAs. Their tax professional suggests claiming the Ohio Retirement Income Credit.

- The Math: Since their income is under $100,000, they are likely eligible for a credit of up to $200. This is a non-refundable credit that directly reduces their state income tax liability. This credit applies to pension and retirement account distribution income, not brokerage account income.

Read more: Ohio Retirement Tax Strategies to Optimize Your Budget

10. Revisit Your Tax Strategy Annually

Tax rules are like the weather in Dayton…they change frequently. New laws like the “One Big Beautiful Bill” (OBBB) have created some temporary planning opportunities, such as the new “Senior Bonus” deduction. To take advantage, it’s important to check in with your tax professional each year to stay on top of your strategy.

- Tax Savings Spotlight: A married couple over 65 wants to maximize their tax-free income before the current bonus provisions expire in 2028.

- The Math: By coordinating their withdrawals, they take advantage of the 2026 deductions totaling $47,500 ($32,200 standard + $3,300 age deduction + $12,000 bonus). This allows them to realize $12,000 more in IRA distributions than they otherwise would have.

Common Retirement Tax Mistakes to Avoid

Some common tax planning mistakes in retirement include the following:

- Ignoring the impact of withdrawals from accounts that generate ordinary income tax

- Forgetting to make quarterly estimated tax payments or adding tax withholding to retirement distributions and Social Security benefits

- Failing to coordinate with a tax professional to avoid Medicare IRMAA surcharges

- And more…

How Can a Professional Help with Your Taxes in Retirement?

Your tax professional helps you account for the taxes you owe. Incorporating advice from a financial planner who specializes in tax planning, can help you look forward to the taxes you might pay for the next 30 years.

The combined advice of your tax professional and financial advisor will help you coordinate things like Roth IRA conversions, your account withdrawal sequence, and charitable goals to keep your ordinary income tax rates as low as possible over your lifetime.

Discover for Yourself the Impact a Financial Advisor Can Make. Contact Stage Ready Financial Planning Today for a Free, Personal Consultation

At Stage Ready Financial Planning, we believe you shouldn’t have to wonder if your investments and tax strategy are set up correctly. You’ve done the hard work of saving; now it’s our job to help you enjoy it with confidence.

We specialize in helping Dayton retirement savers create tax-efficient income so they can rest easy, living their ideal lifestyle. Schedule your intro call today!

Frequently Asked Questions (FAQs)

How are Roth IRA and traditional IRA withdrawals taxed differently?

Traditional IRA contributions receive a tax deduction and withdrawals are taxed as ordinary income. In contrast, a Roth IRA contribution does not receive a tax deduction, but the account offers potentially tax-free growth and withdrawals.

How can I reduce my tax burden on Social Security?

In 2026, A couple filing jointly will owe no tax on their Social Security benefits if they have “provisional income” below $32,000. 50% of their Social Security will be taxable if they have “provisional income” between $32,000 and $44,000. 85% of their Social Security will be taxable if they have “provisional income” over $44,000.

Reducing your Social Security taxes involves keeping your overall taxable income lower, or drawing income from tax-exempt sources like an eligible Roth IRA.

How does Ohio tax pensions and 401(k)s?

Retirees in Ohio are exempt from paying Ohio income taxes on the following sources of income:

- Social Security benefits

- Certain railroad retirement benefits

- Military retirement pay

These retirement income sources are still subject to Ohio income taxes:

- Income from non-military pensions or profit sharing accounts

- Distributions from pre-tax retirement accounts including your 401(k), Traditional IRA, TSP, 403b, or 457

What local taxes should Ohio retirees consider?

Most local income taxes (like those in Dayton) do not apply to your Social Security, pension, or 401(k) withdrawals, only to “earned” wages. An Ohio retiree will likely pay federal and state income tax, but no local income tax unless they have taxable income from a part-time job or own rental properties.

About the Author

Joseph A. Eck, CFP®, is the owner and lead financial advisor at Stage Ready Financial Planning in Dayton, Ohio. He is dedicated to helping retirement savers like you achieve peace of mind by creating retirement tax strategies that account for all of life’s transitions. With the help of your tax professional, Joseph provides personalized guidance on topics including Roth IRAs, RMD management, optimizing retirement income, and more. A proud member of the Dayton community, he is committed to providing down-to-earth guidance that respects the humble, hard-working ethos of the Midwest.

Article References

- Internal Revenue Service. “One, Big, Beautiful Bill provisions.” Accessed January 12, 2026. https://www.irs.gov/newsroom/one-big-beautiful-bill-provisions

- Tax Foundation. “2026 Tax Brackets and Federal Income Tax Rates.” Accessed January 12, 2026. https://taxfoundation.org/data/all/federal/2026-tax-brackets/

- H&R Block. “What are the 2025-2026 tax brackets and federal tax rates?” Accessed January 12, 2026. https://www.hrblock.com/tax-center/irs/tax-brackets-and-rates/what-are-the-tax-brackets/

- Kiplinger. “Older Taxpayers: Don’t Miss This Hefty (Temporary) Tax Break.” Accessed December 10, 2025. https://www.kiplinger.com/taxes/tax-planning/older-taxpayers-dont-miss-this-hefty-temporary-tax-break

- Kiplinger. “Medicare Premiums 2026: IRMAA Brackets and Surcharges for Parts B and D.” Accessed November 15, 2025. https://www.kiplinger.com/retirement/medicare/medicare-premiums-2026-irmaa-brackets-and-surcharges-for-parts-b-and-d

- Current Federal Tax Developments. “2026 Adjustments to Medicare Parts A, B, and D: A Technical Review.” Accessed November 17, 2025. https://www.currentfederaltaxdevelopments.com/blog/2025/11/17/2026-adjustments-to-medicare-parts-a-b-and-d-a-technical-review-of-premiums-and-irmaa-calculations

- NerdWallet. “IRMAA Brackets 2026: What They Are and How They Work.” Accessed January 15, 2026. https://www.nerdwallet.com/insurance/medicare/learn/what-is-the-medicare-irmaa

- Ohio Department of Taxation. “Filing Season Tips.” Accessed January 12, 2026. https://tax.ohio.gov/individual/who-must-file/filing-season-tip

- Ohio Department of Taxation. “Senior Citizens and Ohio Income Tax.” Accessed January 12, 2026. https://tax.ohio.gov/individual/file-now/senior-citizens-and-ohio-income-tax

- IRS. “2026 Publication 926, Household Employer’s Tax Guide.” Accessed January 12, 2026. https://www.irs.gov/publications/p926

- Congress.gov. “H.R.1 – 119th Congress (2025-2026): One Big Beautiful Bill Act.” Accessed January 12, 2026. https://www.congress.gov/bill/119th-congress/house-bill/1

- AARP. “Taxes on Social Security Are Based on Your Income.” Updated January 13, 2026. https://www.aarp.org/social-security/retirement/federal-income-taxes/

- Centers for Medicare & Medicaid Services (CMS). “2026 Medicare Parts B Premiums and Deductibles.” Accessed January 12, 2026. https://www.cms.gov/newsroom/fact-sheets/2026-medicare-parts-b-premiums-deductibles

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.