Investing in your 50s can be exciting and stressful. You’ve been working hard and saving for retirement, and might be wondering:

- Am I doing everything I can to make my money last?

- How should my investments be set up this close to retirement?

- Have I saved enough to support the income I’m going to need?

- How do I turn my savings into a consistent monthly paycheck in retirement?

If you are in your 50s, it’s not too late to make some smart changes to your investment plan! In this article, we will discuss how to maximize your retirement savings in your 50s so that you feel confident when you make the leap to financial freedom.

Article Key Takeaways

- Re-evaluate: Create a clear vision of what you want and what it might cost.

- Optimize: Use catch-up contributions and tax-advantaged accounts to boost your retirement savings.

- Diversify: Focus and align your portfolio with stocks for growth and bonds/cash for stability and income.

Why Your 50s Are Key for Retirement Planning

Your 50s are an important time for retirement planning. You have fewer years left to work and are probably dreaming about your ideal retirement lifestyle.

Maybe you need to take advantage of catch-up contributions to boost your savings. You might benefit from reducing your risk through diversification.

Beyond just investments, your 50s are also an important time to consider other financial planning areas that will impact your retirement:

- Estate Planning: Be sure your will, trusts, and beneficiaries are up-to-date to reflect your wishes for your assets and healthcare.

- Long-Term Care Planning: Explore options for covering potential chronic care costs in your later years, as these can be a significant expense.

- Insurance Review: Reassess your life, disability, and other insurance policies to ensure they still meet your needs as you approach retirement. This may be a chance to cut insurances you no longer need.

- Pension & Social Security Maximization: Review your Social Security benefits and defined benefit pension (if applicable), to understand your payout options and how they integrate with your overall retirement income strategy.

Whatever your focus, now is the time to make changes that will strengthen your retirement accounts and bring you closer to your financial goals.

10 Tips to Investing Wiser in Your 50s

1. Reassess Your Retirement Goals

Start by reevaluating your retirement savings goals. Life evolves, and so should your plans. To help you figure out if you are on track, start to get clear with your retirement lifestyle vision.

Take time to seriously reflect on questions such as:

- When do you really want to retire?

- Will your retirement involve part time work, or be filled with other activities?

- Do you want to travel extensively, or is a quiet, simpler life your dream?

- What would a day, week, and month REALLY look like in retirement?

- Who will you socialize with when you stop seeing coworkers regularly?

- What activities will you do to find fulfillment when you start to get bored?

- What will your plan be to stay healthy and active?

2. Determine If You Are On Track

Once your vision is clear, the next important step is to calculate the retirement budget you’ll need to sustain it. Your budget will help determine if you’re saving enough and how you should be investing.

For example, the more income you need, the more aggressive you may have to be with your portfolio. Alternatively, if you don’t need much income from your investments, you can afford to take less risk.

When building your budget, here are a few tips to consider:

- Start your retirement budget based on what you spend today

- Be honest with yourself about what you REALLY spend and try not to be critical

- Use your bank & credit card statements to figure this out instead of mental math

- Break down 3-6 months of your spending history to get a more consistent average

- Don’t forget the things you pay for once or twice per year in addition to your monthly expenses

- Pad your spending plan – especially for shopping, healthcare, travel, restaurants, and house maintenance

It’s important to remember that inflation erodes your purchasing power over time. History of the Consumer Price Index shows that a dollar in the future will buy less than a dollar can buy today. This means that your retirement budget projections should account for an estimated inflation rate to ensure your savings can cover your living costs throughout a potentially 20-30 year retirement.

Your advisor can help you understand how factors like healthcare inflation may particularly impact your spending. They can run scenarios that project and inflate your expenses moving forward to find out if your goals align with your retirement account’s trajectory.

Example:

Your advisor might compare your current savings balances and trajectory to different scenarios of when you might retire. An example is included below and assumes the following:

- Annual Investment Withdrawal Needs: The table assumes gross investment withdrawal needs of $50,000, $75,000, $100,000, and $125,000 per year

- Growth Rate: An annual growth rate of 5% on investments is assumed before and during retirement

- Withdrawal Rate: The chart assumes an example withdrawal rate of 4% at retirement

- Contributions: The chart assumes $8,000 per year in contributions that stop at retirement

- Length of Retirement: 30 years approximately

Individual investment results will vary. Consult with your financial advisor before taking action using this chart.

| Retirement Age | How much you might need at age 50 if you want to withdraw $50k/year at retirement | How much you might need at age 50 if you want to withdraw $75k/year at retirement | How much you might need at age 50 if you want to withdraw $100k/year at retirement | How much you might need at age 50 if you want to withdraw $125k/year at retirement |

| 60 | $908,000 | $1,350,000 | $1,780,000 | $2,220,000 |

| 62 | $506,000 | $738,000 | $970,000 | $1,200,000 |

| 65 | $285,000 | $397,000 | $510,000 | $640,000 |

| 67 | $206,000 | $293,000 | $380,000 | $470,000 |

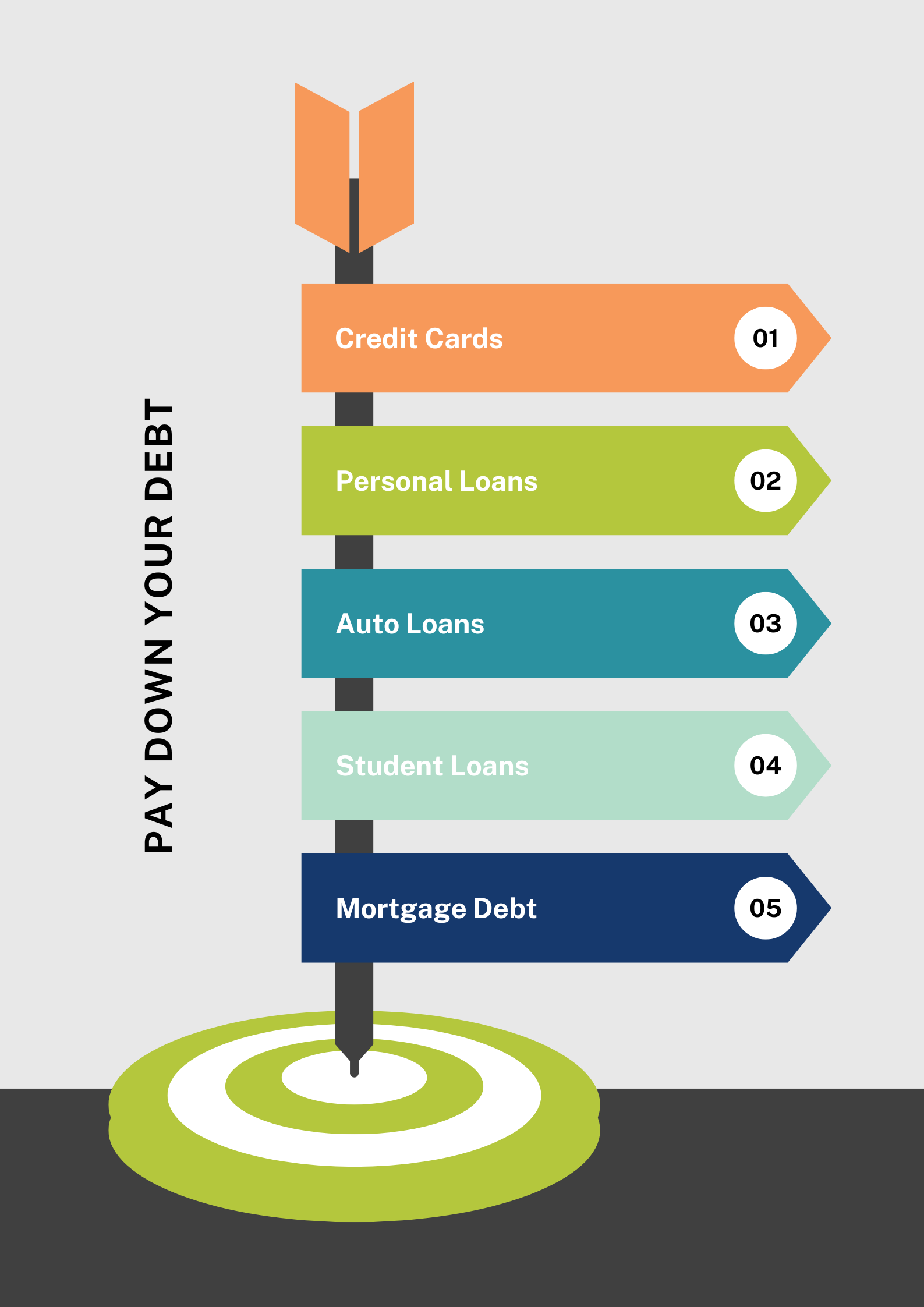

3. Pay Down Your Debt

This may not sound like an investment strategy tip, but it has huge implications on how you invest. Entering retirement with less debt means you can spend more of your retirement savings on the things that matter to you instead of paying down loans.

If you have high interest debts in retirement, you may need to withdraw more of your savings to pay those bills. At the end of the day, how much you need to withdraw from your investments will impact how much risk you need to take in your portfolio.

While you are still employed, consider eliminating your loans in the following order:

This order prioritizes paying off high interest debts first to free up as much of your cash flow as possible. It’s also worth noting that student loan and mortgage interest is potentially tax deductible whereas other debt interest is not.

If you want to pay off your debts quickly, consider using the “debt snowball” method or the “debt avalanche” method.

Debt Snowball

This method suggests that you pay the minimum amount on all of your loans except your smallest loan balance. Pay as much extra as you can on this loan. Once it’s paid off, you would add everything you were paying to what you are paying on your next smallest loan.

Debt Avalanche

This method of debt elimination works similarly. Instead of paying extra on your smallest loan, you would pay extra on your loan with the highest interest rate. The rest of the process is the same.

4. Assess Your Cash Reserves

A solid emergency fund can protect your retirement savings from unexpected expenses. It can also provide you with peace of mind as you approach retirement knowing you have extra cash to live on if the market takes a dip instead of having to sell investments at a loss.

How much cash you keep on hand is a personal preference. You might sleep well at night knowing that your emergency fund is robust enough to cover at least six months of your expenses. You might be comfortable with less cash on hand.

Also consider the amount of cash you have inside your retirement accounts. These assets are incredibly important for generating a consistent ‘paycheck’ in retirement. When the stock market is down, you may be able to switch your systematic withdrawals to being created by selling these conservative holdings. This approach allows you to maintain your income without being forced to sell growth-oriented investments at a loss. Your financial advisor can help you determine a sustainable withdrawal strategy tailored to your specific needs.

5. Catch-Up 401(k) and IRA Contributions

Starting at age 50, you have the ability to make catch-up contributions to tax-advantaged accounts like 401(k)s and IRAs. Depending on your tax bracket, you may be able to lower your income taxes and boost your retirement savings at the same time.

According to the IRS, you are able to contribute the following in 2025 to your retirement accounts:

| 401(k), 457, TSP, etc | 50-59, 64+ | $23,500 | $7,500 |

| 401(k), 457, TSP, etc | 60-63 | $23,500 | $11,250 |

| Traditional IRA or Roth IRA | 50+ | $7,000 | $1,000 |

| Health Savings Account (HSA) | 55+ | $4,300 Individual / $8,550 Family | $1,000 |

6. Diversify Your Asset Allocation Based On Your Needs

A diversified investment portfolio can help you manage market fluctuations while still growing your wealth. The goal is to reduce your risk from the poor performance of any given company or sector.

Investors include different asset classes, such as stocks, bonds, real-estate, and cash in their accounts. Stocks tend to be aggressive and are held for long-term growth. Bonds and cash tend to be conservative and are held to reduce fluctuations and be a resource for income.

Your investment asset allocation should ideally reflect your comfort with risk and the returns you need. Generally, the farther out your goal, the more aggressive you can be. The closer you get to needing to use your investments, the more your asset allocation should include moderate to conservative assets.

Example:

Lets say you are an investor in your late 50s with a moderate risk tolerance, using an asset allocation of 60-70% stocks and 30-40% bonds. As you approach retirement, you’ll need to figure out how much income you will actually need out of your portfolio. This will help you determine if your current moderate allocation will work when you retire or if you need to make adjustments:

- Maybe you don’t need much income and you can consider gradually shifting towards a more conservative mix, perhaps 50-60% stocks and 40-50% bonds, to protect your accumulated wealth while still allowing for some growth.

- Alternatively, maybe you need more income than your current mix will provide and you need to re-evaluate your budget or increase your risk.

These are general guidelines, and your personal allocation should always be tailored to your financial situation and comfort with risk.

Tip: When building your asset allocation, you might consider using low-cost index funds or ETFs as a way of having exposure to stocks, bonds, and cash. These holdings allow you to easily diversify your account with relatively low fees to keep.

7. Stay Exposed to Stocks

As you get closer to retirement, you might be tempted to become very conservative. For example, if you are 50 and plan to retire at 60 or 65, you still have plenty of time to be growth oriented. Maintaining exposure to stocks in your portfolio is a great way to build long-term wealth. This assumes you have a diversified stock portfolio and hold stocks for the long term.

If you’re unsure of how much stock exposure you should have in your investment strategy, consider working with a financial advisor.

8. Build Your Roth Accounts

If you’re in a lower tax bracket in your 50s, you might want to contribute to a Roth IRA or convert some of your traditional IRA into a Roth IRA. You will pay taxes now on your contributions and conversions to potentially enjoy tax-free investment distributions in retirement.

Income from a Roth IRA can help reduce your taxable income in retirement, giving you more flexibility when withdrawing funds. This is especially true if you plan to take large lump withdrawals in retirement for exciting trips or house upgrades.

9. Consider Supplementing with a Taxable Account

Beyond traditional retirement accounts, a taxable brokerage account can provide you with extra retirement flexibility. Unlike 401(k)s and IRAs, there’s no IRS penalty for accessing these funds before age 59.5. This makes taxable brokerage accounts versatile, especially if you want to retire early.

Taxable brokerage accounts are subject to short-term and long-term capital gains tax rates. Long-term capital gains tax rates might be attractive to you if you are in a higher ordinary income tax bracket.

10. Pay Fees for Advice Instead of Products

Not all fees are created equal. Paying fees for comprehensive financial planning advice can be extremely worth your investment. On the other hand, holding mutual funds with high internal fees (expense ratios) may not be quite as helpful.

Consider using low-cost index funds or ETFs to fill your investment portfolio. These holdings allow you to diversify your account and keep more of you.

Investing can feel overwhelming, but it doesn’t have to be. A skilled financial advisor can help you navigate complexities, from balancing your asset classes to minimizing taxes. Investing involves risk, but with expert guidance, you can make informed decisions that align with your retirement goals.

Make the Most of Your Investments (and Future) with Stage Ready Financial Planning

Your 50s are an exciting time to take control of your retirement planning. We can help you align your investment portfolio with your goals so you can feel confident about your financial future.

Schedule your intro call today to create a plan that empowers you to retire on your terms!

FAQs

What Should I Invest in My 50s?

Invest in a diversified mix of asset classes tailored to your goals and risk tolerance. Consider holding stocks for growth, and bonds/cash for stability. Using low-cost index funds and ETFs can be a great way to have diversified exposure to these assets.

Is It Too Late to Start Investing in Your 50s?

It’s never too late to save money! Take advantage of catch-up contributions and work with a financial advisor to optimize your strategy before retirement.

About the Author

Joseph A. Eck, CFP®, is a financial planner committed to helping people create a holistic vision and plan for their ideal retirement. With extensive experience in retirement planning for savers in their 50s and beyond, Joseph offers personalized guidance and support to clients in Dayton and Southwest Ohio. He empowers retirement savers to achieve their financial goals and build a fulfilling life in their ideal Ohio community. Click here to learn more about Joseph.

Article References

- “401(k) limit increases to $23,500 for 2025; IRA limit remains $7,000,” Internal Revenue Service, irs.gov: https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000#:~:text=Highlights%20of%20changes%20for%202025,to%20an%20IRA%20remains%20%247%2C000.

- “Consumer Price Index (CPI) 1913-,” Federal Reserve Bank of Minneapolis, minneapolisfed.org: https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1913-

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.