If you are approaching or finally in retirement, a big question might be lingering in the back of your mind: “Will I be able to enjoy retirement without constantly worrying about money?” You‘d love to spend your time gardening, enjoying your grandkids, or finally taking that big trip. You might worry that instead, you’ll be wondering whether your investments are set up right and how to lower your tax bill. The good news is, peace of mind with your money is possible. One way is by planning ahead and exploring concepts like Roth conversions in retirement.

At Stage Ready Financial Planning in Dayton, Ohio, we believe in making important financial concepts clear and relatable. We’ve seen firsthand how a well-planned Roth conversion strategy can make a difference. It can add significant tax-free resources into our client’s retirement plans. This article will walk you through what a Roth IRA conversion is, how it might or might not work for you, and the important Roth IRA conversion rules you should know.

Key Takeaways

- A Roth conversion is the strategic process of moving pre-tax retirement funds into a Roth account, where you pay taxes now to enjoy potentially tax-free growth and withdrawals later in retirement.

- Roth conversions can be a tool for strategic tax planning, offering retirement spending flexibility and estate planning benefits by allowing your beneficiaries to inherit money tax-free.

- Roth conversions are not for everyone. That said, they can be beneficial if you anticipate a lower tax bracket now than later on in retirement, have a long time horizon for the funds to grow, and can pay the conversion taxes from cash savings.

What is a Roth Conversion?

A Roth IRA conversion is simply moving money from your traditional, pre-tax retirement account into a Roth account. When you do this, the amount you convert to Roth becomes taxable income in the current year. It might seem counterintuitive to willingly pay taxes now. The benefit is that future qualified withdrawals from your Roth IRA can be completely tax-free.

In your traditional IRA, your contributions might have been tax-deductible, but your withdrawals in retirement are taxed at ordinary income tax rates. With a Roth, you’re essentially flipping the script: you pay taxes upfront so you don’t have to worry about them later.

Types of Roth Conversions

Several types of retirement accounts can convert to a Roth:

- Traditional IRA to Roth IRA: This is the most common type of Roth IRA conversion.

- 401(k) to Roth IRA: This is generally possible if you have a 401(k) from a previous employer or if you are over 59.5. You may have to roll pre-tax dollars from your 401(k) into a Traditional IRA first. Then, you can convert them to a Roth IRA. Alternatively, some 401(k) plans allow for direct Roth conversions. They let you roll pre-tax dollars straight into a Roth IRA.

- 403(b), 457(b), Thrift Savings Plan (TSP) to Roth IRA: Similar to 401(k)s, pre-tax funds from these plans can usually be converted to Roth.

- Inside Your Group Retirement Accounts: Some group retirement plans, like 401(k)s, allow you to convert pre-tax dollars to Roth. This can happen inside your existing plan without moving funds to a Roth IRA.

- SEP IRA & SIMPLE IRA to Roth IRA: These conversions work very similar to converting a Traditional IRA. SIMPLE IRA conversions can’t start until two years after you begin participation.

- 529 Plan to Roth IRA: The Secure Act 2.0 now allows a 529 beneficiary to transfer unneeded funds from their 529 plan into a Roth IRA. Certain conditions must be met for this to be allowed. As of 2025, the annual transfer amounts are subject to the Roth IRA contribution limits with a lifetime cap of $35,000. Also, the 529 plan must have been open for at least 15 years, and contributions made within the last five years are not eligible for this conversion.

How a Roth IRA Works (and How It Differs from a Traditional IRA)

To understand why a Roth conversion might be a good idea, it’s helpful to know how a Roth IRA works and how it differs from a Traditional IRA.

Roth IRA Basics

You fund a Roth IRA with after-tax dollars. This means that when you contribute to a Roth IRA, you don’t get a tax deduction. Because of this, your contributions can be withdrawn tax-free and penalty-free at any time. Most importantly, the IRS states that qualified withdrawals of earnings are also completely tax-free. This benefit kicks in once you meet two conditions:

- The Roth account has been open for at least five years

- And you are age 59½ or older, disabled, or using the funds for a qualified first-time home purchase

The idea of having tax-free withdrawals in retirement can be incredibly appealing. This is especially true if you are in a higher tax bracket. It’s also popular for people who want more freedom to spend without worrying about extra taxes.

Key Differences vs. Traditional IRAs

Let’s look at the main differences between a Roth IRA and a Traditional IRA:

| Traditional IRA | Roth IRA | |

| Contributions | Often tax-deductible (Tax deductibility is not permitted at higher income levels) | Made with after-tax dollars (No tax deduction) |

| Growth | Tax-deferred | Tax-free growth (for qualified withdrawals) |

| Withdrawals | Taxable in retirement as ordinary income | Tax-free in retirement (qualified withdrawals) |

| RMDs | Subject to Required Minimum Distributions (RMDs) starting at age 73 (or 75 for those born in 1960 or later) | No RMDs for the original owner |

Why Consider a Roth Conversion?

So, why would you want to pay extra taxes now? If you are retired or getting close to retirement, a Roth conversion offers some potentially compelling advantages, These include lifetime tax savings, increased spending flexibility, and estate planning benefits.

Strategic Tax Planning

One of the most popular reasons to consider a Roth conversion is for strategic tax planning. Let’s say that you believe your income taxes will put you in a higher tax bracket in retirement. In that case, converting while you might be in a lower tax bracket has the potential to save you money on your future income taxes. It’s important to note that this strategy may work against you. This can happen if you end up in a lower tax bracket later in life and you convert dollars in a higher tax bracket.

Roth conversions can be especially helpful if you anticipate your tax bracket will go up. This can happen due to higher Social Security income combined with pension payments, or other retirement income streams. Large required minimum distributions (RMDs) pushing you into a higher tax bracket later in life are another great example of this.

The most common way of executing this type of planning is to convert pre-tax dollars to Roth in the early years of retirement. This period is usually after your employment income has ended but before required minimum distributions (RMDs) begin.

By converting your IRA to a Roth IRA, you are “locking in” your tax rate on those converted funds today. It’s like prepaying for a service you know you’ll eventually need, but at a potentially lower price.

Example: Let’s say you retire at age 65 and don’t plan to take your Social Security benefits until age 67. In the meantime, you plan to live off of extra cash savings you’ve built up. Your taxable income in these early years of retirement may be very low and a good time to consider a Roth conversion.

Retirement Spending Flexibility

Roth IRAs can be great for spending flexibility in retirement. Since qualified withdrawals are typically tax-free, you can have more control over your taxable income in retirement. This is particularly useful for managing your Medicare premiums, which can increase or decrease based on your taxable income. Having a tax-free bucket of money can be a big stress reliever. You can access these funds for large withdrawals, such as vacations or car purchases.

Example: Imagine you are 64 and retired with $250,000 in a Roth IRA. If it’s been open and funded for at least five years, you could potentially take a tax-free withdrawal. You could then use this to pay cash for your next vehicle. On the other hand, if all your money is in a pre-tax 401(k) or Traditional IRA, that same withdrawal would increase your tax bill. It could also potentially push you into a higher tax bracket.

Unlike Traditional IRAs and 401(k)s, Roth IRAs are not subject to required minimum distributions (RMDs) during the original account owner’s lifetime. This means you don’t have to start taking money out at a certain age if you don’t need it. Because of this, Roth IRAs allow your dollars to continue to benefit from extended periods of tax-free growth.

Estate Planning Benefits

Roth IRAs can be extremely useful in maximizing your estate plan. When you’re no longer here, your beneficiaries can inherit your Roth IRA tax-free, assuming your Roth account has met the five-year rule. This can be a tax-efficient way to pass your savings. Compare this to a Traditional IRA, where your beneficiaries would have to pay income taxes on withdrawals.

Example: If you left your two children a Roth IRA, valued at $500,000, they would each be able to inherit and spend $250,000 tax-free. Alternatively, if you left them a $500,000 Traditional IRA, they would each have to pay tax on $250,000 of additional income. The IRS would likely force them to spend down the account in the first ten years after you pass. This means they wouldn’t be able to stretch out those taxes for a very long time.

When Does a Roth Conversion Make Sense?

Roth conversions involve assumptions and are not a one-size-fits-all solution. It’s important to know when they might be helpful and when they might not.

Good Times to Consider Converting

During a low-income year:

If you have a year where your taxable income is lower than usual, this could be a beneficial time to convert to a Roth. Examples of this situation include:

- A job change or pay cut

- A sabbatical or time off work

- A part-time work transition into retirement

- The early years of retirement before other income streams kick in

If you expect to be in a higher tax bracket in retirement:

If you’re confident your tax bracket will be higher in retirement, a Roth IRA conversion can be a smart move. An example of this would be if you’ve saved well in pre-tax retirement accounts and expect large required minimum distributions (RMDs).

Before required minimum distributions (RMDs) begin:

The IRS does not permit your required minimum distributions (RMDs) to be converted once they start. Converting funds to a Roth IRA before they kick in can reduce the size of your Traditional IRA. This could potentially reduce your future RMDs and their associated tax bill.

When tax rates or market values are historically low:

No one has a crystal ball, and consistently predicting the future is impossible. That said, if current tax rates seem historically low, converting your IRA to a Roth IRA might be advantageous. Similarly, if the stock market is experiencing a short-term drop in value, it could be beneficial to convert before prices recover.

Who Benefits Most?

In general, you would benefit most from a Roth IRA conversion if you:

- Are in a lower tax bracket now than you expect to be in retirement

- You don’t need the converted funds immediately and can afford to pay the taxes from other savings, not from the converted amount itself

- You have a long time horizon until you need to spend the money, allowing for more tax-free growth within your Roth account

- You want to leave a tax-free inheritance to your beneficiaries

Who Benefits Least?

You may benefit the least from a Roth IRA conversion if you:

- Are experiencing a very high income tax-bracket year

- Expect to be a much lower tax bracket in the majority of your retirement

- If you need to immediately live on your pre-tax invested savings and can’t afford to reduce the value of your IRA

- If you are on the edge of a higher tax bracket or Medicare premium (IRMAA) threshold

Should Retirees Consider a Roth Conversion?

You might be thinking, “I’m already retired, or close to it. Is a Roth conversion still something I should consider?” The answer depends, but being close to retirement is not a deal breaker. On the contrary, Roth conversions can be particularly helpful in the early years of retirement. This is especially true if you are looking to effectively control your tax bill down the road.

Roth Conversions in the Early Retirement Window

If you retire before you begin taking Social Security or pension income, there can be an “early retirement window” where your taxable income is lower. This period may be a great time to strategically convert portions of your Traditional IRA to a Roth IRA. You can take advantage of your potentially lower tax bracket. This may help smooth out your tax obligations later in retirement and lessen the impact of future required minimum distributions (RMDs).

RMD Avoidance and Withdrawal Flexibility

Roth IRAs are not subject to required minimum distributions (RMDs) for the original account owner. By converting funds to a Roth IRA, you reduce the balance of your Traditional IRA, which may lower the amount of your future required minimum distributions (RMDs).

No required minimum distributions (RMDs) from your Roth IRA means you have more control over when you can withdraw money from your retirement accounts. You’ll have greater flexibility in managing your cash flow and avoiding unnecessary taxable income.

Estate Planning Considerations for Retirees

The estate planning benefits of Roth IRA conversions are compelling if you want to leave money to your loved ones instead of Uncle Sam. By converting funds to Roth, your beneficiaries won’t face an immediate tax bill when they inherit your Roth retirement savings.

Tax Implications of a Roth Conversion

One of the most important aspects of planning a Roth conversion is understanding the near term tax implications.

How It’s Taxed

When you convert to a Roth, the amount you transfer is added to your gross income for that year. This means it will be taxed at your federal and potentially state ordinary income tax rates.

Example: If you convert $50,000 from your Traditional IRA to a Roth, that $50,000 will be added to your other income and taxed accordingly. If you file jointly and your federal taxable income for 2025 was $90,000, your taxable income would be $140,000 post-conversion. This would push you from the 12% to the 22% federal bracket, and increase your tax bill for 2025.

You can usually choose to withhold the taxes from the amount you convert. Alternatively, you can pay the taxes separately using quarterly estimated payments directly from your cash savings.

For the maximum benefit of a Roth Conversion, it’s usually best to pay the taxes separately. This helps keep as much invested in your Roth IRA as possible. That said, you should work closely with your tax professional and financial advisor to avoid underpayment penalties and surprises.

What to Watch Out For

- Higher Tax Bracket: Roth IRA conversions have the potential to push you into a higher tax bracket. This is why strategic planning and “partial” Roth conversions are commonly recommended.

- Medicare Premiums (IRMAA): Your federal adjusted gross income (AGI) impacts your Medicare Part B and Part D premiums through something called the Income-Related Monthly Adjustment Amount (IRMAA). A Roth conversion could temporarily increase your AGI, leading to higher Medicare premiums two years later. For 2025, Medicare beneficiaries whose 2023 income exceeded $106,000 for single filers or $212,000 for married couples filing jointly paid an additional monthly surcharge.

- Other Income-Based Thresholds: A Roth conversion could impact other income-based credits or deductions you might be eligible for. Common examples include vehicle and education tax credits. This makes working with your tax advisor extremely important if you are considering Roth conversions.

- Understand The Five-Year Rule: The five-year rule can be tricky because there are two separate waiting periods that apply to Roth IRAs. The first is a five-year rule on your Roth IRA contributions, and the second is a five-year rule on your Roth conversions. Each conversion you do to a Roth IRA starts its own five-year clock. This means you must wait five years after each individual conversion to access your converted funds and their earnings tax-free and penalty-free.

Managing the Tax Impact

- If possible, pay taxes from your cash savings: It’s often best to pay the conversion taxes from money outside of your retirement accounts. If you pay taxes from the converted amount, that portion is considered a withdrawal. It will decrease how much money you move into your Roth IRA. It could also be subject to an additional 10% early withdrawal penalty if you’re under 59½, on top of income taxes.

- Potentially spread your conversions over multiple years: Instead of converting a large amount, you could spread your Roth conversions over several low income years. This strategy can help you stay within your desired tax bracket and control your overall tax bill.

- Consult both your tax advisor and financial planner: They can help you model the tax impact of various conversion amounts from your IRA to a Roth IRA.

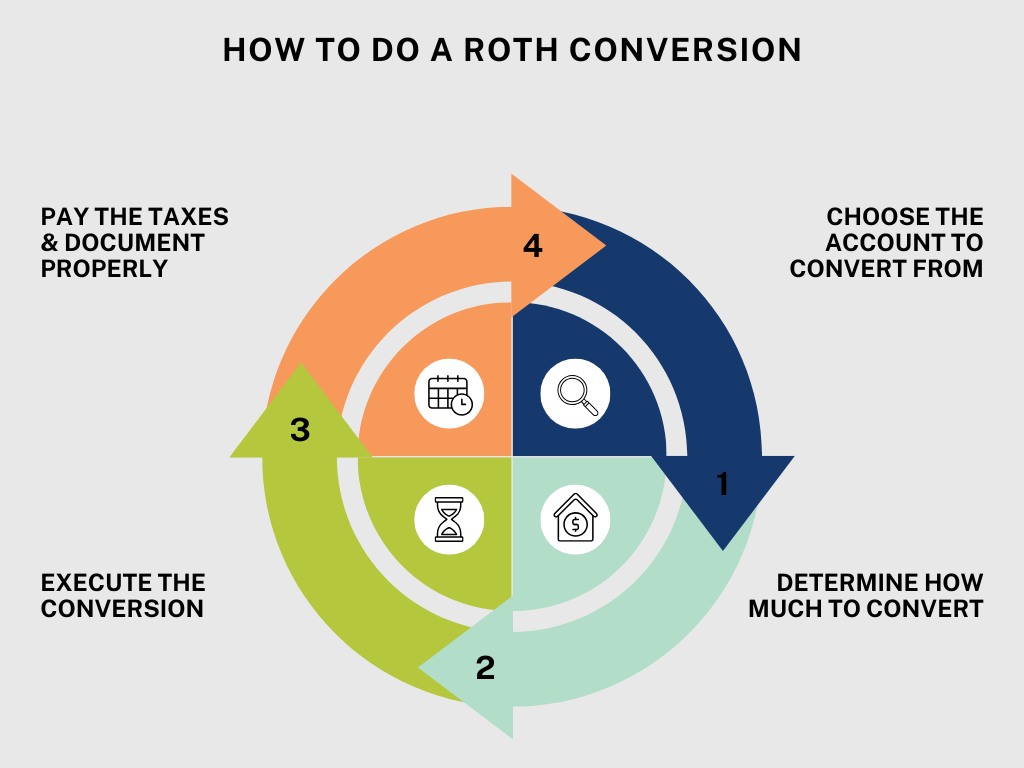

How to Do a Roth Conversion: Step-by-Step Process

The process of completing a Roth conversion is fairly straightforward once you understand the steps. Keep in mind that subtle differences may occur depending on your financial institution.

Step 1: Choose the Account to Convert to a Roth From

The first step is to decide which pre-tax retirement account dollars you want to convert to a Roth. This might be money in your Traditional IRA or pre-tax 401(k). If you have an old 401(k) or similar employer plan, you may first need to roll it over into a Traditional IRA. However, some 401(k) plans allow in-plan Roth conversions.

Step 2: Determine How Much to Convert to a Roth

This is the part of the process where professional guidance is most helpful. You’ll want to consider your projected year-end income, and your preferred tax bracket. It’s common to convert to a Roth only enough to fill up your current tax bracket. We help our clients make these decisions closer to the end of the year when tracking projected income is a bit easier.

Step 3: Execute the Conversion

Next, you’ll need to contact your financial institution. They will have a specific process for initiating your Roth IRA conversion. This could involve filling out paperwork to direct the transfer of funds from your Traditional IRA to your Roth IRA. Some investment custodians have an electronic process that can simplify things for you. The transfer is done directly between your accounts at the financial institution, which helps avoid accidental early withdrawal penalties.

Step 4: Pay the Taxes & Document Properly

The amount you transferred will be considered taxable income in the year of your Roth IRA conversion. You’ll need to account for these conversion taxes and document them correctly on your tax return. You can either withhold taxes directly from your conversion or set aside funds from your non-retirement accounts to cover this tax bill. Note that the timing of your conversion can impact how you’ll need to pay taxes to avoid penalties. Be sure to work closely with your tax advisor to avoid paying Uncle Sam more than necessary.

Other Roth Conversion Strategies

Depending on your situation, there are a few other strategies that have the potential to make Roth conversions even more useful

Conversion Ladder

A Roth conversion ladder involves converting funds to a Roth IRA on a periodic basis and then waiting five years before touching each converted amount. After each five-year period, the converted amount and its earnings can be withdrawn tax-free and penalty-free if you are over 59.5. This provides a way to create a continuous series of accessible funds (ladder) to use tax-free in retirement.

Backdoor Roth Strategy

A backdoor Roth strategy is used by high-income earners who exceed the limits for a direct Roth IRA contribution. The IRS sets income limits for direct Roth IRA contributions annually. For example, for a single filer in 2025, a Roth contribution isn’t permitted if your modified adjusted gross income exceeds $165,000.

If you don’t qualify to contribute directly to a Roth IRA, there are two steps to a backdoor Roth contribution. You start by making a non-deductible contribution to your Traditional IRA. Next, you would immediately convert that non-deductible contribution to a Roth IRA. Since your initial contribution was after-tax, only the earnings that build after your contribution would be considered taxable income. By converting immediately, you minimize the likelihood that you will pay tax on any part of this transfer.

There are a few things to watch out for with this strategy. You will need to make sure you have no other dollars in a Traditional IRA if you want your backdoor Roth conversion to be tax-free. You will also need to make sure that the IRS Form 8606 is filed properly with your tax return.

Market-Timing Advantage

At Stage Ready Financial Planning, we rarely advocate for trying to time the stock market. However, there can be a market-timing advantage when it comes to completing Roth conversions.

A stock market downturn means your retirement account balances will temporarily drop in value. Converting while the market is down means you’re paying conversion taxes on a smaller amount. If and when the market recovers, the subsequent recovery growth within your Roth IRA can be tax-free.

Example: Let’s say you want to make a $40,000 Roth conversion from your Traditional IRA, and the market experiences a 25% drop. You could theoretically convert $30,000 and pay taxes only on $30,000 while the market is down. If and when the market recovers, your $30,000 could eventually recover to $40,000 but you only paid tax on the smaller amount.

Common Mistakes to Avoid

Even with the best intentions, it’s easy to make mistakes when navigating Roth conversions. Being aware of common pitfalls can save you headaches and income taxes.

Not Having Professional Help

One of the biggest mistakes you can make is trying to navigate Roth conversions alone. Without help from a qualified financial advisor and tax advisor, you might:

- Miscalculate your tax bill: This could lead to an unexpected tax bill that includes underpayment or timing penalties.

- Convert too much to a Roth: Too much income can push you into a higher tax bracket unnecessarily or increase the cost of your Medicare premiums (IRMAA).

- Miss out on strategic timing: Examples of this include not taking advantage of a low-income year or a market dip for converting your IRA to a Roth.

- Fail to coordinate with your broader financial goals: A Roth conversion should fit seamlessly into your comprehensive retirement and estate plan. It might sound attractive, but a Roth conversion could actually work against you if you need to live on your Traditional IRA or 401(k) dollars for income.

You Don’t Need to Navigate the Roth IRA Conversion Rules Alone. Stage Ready Financial Planning is Here to Help You.

At Stage Ready Financial Planning in Dayton, Ohio, we specialize in helping retirement savers over 50 navigate Roth conversions with clarity and confidence. We know you’ve worked hard and our goal is to help you set things up correctly so you can comfortably live your ideal retirement lifestyle and keep more of your hard earned savings.

We’ll sit down with you to understand your situation, and help you determine if a Roth IRA conversion is the right move. We’ll show you how it fits into your overall plan, potentially helping you minimize income taxes and ensure your investments are aligned with your retirement goals. You don’t have to tackle this on your own. Schedule your complimentary intro call today!

FAQs

Should retirees do Roth conversions?

Yes, retirees should at least consider Roth conversions especially in the early low-income years before Social Security begins. They can be potentially helpful for managing required minimum distributions (RMDs), creating tax-free resources, and enhancing your estate plan.

Who benefits most from Roth conversions?

You can benefit most from a Roth conversion if you expect to be in a higher tax bracket in retirement than you are currently. Roth conversions are also extremely helpful if you want to reduce your future required minimum distributions (RMDs) or leave a tax-free inheritance to your loved ones.

What are the downsides of Roth conversions?

A primary downside is that the amount you convert is immediately considered taxable income. This can cause you to have a larger tax bill in the short term. It could also potentially push you into a higher tax bracket, impacting things like your Medicare premiums. If your tax bracket in the future ends up being lower than when you convert, then you may have paid more taxes than you needed to on the converted amounts.

How do I avoid taxes on Roth IRA conversions?

You technically can’t avoid income taxes on the Roth IRA conversion itself. The primary purpose of a Roth conversion is to pay taxes now so that your future qualified withdrawals can be tax-free. However, you can manage the tax bill by converting smaller amounts over several years and timing your Roth IRA conversion to occur during lower tax bracket years.

About the Author

Joseph A. Eck, CFP®, is a financial planner with over ten years of experience in investment management, Roth conversions, and comprehensive retirement planning. As the founder of Stage Ready Financial Planning, he is dedicated to helping retirement savers achieve their financial goals and strategically manage their wealth for a tax-efficient future. Joseph believes that everyone deserves to feel confident that their finances are set up correctly to live their ideal retirement. Click here to learn more about Joseph.

Article References

- Internal Revenue Service. “Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs).” https://www.irs.gov/publications/p590a#en_US_2024_publink1000129982

- Internal Revenue Service. “Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs).” https://www.irs.gov/publications/p590b#en_US_2024_publink100089627

- Internal Revenue Service. “Form 8606, Nondeductible IRAs.” https://www.irs.gov/pub/irs-pdf/f8606.pdf

- Social Security Administration. “Form SSA-44, Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event.” https://www.ssa.gov/forms/ssa-44.pdf

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.