Are you confident that your family would know exactly what to do if something happened to you? Would they know how to manage your healthcare if you became incapacitated? Are you sure they have the legal authority and know how to manage your financial accounts if something happens to you?

Navigating estate planning can feel overwhelming, but it’s one of the most important gifts you can give your loved ones. Your estate plan is about more than just your will. It ensures your hard-earned savings go exactly where you intend them to in a tax-efficient way. It also ensures your loved ones aren’t burdened with confusion or legal battles during an already difficult time.

If you’re like many of our clients here in Ohio, you’ve worked hard, saved diligently. You likely value security and want what’s best for your family members. You want to enjoy your ideal retirement with peace of mind, knowing that no matter what happens, you’ve got a comprehensive estate plan in place.

This Ohio estate planning guide will walk you through the important aspects of estate planning and the Ohio specific rules you need to know to make informed decisions and protect your loved ones.

Key Takeaways

- More Than Just a Will: Estate planning in Ohio covers who gets your assets and who makes healthcare and financial decisions for you if you can’t. Be sure to understand the other estate planning documents you need besides your will.

- Ohio Has Its Own Rules: Ohio law dictates how your assets are distributed without a will, what your spouse is entitled to, and even how your digital life is handled. Local knowledge matters!

- Planning = Peace of Mind: Taking the time to create a comprehensive estate plan, including documents like a will, power of attorney, and healthcare directives, is one of the most thoughtful gifts you can give your loved ones.

What is Estate Planning?

A well-crafted Ohio estate plan is a gift to your family members and friends. Think of it as creating a roadmap that covers two major areas. First, it outlines exactly how you want your assets distributed after you’re gone. Secondly, it explains how you want your assets and healthcare managed if you have a medical issue and cannot make your own decisions.

Distributing Your Assets

The core of your estate plan is your last will and testament. This document is what your state will use to distribute your assets to your loved ones through the legal proceeding known as the probate process. Your last will and testament also allow you to name a guardian for your minor children.

Your financial accounts that have a beneficiary, a TOD designation, or are owned by a trust can pass to your heirs outside of the probate process. This will likely save your family members time and the cost of a complicated, lengthy probate. Accounts with beneficiaries or TOD designations commonly include your retirement accounts, investment accounts, and life insurance policies.

Managing Your Financial Matters and Healthcare

Your estate plan should also include a durable power of attorney. This document allows you to name a trusted person to handle your financial matters if you become incapacitated. Your power of attorney would have the authority to manage your financial accounts and pay your bills. Choosing a trustworthy power of attorney can almost be considered a form of asset protection.

Similarly, your estate plan should include a healthcare power of attorney and living will directive. These documents specify the person or persons you want to make healthcare decisions for you if you become unable to do so. The living will directive specifies how you want to handle end-of-life care, including whether or not you want to be kept on life support.

What Exactly is Probate?

According to the Ohio Bar Association, probate is a formal court proceeding. During this process, your assets are distributed, and any taxes or liens are paid from your estate according to your will or Ohio law. You can name an executor that can facilitate this process, or the court will appoint one for you. Any asset you own that doesn’t have a named beneficiary will be distributed through probate including your:

- Home

- Vehicles

- Financial accounts (without beneficiaries)

- Personal belongings

- And more..

One helpful note is that Ohio has a simplified probate process for small estates. Section 2113.04 of the Ohio Revised Code outlines that estates valued at $35,000 or less or $100,000 or less under certain conditions qualify. Additionally, estates worth less than $5,000 may be waived from probate in Ohio completely as a “Summary Release from Administration.”

Why Ohio Estate Planning Specifics Matter

You might be wondering what you should understand about having an Ohio estate plan? Each state has its own rules and planning challenges. Below we will discuss some important estate planning specifics about Ohio law.

Ohio laws determine things like:

- How your property is distributed if you don’t have a will

- What your spouse is entitled to from your estate if you leave them out of your will

- What taxes your estate might owe including estate tax

- What legal documents are recognized in our state

What Happens If You Don’t Have a Will in Ohio?

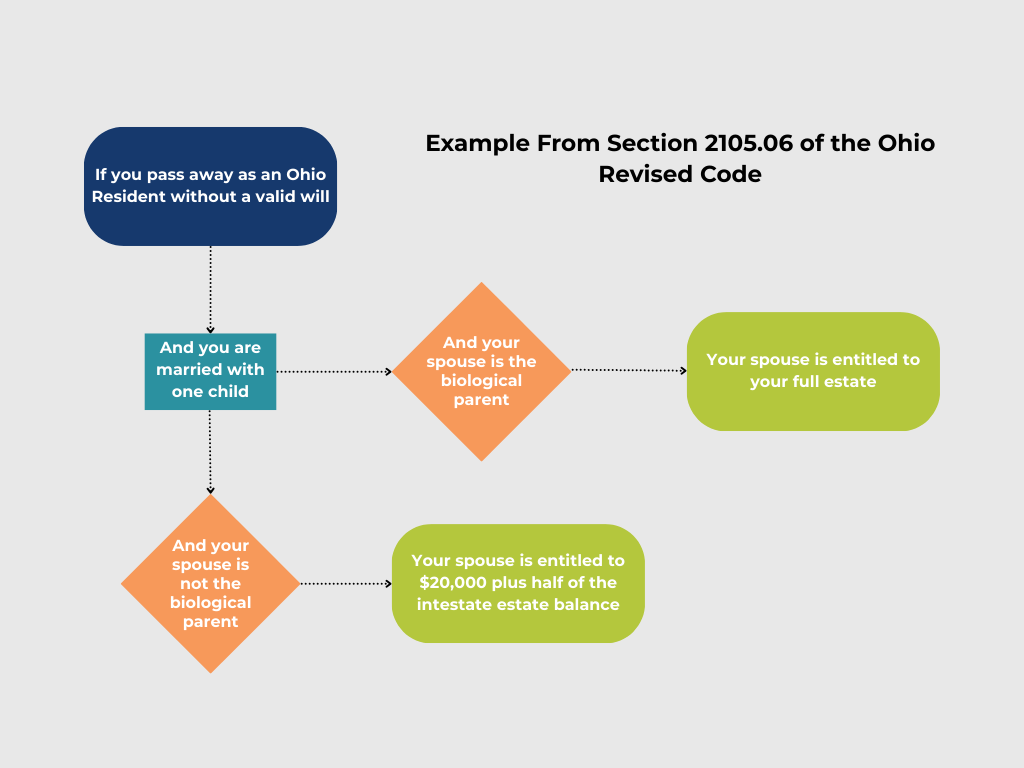

Passing away without a will (intestate) is also known as intestacy. Section 2105.06 of the Ohio Revised Code outlines how the state will distribute your assets if you don’t have a will. The state’s approach might not align with your wishes for your family.

For example, item C of the Ohio Revised Code 2105.06 says that:

- If you die in Ohio without a will and are married

- Have one child but your spouse isn’t the biological parent

- Your spouse gets the first $20,000 plus one half of the remaining intestate estate, and your child gets the rest, per stirpes

*Example illustration of items B and C in Section 2105.06 of the Ohio Revised Code

What Does My Spouse Receive From My Estate If I Leave Them Out of My Will?

Section 2106.01 of the Ohio Revised Code stipulates that your spouse is entitled to a portion of your estate even if you disinherit them. In Ohio, your spouse will be entitled to half or a third of your estate, depending on your family structure.

Does Ohio Have an Estate Tax?

As of 2013, Ohio repealed its estate tax. Ohio also doesn’t have an inheritance tax or a state specific gift tax. However, it’s important to note that the federal estate tax and gift tax rules still apply to Ohio residents. Also, if you own property in multiple states, or receive inheritance from someone in another state, you might have an estate tax or inheritance tax liability.

An estate planning attorney can help you determine if you will have an estate tax liability and ensure your estate plan is tax-efficient.

What Estate Plan Documents Are Recognized in Ohio?

As an Ohio resident, you might be wondering what estate planning documents you need? Here are the essentials for a solid Ohio estate plan:

Last Will and Testament

This is the cornerstone of your basic estate plan. It directs how your assets will be distributed after your death in the probate process. Your will also allows you to appoint a guardian if you have minor children. One important note is that Ohio recently passed the Uniform Fiduciary Access to Digital Assets Act, Chapter 2137 of the Ohio Revised Code. This act recognizes your online accounts as digital assets. You can make decisions about these assets in your last will and testament, as well as in power of attorney documents.

Durable Power of Attorney

As mentioned earlier, this legal document allows you to appoint someone to manage your finances if you become incapacitated. This person listed in this estate planning document is known as your attorney-in-fact.

Healthcare Power of Attorney and Living Will (Advance Healthcare Directive)

These legal documents allow you to grant someone medical power permissions to make healthcare decisions for you if you can’t. The living will arrangement outlines your wishes for end-of-life care including if you want to be left on life support or not.

Trust Documents (if applicable)

Your estate planning attorney may suggest that you create a trust to help your heirs avoid probate and control how they receive your assets. Your attorney might also suggest a trust to help you reduce your federal estate tax. A popular trust arrangement in Ohio is the revocable living trust. This legal document allows you to control all of your assets until your passing. It also lets you specify how you want these assets managed afterward.

HIPAA Release

This legal document authorizes healthcare providers to release your medical history to your designated beneficiaries. Most healthcare providers in Ohio will provide you with a state approved HIPAA release form such as this.

Beneficiary and Transfer-on-Death (TOD) Designations

Most financial assets, such as bank accounts, investment accounts, and insurance policies, allow you to add beneficiary or Transfer-on-Death (TOD) designations. This allows them to pass directly to your designated beneficiaries without going through probate. According to Ohio Legal Help, you can even add TOD designations to property like house and car titles, allowing these assets to avoid probate as well. Here’s a link to the form you would complete and submit to your County.

8 Essential Estate Planning Tips for Ohio Residents

Let’s walk through some essential tips to make sure your estate plan is set up the way you want it to be:

- Start Sooner Than You Think

- Don’t Just Write a Will. Make a Plan

- Use Power of Attorney While You’re Alive

- Consider a Living Will

- Review and Understand Ohio’s Probate Process

- Update Beneficiaries Regularly

- Set Up a Trust if it Fits Your Situation

- Review and Update Your Plan Every Few Years

1. Start Sooner Than You Think

It’s easy to put off estate planning. You want to enjoy your retirement, and thinking about “what-ifs” and passing away isn’t exactly fun. But here’s the truth: the best time to start is now. Estate planning isn’t just for the elderly or the super-rich. Accidents happen, and life is unpredictable. We often hear from clients who say something like, ‘I always thought I had time, but a health scare made me realize how important it is to have a plan for my wife and kids.’

2. Don’t Just Write a Will. Make a Plan

Estate planning is more than just stating where your assets go. A comprehensive estate plan includes organizing how your healthcare and financial affairs will be managed if you become incapacitated. It also includes asset protection strategies to minimize unnecessary taxes and potential estate taxes.

3. Use Power of Attorney While You’re Alive

What if your health declines and you reach a point where you can’t make financial or medical decisions for yourself? That’s where power of attorney documents come in. A durable power of attorney allows you to appoint someone, your attorney-in-fact, to manage your financial affairs. Similarly, a healthcare power of attorney allows you to appoint someone to make medical decisions for you.

4. Consider a Living Will

A living will is a legal document that outlines what you want for end-of-life medical care. It notes what types of treatment you do or do not want if you become terminally ill or incapacitated. In Ohio, this is often combined with a healthcare power of attorney into one document called an advance healthcare directive.

5. Review and Understand Ohio’s Probate Process

Probate is the legal process of validating your will and distributing your assets after you pass away. In Ohio, your county probate court oversees this process. If you live in Montgomery County, Dayton Ohio, here’s a link to your probate process. It can involve probate court fees, attorney document fees, and can be time-consuming. Understanding probate can help you decide whether you should build estate planning strategies to simplify or avoid it, if appropriate.

6. Update Beneficiaries Regularly

Can you remember who you named as beneficiary for your former employer’s 401(k)? What if you named an ex or a family member who passed away? It’s so important to review and update your beneficiary designations on your financial accounts (retirement accounts, life insurance policies, etc.). Financial accounts with a beneficiary can pass directly to your designated beneficiaries, regardless of what your will says. Forgetting about outdated beneficiaries is an easy way to disinherit the people you care about.

7. Set Up a Trust if it Fits Your Situation

Trusts are legal documents that can hold and manage assets for the benefit of your designated beneficiaries. Unlike your will, a trust will help you avoid the probate process (the court process of administering a will). Also unlike your will, a trust allows you to control how and when your assets are distributed.

For example, maybe you are worried about a child not being responsible to manage their inheritance. With a revocable living trust, you could stipulate that your assets be paid to them over a period of time instead of all at once.

Trusts can also be used to reduce federal estate tax, gift tax, and preserve government benefits like Medicaid, for long-term care. An estate planning attorney can help you decide if a trust is right for your estate plan.

8. Review and Update Your Plan Every Few Years

Your estate plan shouldn’t be a “set it and forget it” kind of thing. Ohio laws change, your financial situation evolves, and your family dynamics shift. Consider reviewing your estate plan and estate planning documents every few years, or sooner if you experience a major life event. An estate planning attorney or online provider can help with these updates, ensuring your estate plan remains compliant with Ohio law.

Why Estate Planning Is a Key Part of Financial Planning

Ohio estate planning isn’t just drafting your estate planning documents, it’s all about protecting yourself and the people you care about. At Stage Ready Financial Planning, we believe that thorough estate planning is a core part of your financial plan.

We work alongside your estate planning attorney to ensure that your estate plan and financial plan are in sync. As fiduciaries, we always act in your best interest. We’re right here in Dayton and understand the needs of Ohio residents.

Whether you have a large estate or plan to spend all your money in retirement, we will ensure your estate plan is tax-efficient and aligns with your goals.

Ready to Align Your Estate Plan with Your Financial Goals? Let Stage Ready Financial Planning Help

At Stage Ready Financial Planning, we see estate planning as more than just your estate planning documents. It’s about securing your legacy and providing for the people who matter most.

Here’s how we can help:

- Coordination with Legal Professionals: We understand that estate planning involves legal expertise. We collaborate closely with your estate planning attorney to ensure that your financial plan aligns seamlessly with your estate planning documents.

- Ongoing Support: Estate planning is not a one-time event; it’s an ongoing process. We provide ongoing support by regularly reviewing and updating your estate plan to reflect shifts in Ohio law and changes in your financial situation.

- Local Expertise: As a fee-only RIA based in Dayton, Ohio, we have a deep understanding of the local landscape and the challenges and opportunities faced by Ohio residents.

Don’t leave your estate plan to chance. Contact Stage Ready Financial Planning today to schedule your intro call and take the first step.

Frequently Asked Questions (FAQs)

Do I need an estate planning attorney to create a will in Ohio?

If you’re an Ohio resident who has saved well and has a decent net worth, It’s highly recommended to consult with an Ohio estate planning attorney. They can make sure your will complies with Ohio law and address complex questions and issues, like navigating estate tax or inheritance tax.

Popular low cost alternatives for drafting templated estate planning documents include online vendors such as Trust & Will, Legal Zoom, and more.

Are retirement accounts included in my estate plan?

Retirement accounts (like 401(k)s and IRAs) are not controlled by your will and instead, pass directly to your designated beneficiaries. That’s why it’s important to keep your designated beneficiaries up-to-date. That said, your retirement accounts do count as assets in your overall estate plan for estate tax purposes.

About the Author

Joseph A. Eck, CFP®, is a financial planner dedicated to helping retirement savers achieve their financial goals and build a solid estate plan. With years of experience in estate planning and retirement planning, Joseph provides personalized guidance and support to clients in Dayton and Southwest Ohio. He believes that everyone deserves to feel confident living their ideal retirement. Click here to learn more about Joseph.

Article References

- “Law Facts: Probate,” Ohio Bar Association, ohiobar.org: https://www.ohiobar.org/public-resources/commonly-asked-law-questions-results/law-facts/law-facts-probate/

- “Ohio Revised Code – Section 2105.06: Statute of Descent and Distribution,” Ohio Legislature, codes.ohio.gov: https://codes.ohio.gov/ohio-revised-code/section-2105.06

- “Ohio Estate Tax Information (Prior to 2013),” Ohio Department of Taxation, tax.ohio.gov: https://tax.ohio.gov/professional/estate/prior2013

- “Ohio Revised Code – Chapter 2137: Uniform Fiduciary Access to Digital Assets Act,” Ohio Legislature, codes.ohio.gov: https://codes.ohio.gov/ohio-revised-code/chapter-2137

- “Ohio Medicaid Release Form (ODM 10221),” Ohio Department of Medicaid, dam.assets.ohio.gov: https://dam.assets.ohio.gov/image/upload/medicaid.ohio.gov/Resources/Publications/Forms/ODM10221fillx.pdf

- “Estate Planning & Probate,” Montgomery County, Ohio Probate Court, mcohio.org: https://www.mcohio.org/466/Estate

- Trust & Will, trustandwill.com: https://trustandwill.com/

- LegalZoom, legalzoom.com: https://www.legalzoom.com/

- “Transfer on Death (TOD) Affidavit,” Franklin County Law Library, fclawlib.libguides.com: https://fclawlib.libguides.com/ld.php?content_id=8143020

- “Transferring Your Home or Car Title with a TOD Affidavit,” Ohio Legal Help, ohiolegalhelp.org: https://www.ohiolegalhelp.org/topic/TOD-home

- “Ohio Revised Code – Section 2113.03: Summary Release From Administration,” Ohio Legislature, codes.ohio.gov: https://codes.ohio.gov/ohio-revised-code/section-2113.03

- “Ohio Revised Code – Section 2106.01: Election by Surviving Spouse,” Ohio Legislature, codes.ohio.gov: https://codes.ohio.gov/ohio-revised-code/section-2106.01

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.