You’ve retired and you’re enjoying your early retirement years, watching your savings continue to grow while staying in a lower taxable income bracket. But you keep hearing about something called Required Minimum Distributions, or RMDs that will kick in at some point. Before you know it, RMDs are here and you realize you have to distribute a large chunk of your tax deferred accounts, whether you need the money or not. Your tax return shows a sudden increase in income taxes, which means your Medicare premiums might go up. Given your tax bracket increase, you may also have to increase withholding on your Social Security benefits to avoid underpayment tax penalties.

The good news is that you can get ahead of this situation and learn how to minimize RMD tax to take back control. At Stage Ready Financial Planning, we specialize in helping our clients overcome these retirement planning challenges. We’ve created this article to help you plan ahead for RMDs so you can keep more of your hard-earned savings right where they belong: with you.

Key Takeaways

- Be Proactive: Don’t wait until you have to take RMDs to start planning. Thinking about strategies like Roth conversions or making strategic withdrawals in your 60s can help you control your lifetime tax bill.

- QCDs Are Your Friend: If you’re feeling charitable, a Qualified Charitable Distribution (QCD) lets you give to the causes you care about and satisfy your RMD without it counting as taxable income.

- Small Tweaks, Big Impact: Managing your RMDs isn’t about one-time fixes. Ongoing strategies like bracket management and strategic withdrawals can help you spread out your tax liability over several years, avoiding a large, unexpected tax bill and keeping more money for your ideal lifestyle.

What Are Required Minimum Distributions (RMDs)?

Required minimum distributions (RMDs) are the annual withdrawals that the IRS requires you to make once you hit a certain age. The age for starting RMDs has changed over the years and has been recently pushed back again with the passing of the SECURE Act 2.0. According to the IRS, if you were born on January 1 1951 or later, your RMDs will likely begin in the year you turn 73. If you were born in 1960 or later, you may be able to wait until age 75. The RMD rules are in place so that you can begin to pay taxes on the money that the government has allowed you to grow tax deferred for years.

The amount you have to withdraw each year is determined based on your pre-tax retirement account balances from the end of the previous year. You divide those balances by a “life expectancy factor” provided by the IRS.

Uniform Lifetime Table (RMD)

| Age | Factor | Age | Factor |

| 73 | 26.5 | 89 | 12.9 |

| 74 | 25.5 | 90 | 12.2 |

| 75 | 24.6 | 91 | 11.5 |

| 76 | 23.7 | 92 | 10.8 |

| 77 | 22.9 | 93 | 10.1 |

| 78 | 22.0 | 94 | 9.5 |

| 79 | 21.1 | 95 | 8.9 |

| 80 | 20.2 | 96 | 8.4 |

| 81 | 19.4 | 97 | 7.8 |

| 82 | 18.5 | 98 | 7.3 |

| 83 | 17.7 | 99 | 6.8 |

| 84 | 16.8 | 100 | 6.4 |

| 85 | 16.0 | 101 | 6.0 |

| 86 | 15.2 | 102 | 5.6 |

| 87 | 14.4 | 103 | 5.2 |

| 88 | 13.7 | 104 | 4.9 |

*The table above is the official IRS Uniform Lifetime Table for the 2024 tax year, used to calculate RMDs for 2025. See IRS Publication 590-B

Example: If you turn 73 in 2025, and your December 31st, 2024 IRA balance was $1,000,000, you would calculate your RMD by dividing $1,000,000 by 26.5. This would result in a required taxable RMD for 2025 of $37,735.85.

You will need to calculate the required minimum distributions for each of your traditional IRA accounts separately. That said, you can take the total required minimum distributions amount from just one or a combination of them. The IRS doesn’t care which account the distribution comes from, as long as you meet the annual requirement. (Note: RMD rules for 401(k) plans are different. More on that later.) It’s also important to know that RMD rules do not apply to Roth IRA or after-tax accounts, since those accounts are funded with after-tax money.

Why RMDs Are Taxable

When you originally contributed to your traditional IRA or 401(k), you likely received a tax deduction. Over time, your money grew and compounded, all without being taxed by the IRS. The trade-off for these tax benefits is that the IRS will eventually collect income taxes on your savings when you are retired. When you have to take them, your RMDs are taxed as ordinary income, meaning your RMD will be subject to the same income tax brackets as your old paycheck would have been.

Example: In the example above, let’s say your RMD for 2025 was $37,735.85 and you would have already been in the 22% federal income tax bracket. You would likely owe $8,301.89 in federal income taxes on your RMD. If you were retired in Ohio, you would likely also owe Ohio income taxes on that RMD. Click here to read more about Ohio income tax rules for retirees.

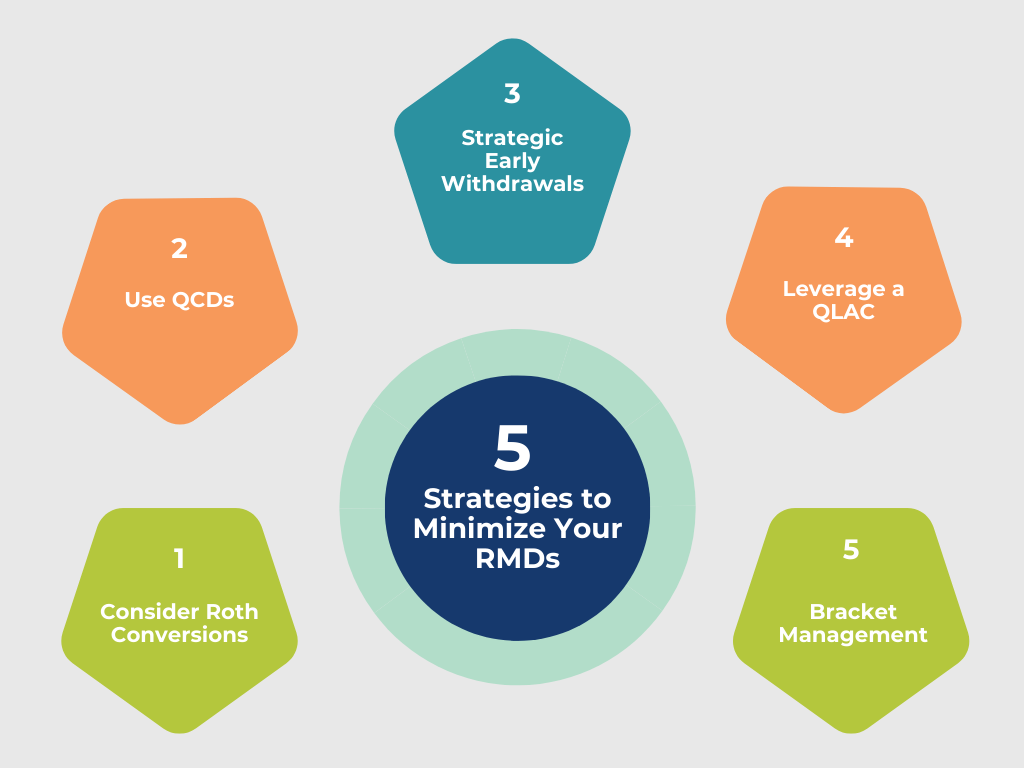

5 Strategies to Minimize Your RMDs

Managing your RMDs effectively means you’ll need to be proactive. Here are a few smart strategies you can use to potentially control your tax liability in the middle to later years of retirement:

- Consider Roth Conversions Before Your RMD Age

- Use Qualified Charitable Distributions (QCDs)

- Smart Withdrawals Before You’re Required

- Leverage a Qualified Longevity Annuity Contract (QLAC)

- Withdraw with a Bracket Management Approach

1. Consider Roth Conversions Before Your RMD Age

One effective way to reduce your future required minimum distributions is by converting some of your pre-tax retirement accounts into a Roth IRA.

What Is a Roth Conversion?

A Roth conversion is the process of moving money from a tax deferred account, like your traditional IRA or 401(k), into a Roth IRA. You’ll have to pay taxes in the year you make the conversion, meaning the conversion amount will show up on your tax return. This can impact your overall tax bill and your qualification for other tax benefits, including the cost of Medicare.

Why It Helps Minimize Future RMDs

When you move money to a Roth IRA, you will paid taxes on your deposit upfront. Once complete, your Roth money can grow tax free and will not be subject to future RMD rules. By doing a Roth conversion, you essentially reduce the balance of your pre-tax retirement accounts, lowering your future required minimum distributions and potentially your taxable income. Roth conversion strategies can be especially helpful if you expect your tax bill to be higher later in retirement.

When to Convert

A good time to consider Roth conversions is after you retire and before required minimum distributions begin. In this window of time, a popular strategy is to “fill up” your lower current tax bracket. For example, in a year where your federal taxable income is in the 10% or 12% bracket, you could convert just enough to a Roth IRA to stay within your current bracket. We recently published a detailed article about how to use Roth conversions in this early retirement window that you may find helpful.

2. Use Qualified Charitable Distributions (QCDs)

If you are required to take required minimum distributions and enjoy giving to charities, a qualified charitable distribution (QCD) can be a great way to lower your taxes and support a cause you care about.

What Is a QCD?

A qualified charitable distribution (QCD) allows you to donate up to $108,000 annually directly from your traditional IRA or 401k to a qualified charity (501(c)(3)). As a married couple in 2025, you could donate up to $216,000. Your QCD counts toward your required minimum distributions for the year and any amount you donate via a QCD does not get added to your income tax return.

How QCDs Lower Your Tax Burden

Because a qualified charitable distribution is transferred directly from your retirement account to your chosen charity, it’s not considered taxable income for you. This gifting method is different from a traditional charitable deduction, where you would first pay taxes on your income and then potentially deduct the donation later. With a QCD, you get the tax benefits without the added income tax costs. Using a QCD can also help you reduce your adjusted gross income (AGI), which can be beneficial for things like keeping your Medicare premiums from going up.

3. Smart Withdrawals Before You’re Required

You don’t have to wait until you turn 73 to start taking money from your tax deferred retirement accounts. If you are worried about RMDs, it could be a good idea to start a strategic withdrawal plan as early as age 59.5.

Early Strategic Withdrawals

By taking distributions from your tax deferred accounts in the years between age 59.5 and 73, you may be able to lower the overall balance of your retirement accounts, resulting in lower RMDs. If you’d prefer to keep your money invested, you could reinvest your withdrawals in a taxable account, instead.

Why It Works

Taking distributions before RMDs begin is a basic way to control your future income taxes. You could potentially use a period of lower income, such as a year when you’ve fully retired but haven’t started collecting Social Security benefits to take extra withdrawals. This way you spread out your retirement account tax liability over several years instead of waiting for a larger, potentially more impactful tax bill later on when RMDs kick in.

4. Leverage a Qualified Longevity Annuity Contract (QLAC)

What Is a QLAC?

A Qualified Longevity Annuity Contract (QLAC) is a special type of deferred annuity specifically funded with money from your retirement account. It’s meant to create a guaranteed income stream later in life while also delaying a portion of your RMDs.

You can use a QLAC to exclude up to 25% of your account balance (up to the lifetime cap of $210,000 in 2025) from your required minimum distributions calculations. The payments from the annuity won’t start until a future date you choose, possibly up to age 85.

Benefits for Tax Minimization

Putting money into a QLAC reduces the balance of the retirement account used to calculate your RMDs. This can lower your required minimum distributions amount and the resulting tax liability in the years before your annuity payments begin. Technically, you aren’t eliminating your tax bill but you are shifting some of your income taxes and your overall tax liability further into the future.

5. Withdraw with a Bracket Management Approach

Bracket management involves making calculated withdrawals each year to control your lifetime income taxes.

Bracket-Filling Withdrawals

The goal of this approach is to fill up your current tax bracket with taxable income. You don’t want to exceed the amount that would push your tax bracket higher. For example, you could use this strategy during a year when your taxable income is low to take more from your traditional IRA, paying a lower income tax rate on your extra withdrawals.

Proportional Withdrawals

Another way to manage your bracket is to use a proportional approach by taking a small percentage of your income from each of your different types of retirement accounts. Your mixture can include taxable accounts, tax deferred accounts, and tax free (Roth IRA) accounts. You would calculate how much to withdraw from each source to manage your total income and keep you out of a higher tax bracket.

Example: Let’s say you expect to have $25,000 of room left in the 12% tax bracket, and you need $50,000 of income in 2025. You might withdraw approximately $20,000 from your traditional IRA and $30,000 from your taxable accounts. This would help you meet your spending needs but not pull the full amount from an account that would push you into a higher tax bracket.

Common Mistakes to Avoid When Managing RMDs

Even with a solid game plan, it’s easy to make mistakes with your taxes and RMDs, especially when you try these techniques without professional help.

Trying RMD Minimization without an Expert

The RMD rules can get a bit complicated. There are a lot of variables to consider, and tax penalties for errors can be expensive. Working with a qualified tax advisor or tax professional as well as your financial planner who specializes in retirement can help you navigate these RMD rules with confidence.

Missing the Deadline

The penalty for not understanding the RMD rules and taking them on time is significant. The IRS will likely impose a 25% excise tax on any amount you should have withdrawn but didn’t. If you correct the mistake within two years, the penalty may be reduced to 10%.

Overlooking QCDs or Roth Conversion Windows

You might miss out on opportunities to use a qualified charitable distribution (QCD) or make a Roth conversion because you aren’t aware of the current RMD rules. Being proactive and planning ahead can make a big difference for your taxes and the growth of your retirement accounts.

Incorrectly Aggregating Accounts

If you have multiple traditional IRA accounts or 403(b)s, you can take your total required minimum distribution from any of them. However, you might be surprised if you have 401(k) plans from different employers, you must take the RMDs from each individual 401(k). Mixing up these rules could lead to a penalty, reinforcing the value of a tax professional and financial planner.

Looking for Personalized Retirement Help? Contact Us at Stage Ready Financial Planning for a No-Commitment Consultation

At Stage Ready Financial Planning, we specialize in helping people just like you navigate the complexities of retirement including planning for RMDs. We understand that your goal is to live your ideal lifestyle without worrying about whether your savings will last or if you’re paying more in taxes than you need to.

That’s why we offer a no-commitment consultation to discuss your situation and see if our services are a good fit. We can help you create a plan to potentially minimize your tax liability and gain the confidence you need to enjoy a well-deserved retirement. Schedule your intro call today!

Frequently Asked Questions (FAQs)

How do I reduce income taxes on RMD distributions?

In general, the best ways to reduce income taxes on your RMDs involve being proactive. Strategies like making Roth conversions before you reach RMD age, using qualified charitable distributions (QCDs) to satisfy your RMDs without them counting as taxable income, and taking withdrawals in lower-income years can all help.

How to potentially reduce RMD taxes after age 73?

Qualified charitable distributions (QCDs) are a great option if you’d like to give to non-profit organizations you care about. You can also use a bracket management approach to time your withdrawals from different tax deferred retirement accounts to avoid jumping into a higher tax bracket. Some people will still explore Roth conversions even when RMDs have begun as well.

How can I minimize income taxes on mandatory IRA distributions?

To minimize income taxes on your mandatory IRA distributions, you could explore doing Roth conversions in low-income years, using QCDs, and making strategic withdrawals from your traditional IRA between age 59.5 and 73 to lower your retirement account balance before required minimum distributions start.

What is the RMD tax bomb?

The RMD tax bomb is a term used to describe the potentially large and sudden tax bill that comes from unexpected required minimum distributions. If you’ve saved a large amount in tax deferred accounts, your RMDs could be substantial later in retirement, pushing you into a higher tax bracket and potentially increasing your Medicare premiums. That said, the phrase “RMD tax bomb” can be misleading and sometimes be a marketing tactic for financial services rather than a real problem for retirees. Be sure to speak to a fee-only financial advisor to understand if this situation applies to you or not.

Is it better to take my RMD monthly or annually?

The pro of taking your required minimum distributions in one lump sum at the end of the year is that your money can grow tax deferred for as long as possible. However, taking monthly or quarterly distributions can create a smoother, more predictable income stream for budgeting. It can also help you avoid pulling money out at a bad time if the market is low at year end. The timing of your RMDs should be based on your personal cash flow and investment goals.

At what age is an IRA withdrawal tax free?

Withdrawals from a Roth IRA can be potentially taken tax free if you are over 59.5 and have had the Roth IRA for at least five years. (Note: Each Roth conversion amount has it’s own 5 year rule in order for the gains to be tax free) For traditional IRAs, all withdrawals are subject to ordinary income tax unless you have already paid taxes on a portion of the funds (your basis) or if a special rule, such as for a qualified charitable distribution, applies.

About the Author

Joseph A. Eck, CFP®, is a Certified Financial Planner® professional who specializes in helping clients in the greater Dayton, Ohio area build tax-smart retirement accounts and strategies. With years of experience in helping retirement savers with tax benefits and tax-efficient planning, investment management, and income strategies, Joseph provides personalized guidance and support to help clients feel confident that their finances are set up to support their ideal retirement. Click here to learn more about Joseph.

Article References

- Fidelity. “Qualified Charitable Distributions (QCDs).” Accessed September 8, 2025. https://www.fidelity.com/retirement-ira/required-minimum-distributions-qcds

- Investopedia. “IRS Publication 590-B: What It Is, How It Works.” Accessed September 8, 2025. https://www.investopedia.com/terms/i/irs-publication-590b-distributions-individual-retirement-arrangements-iras.asp

- IRS. “Give More Tax-Free; Eligible IRA Owners Can Donate up to $105,000 to Charity in 2024.” Accessed September 8, 2025. https://www.irs.gov/newsroom/give-more-tax-free-eligible-ira-owners-can-donate-up-to-105000-to-charity-in-2024

- IRS. “IRS Reminds Those Aged 73 and Older to Make Required Withdrawals from IRAs and Retirement Plans by Dec. 31; Notes Changes in the Law for 2023.” Accessed September 8, 2025. https://www.irs.gov/newsroom/irs-reminds-those-aged-73-and-older-to-make-required-withdrawals-from-iras-and-retirement-plans-by-dec-31-notes-changes-in-the-law-for-2023

- IRS. “Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs).” Accessed September 8, 2025. https://www.irs.gov/publications/p590b

- IRS. “Retirement Plan and IRA Required Minimum Distributions FAQs.” Accessed September 8, 2025. https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

- Northwestern Mutual. “What Is a QLAC? Here’s How It Works.” Accessed September 8, 2025. https://www.northwesternmutual.com/life-and-money/what-is-a-qlac/

- Stage Ready Financial Planning. “A Guide to Roth Conversions in Early Retirement.” Accessed September 8, 2025. https://stagereadyfp.com/blog/roth-conversions-guide/

- T. Rowe Price. “A Closer Look at RMDs and the SECURE 2.0 Rules.” Accessed September 8, 2025. https://www.troweprice.com/personal-investing/resources/insights/a-closer-look-at-rmds-and-the-new-secure-20-rules.html

- Wealthkeel. “Are You Sitting on a Ticking Tax Bomb? RMDs and Your Retirement.” Accessed September 8, 2025. https://wealthkeel.com/blog/rmd-tax-planning-retirement/

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.