The most important part of planning your ideal retirement is creating an accurate projected budget, allowing you to make decisions about your income and other resources. Once you’ve projected your regular expenses, you should be aware of the unexpected expenses that can disrupt your plan.

While you’ve likely saved diligently in your retirement accounts and have a plan for your retirement income, surprise costs can strain your retirement savings if you’re not prepared. Here are some unexpected expenses you should be ready for to ensure your retirement costs stay under control.

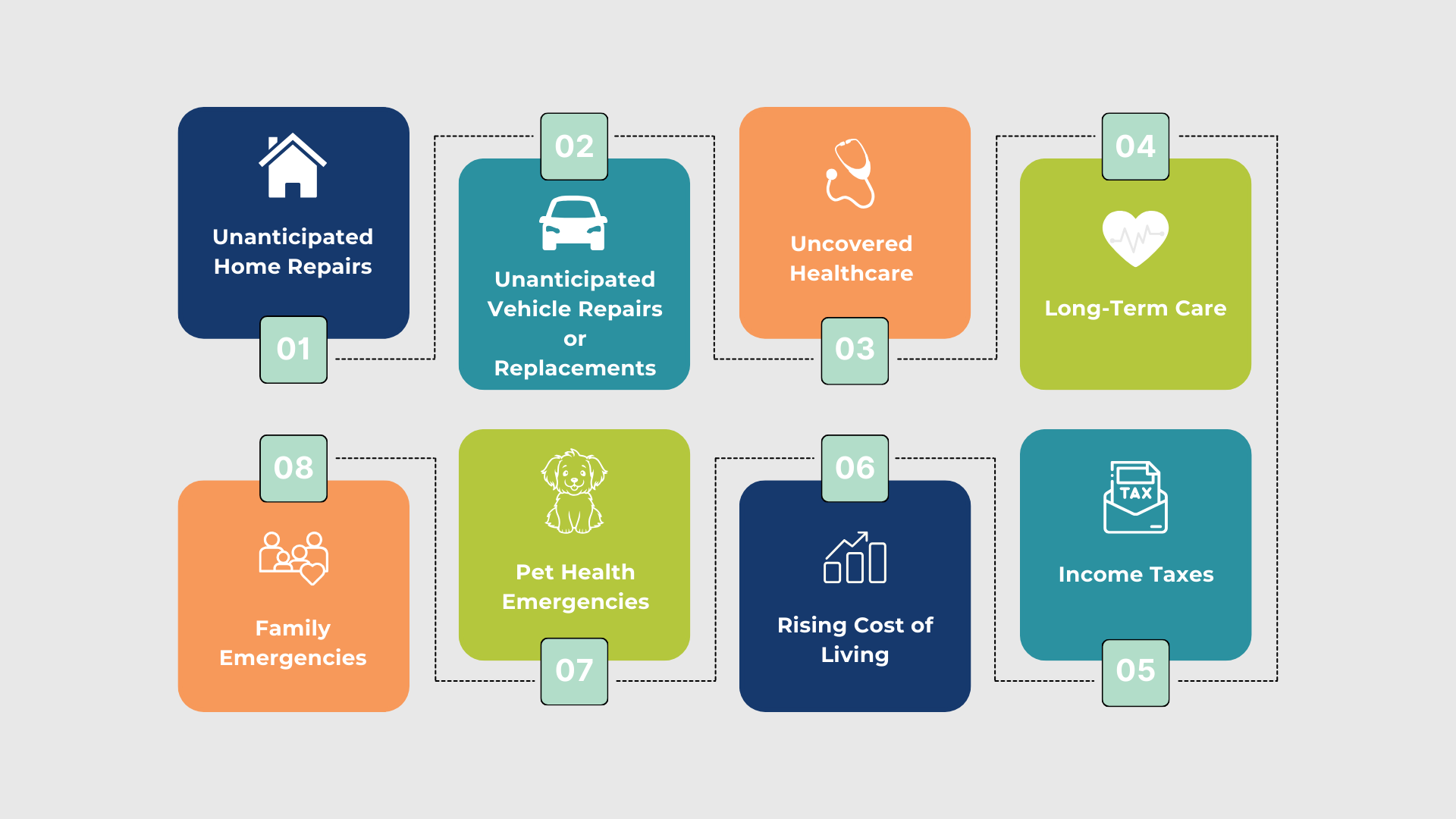

What Are the Most Common Hidden Costs in Retirement?

1. Unanticipated Home Repairs

Owning a home means there’s always a potential for unexpected expenses in maintenance and repairs that go above and beyond your mortgage cost. According to a 2019 report from HomeAdvisor, homeowners spend an average of $1,105 annually on home maintenance. Additionally, the report indicates that 1 in 3 homeowners reported having to complete an emergency home project with an average cost of $1,206.

Major repairs, such as a new roof, can easily cost $10,000 or more. If you don’t factor these expenses into your monthly retirement budget, you may need to withdraw more from your savings than planned. Excess distributions from retirement accounts have the potential to make your future income unsustainable.

Instead of potentially harming your retirement accounts, consider saving a small amount of your income each month into a bank account earmarked for house projects and repairs. If the emergency repair is needed, you have the money sitting, ready to go.

2. Unanticipated Vehicle Repair or Replacement

Cars don’t last forever, and as they age, your out of pocket costs for repairs can become frequent and expensive. Data from AAA indicates that the average annual cost to own and operate a vehicle is about $9,282. This number includes car loan expenses, maintenance, fuel, and insurance costs.

When building your retirement budget, consider assuming that you will have car expenses throughout retirement, whether your current car is paid off or not. Saving a monthly amount of the income you receive from your retirement accounts for a future vehicle replacement or major repair can help you manage these unexpected expenses.

3. Uncovered Healthcare

Healthcare will likely be one of your most significant expenses in retirement. While Medicare covers many services, it doesn’t cover everything. For instance, Medicare covers preventative doctor visits, but you might face out of pocket costs for prescription drugs or co-insurance costs for specialized treatments.

According to Fidelity, a 65-year-old couple retiring in 2023 can expect to spend an average of $315,000 on healthcare throughout their retirement. This estimate includes Medicare part B and D premiums as well as co-insurance and deductible costs associated with Medicare part A, B, and D. It’s important to note that this figure does not include the cost of over the counter medications, most dental services, and the cost of long-term care.

Consider building a much larger number than you think you need for medical costs in your retirement budget. If you have a health savings account, consider contributing as much as possible before you retire and investing your savings to create a tax-advantaged way to pay for your qualified medical expenses.

When planning the cost of your Medicare options, be sure to research Medicare Advantage vs Medicare Supplements. Medicare Advantage is offered through private health insurance companies and typically bundles Parts A, B, and D. Premiums for Medicare Advantage tend to be less expensive but your out-of-pocket additional costs can be higher.

Medicare Supplements can be purchased when also paying for Medicare parts A,B, and D directly and fill the gaps that traditional Medicare doesn’t pay for. Premiums tend to be higher, with fewer out-of-pocket costs.

4. Long-Term Care

Long-term care is often needed later in life for help with the ‘activities of daily living’ you can no longer perform on your own. Examples of ‘activities of daily living’ include help with eating, dressing, toileting, continence, and transferring. Those most likely to pay for some form of long-term care are single or widowed, as they no longer have an in-house family member to care for them.

Medicare does not provide long-term care coverage, therefore you may have to pay for this care out of pocket or through having long-term care insurance. Genworth’s 2023 Cost of Care Survey reports that the median cost for a private room in a nursing home is $116,800/year or $9,733/mo. If you need long-term care, whether at home or in a facility, these healthcare costs can quickly deplete your retirement savings.

If you want more control over the form of care you receive later in life, consider planning for the cost of long-term care insurance. Long-term care insurance is quite expensive, so another option would be to earmark investment accounts that you would use specifically for this purpose and plan to not touch them until that time.

5. Family Emergencies

Whether it’s supporting adult children through tough times or covering unexpected medical costs for a struggling family member, financial support for your loved ones can become an unexpected expense in retirement. A 2024 survey by Bankrate suggests that 61% of parents with adult children have sacrificed to provide them with financial support.

You can prepare for these situations a couple of different ways. The first way would be to build a miscellaneous category into your retirement budget. Each month, you would set aside a small amount of the income you receive from your retirement savings to prevent these costs from derailing your retirement income.

Another approach would be to simply pre-determine the discretionary parts of your retirement spending that you would be willing to forgo if you needed to help a family member or loved one.

6. Pet Health Emergencies

Pets are family too, and their medical expenses can be costly, especially as they age. According to Forbes 2024 Pet Ownership Statistics, the average cost for essential dog expenses is $1,533 annually. The study also indicates that pet owners who travel and rely on pet daycare regularly could expect to spend an additional $2,980 per year.

Even if your pet is healthy and doesn’t have unexpected medical bills, maybe you want to travel a lot more in retirement. Extra travel means that you will need to pad your travel budget to afford the daycare and boarding costs for your pet each time you leave town.

Unexpected costs for your pets including healthcare expenses can strain your retirement budget. Some options to consider are to explore pet insurance and to establish a dedicated savings account and monthly automatic savings for pet health care in your retirement plan.

7. Rising Cost of Living

Inflation is a subtle cost that can erode the purchasing power of your retirement income. The U.S. Bureau of Labor Statistics reports that inflation has averaged between 2-3% per year over the last decade. A 3% annual inflation increase means that if today, you spend $1,000 per month on groceries, in 15 years you might be paying $1,558 per month for the same items.

Even with careful budgeting, your retirement expenses will likely increase over time as prices rise. It’s important to make sure that your retirement savings are invested in a way that provides you with income, plus enough additional growth to create cost of living raises (COLA) to help you maintain your standard of living.

8. Income Taxes

Taxes don’t stop in retirement. For instance, pension payments, Social Security benefits, and withdrawals from certain retirement accounts can all be subject to income tax. Depending on how much you’ve saved in pre-tax retirement accounts, your taxes can be higher than expected when you reach your 70s.

As you age, the IRS requires that you begin to start liquidating your pre-tax retirement accounts, including IRAs and 401ks, so that you can pay taxes on your savings. The term for this IRS rule is: Required Minimum Distributions (RMDs). Current IRS rules state that those who turned age 72 in 2023 must begin making RMDs at age 73.

RMDs are required whether you need income from your pre-tax accounts or not, and therefore can increase your tax bill and your marginal tax bracket. Tax planning can help minimize these costs. Consider working with your financial advisor and your CPA to help you minimize your potential lifetime income taxes.

What Can You Do to Fully (and Safely) Prepare for Retirement?

To help you navigate unexpected expenses in retirement, consider:

| Unexpected Expense | Consider |

| Unanticipated Home Repairs | Save monthly for house repairs and upgrades in your retirement budget |

| Unanticipated Vehicle Repair or Replacement | Save monthly for vehicle repairs & replacements in your retirement budget |

| Uncovered Healthcare | Maximize your HSA & budget for higher than expected healthcare costs |

| Long-Term Care | Explore long-term care insurance or earmark the invested savings you would use to pay for care later in life |

| Family Emergencies | Set aside funds or plan for how you would cut your discretionary spending to help family out |

| Pet Health Emergencies | Explore the cost of pet insurance or save monthly for pet healthcare costs in your retirement budget |

| Rising Cost of Living | Invest your retirement savings for growth and income to create potential cost of living raises |

| Income Taxes | Explore tax planning with your financial advisor & CPA to potentially reduce your lifetime tax liability |

Why Is It Important to Plan for Retirement with a Professional?

Planning for retirement involves much more than just saving money. A great retirement plan balances strategies to help you live your ideal life while managing potential costs and risks.

A financial advisor can help you navigate complex tax planning, ensure you’re taking full advantage of your investments and retirement accounts, and help you prepare for both expected and unexpected expenses.

FAQs

What is the biggest expense for most retirees?

Health care often becomes the most significant expense for retirees, especially as they age. Costs not covered by Medicare covers such as dental, vision, and long-term care, can quickly add up and strain your retirement savings. Medicare covers many services, but retirees often face significant out of pocket costs for qualified medical expenses and prescription drugs.

What is a realistic retirement budget?

A realistic retirement budget should include both essential and discretionary retirement expenses, with a buffer for unexpected expenses. It should account for medical expenses, rising health care costs, income taxes, and financial support for adult children or family emergencies.

The budget you build should be based on your ideal lifestyle and adjust for inflation over time. Working with a financial advisor can help you create a spending and saving plan tailored to your situation, accounting for other expenses such as taxes.