Moving from a regular paycheck to living off your savings can feel a bit like walking a tightrope. You want to enjoy the lifestyle you’ve saved for, but you also want to make sure you aren’t leaving yourself vulnerable to market swings or unnecessary taxes.

In this article, we’ll review 10 retirement withdrawal strategies that can help you fine-tune your income for a high-performance retirement.

Key Takeaways

- The “Anti-Waterfall” Tax Strategy: Withdrawing from all your accounts at once (proportional) might actually save you more in taxes than draining one account at a time.

- A Safety Net for Volatility: Using a “Cash Buffer” or “Bucket” method can help you make sure that a market dip doesn’t derail your lifestyle.

- The Power of Dynamic Income: Many successful retirees don’t just use a fixed withdrawal rate, but instead adjust their spending based on clear “if/then” rules.

Why Your Withdrawal Strategy Matters in Retirement

You might be thinking of retirement planning as reaching the right savings number and age. But how you take your money out is just as important as how much you’ve saved. Without an orchestrated retirement withdrawal strategy, you might find yourself with a higher tax burden. Or worse, you might withdraw too much during a market dip, which could permanently damage your portfolio’s longevity.

What Are 10 Withdrawal Strategies to Use for a Better Retirement?

1. Start with a Sustainable Withdrawal Rate (Built from Your Actual Budget)

For years, the “4% Rule” was a popular way of determining how much income you could withdraw yearly from your retirement savings. As the market has evolved, Morningstar research suggests a safer starting point might now be closer to 3.9%. This percentage assumes a balanced mix of stocks and bonds. It may or may not work depending on your specific investment mix.

But here’s the most important part: your withdrawal rate shouldn’t just be a number pulled from a textbook. Consider starting your withdrawal plan by projecting your needs based on what you really spend today. Then, add costs like travel goals, healthcare, and other projected expenses.

- Track your current lifestyle: Use your bank statements to see where your money is actually going. Don’t guess. Do the work to figure out how much you REALLY spend.

- Adjust for retirement shifts: Some costs like work commuting will drop, while others like travel or healthcare may go up. Consider starting by including all of the things you really want to do in retirement.

- Calculate the difference: Once you have an idea of your annual spending needs, subtract your guaranteed sources like Social Security and pension income. The remaining amount is what your retirement accounts need to provide.

Example: Imagine you’ve tracked your spending and found that you need $90,000 annually. If your Social Security provides $35,000, your retirement savings must cover $55,000. To fund this sustainably at a 3.9% rate, you would need a portfolio size of approximately $1.410 million.

2. Use a Tax-Efficient Withdrawal Order

The arrangement of how you tap your retirement accounts can save or cost you thousands in lifetime taxes.

Sequential Withdrawals

Many people use a sequential approach, which works like a waterfall:

- Taxable Accounts First: This includes your brokerage accounts, potentially qualifying for long-term capital gains treatment.

- Tax Deferred Accounts Second: These are your Traditional IRAs and pre-tax 401(k)s. You start to draw from these to make required minimum distributions less intense at age 73 or 75.

- Roth Accounts Last: Tax free assets are often your best long-term growth vehicle as they are not subject to mandatory distributions. The more time you let your Roth IRA compound, the bigger the tax free benefits.

Proportional Withdrawals

Alternatively, you might use a proportional withdrawal strategy, which involves taking a blended amount from all your accounts at once. Don’t just drain one bucket until it’s empty. Instead, take a small slice from each account every year based on its total value and your tax bracket. A blended approach might help you minimize taxes by keeping your ordinary income lower consistently throughout retirement rather than letting it spike later on.

Example: Imagine you and your spouse need $100,000 in net spending money this year. You receive $40,000 in Social Security, leaving a $60,000 gap to fill from your retirement savings.

If you pulled the entire $60,000 from your tax deferred accounts, your taxable income would likely push you into the 22% federal tax bracket. Instead, you could engineer your retirement withdrawal to stay in the 12% bracket:

$25,000 from Taxable Accounts: This provides cash while keeping ordinary income low, utilizing the 0% or 15% long-term capital gains tax bracket.

$23,000 Gross from Tax Deferred Accounts: By pulling roughly $23,000 (and assuming a 13% combined withholding for federal and state taxes), you might net about $20,000. This “fills up” your 12% bracket without crossing into the 22% range.

$15,750 from Tax-Free Accounts: Since your Roth IRA is a tax exempt account, it provides the final net dollars you need without adding to your taxable income or pushing you into a higher bracket.

Using this blended approach, you’ve kept your federal tax bracket at 12%. If you had taken the full amount from your IRA, you could have paid 22% on that final $15,000, costing you an extra $1,500 in federal taxes alone, not to mention potential increases in state taxes.

Sequential Withdrawals vs. Proportional Withdawals

| Feature | Sequential “Waterfall” Strategy | Proportional Withdrawal Strategy |

| Withdrawal Order | Drains one account type at a time: Taxable accounts first, then tax deferred accounts, then roth accounts last. | Withdraws from each account type simultaneously based on their percentage of total retirement savings and target tax bracket. |

| Tax Bill Predictability | Can lead to a “tax bump” in mid-retirement when moving from capital gains to ordinary income. | Aims for a more stable tax bill by spreading ordinary income, capital gains, and tax free withdrawals across all years. |

| RMD Management | May result in larger required minimum distributions later in life as tax deferred balances grow untouched longer. | Helps minimize taxes later in life by systematically shrinking the balance of tax deferred retirement accounts early on. |

| Portfolio Longevity | Simple to follow, but may lead to higher total taxes paid overall due to higher lifetime brackets. | Research suggests it can reduce total lifetime taxes by smoothing out income, potentially extending the life of your retirement accounts |

| Complexity | Very simple for a financial professional or individual to implement. | More complex; requires recalculating ratios annually as retirement accounts shift in value. |

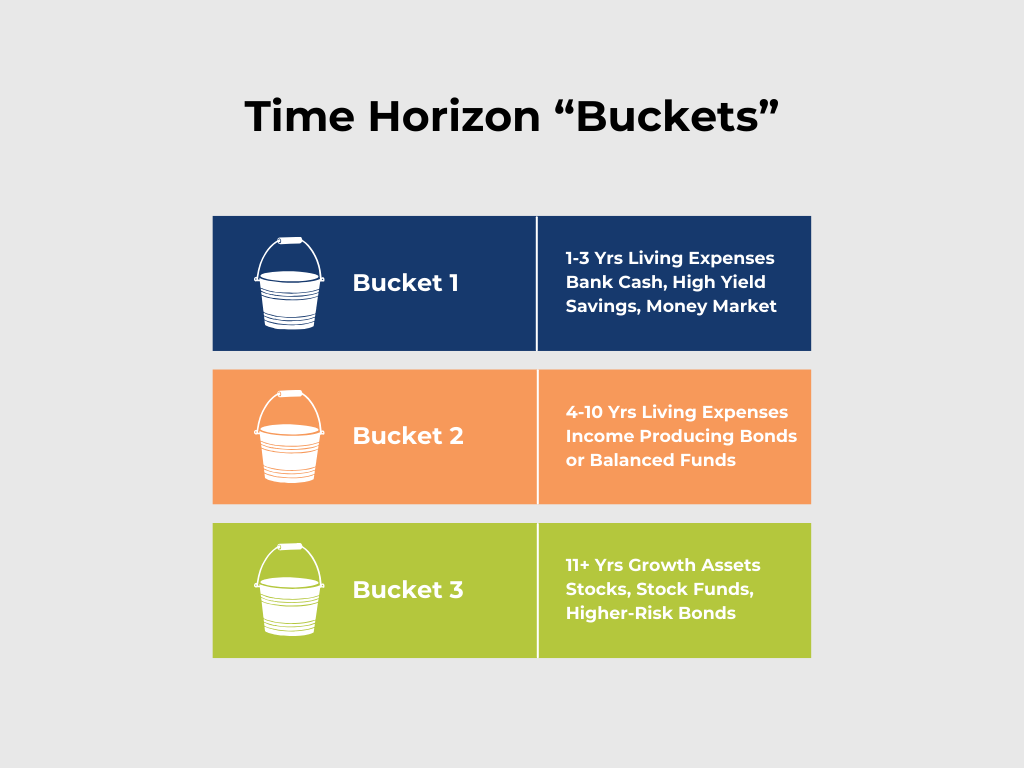

3. Create “Buckets” for Different Time Horizons

A “bucket” strategy might help you manage the emotional roller coaster of the market by arranging your savings into different time horizons. According to research from Charles Schwab, this approach would mean that you aren’t forced to sell your long-term investments when the market is down.

The time horizon of each bucket can be tuned based on your preferences but an example might look like:

- Bucket 1 (Short-term): 1-3 years of cash for living expenses in bank cash, high-yield savings, or CDs.

- Bucket 2 (Mid-term): 4-10 years of conservative growth in bonds or balanced funds.

- Bucket 3 (Long-term): Growth-oriented stocks and higher-risk bonds for 10+ years out.

Example: Let’s say you have a $1 million portfolio. Rather than worrying about the entire balance during a market crash, you focus on your buckets.

You keep $150,000 in cash (Bucket 1) to cover your next three years of bills. Even if the stock market drops tomorrow, your lifestyle doesn’t change because you aren’t touching your stocks.

When the market is strong, you harvest gains from your stock-heavy bucket 3 to refill your cash or bucket 2. If the market is down, you simply stop selling stocks (bucket 3) and live off your cash and bonds (buckets 1 & 2). This gives your retirement accounts the time they need to recover without being depleted at the bottom of a market cycle.

4. Build a Cash Buffer for Market Downturns

A cash buffer isn’t just an extra bank account. It’s the root voice in your asset allocation. In fact, many retirement withdrawal strategies, including the “bucket” method we just discussed, hinge on having a liquid buffer integrated into your portfolio to protect against down markets.

Example: Consider a $1 million retirement portfolio. Instead of being invested in all stocks and bonds, you might use a 60/30/10 asset allocation:

- 60% Stocks ($600,000): For long-term growth (Bucket 3)

- 30% Bonds ($300,000): For steady income (Bucket 2)

- 10% Cash ($100,000): Your cash buffer (Bucket 1)

If you need $50,000/year from your portfolio, your 10% cash allocation gives you a full 2-year safety net. If the stock market dips 15% in year two, you don’t panic. You stop taking your retirement withdrawal from your stocks and simply pull from that $100,000 cash buffer. This gives your $600,000 in stocks the necessary time to rebound without having to sell them at a discount.

5. Use Bond or CD Ladders for Steady Cash Flow

A bond or CD bridge (or ladder) can be used to cover your income needs during a specific window of time. According to research from Fidelity, it can be particularly beneficial to fill the gap between retiring and claiming Social Security.

Example: Imagine you retire at 62 but want to wait until 67 to maximize your Social Security.

You invest $150,000 from your taxable accounts into a 5-year bond or CD bridge.

Every year, a $30,000 bond matures. You spend that maturing principal to cover your bills.

While you wait for each rung to mature, the bond interest can either be sent to your bank or reinvested back into the bridge to help your savings keep tempo with inflation.

When you reach 67, your Social Security benefit is approximately 30% higher than it would have been at 62. You’ve successfully hedged against market volatility while locking in a larger lifetime paycheck and protecting your long-term retirement savings.

6. Adjust Withdrawals Based on Market Performance

Another retirement withdrawal strategy is to use a strategy with dynamic spending rules. While some approaches use a fixed percentage, like the “4% Rule,” we prefer the Guyton-Klinger Guardrail method at Stage Ready Financial Planning. It provides a series of “if/then” cues.

- Initial Rate: You start with a target retirement withdrawal rate based on your asset allocation and income needs (often between 4% and 5.5%).

- The Preservation Rule (Down Market): If the market performs poorly and your withdrawal rate rises 20% above your starting point, you reduce your spending by 10%. This haircut potentially protects your retirement savings from being depleted too quickly.

- The Prosperity Rule (Up Market): If the market performs well and your rate drops 20% below your starting point, you give yourself a 10% raise.

Example: Imagine you start with a 5% withdrawal ($50,000) on a $1M portfolio and the stock market drops, meaning your portfolio value falls to $800,000.

Your $50,000 withdrawal is now 6.25% of your portfolio, which is 25% higher than your starting point. This triggers the Preservation Rule. You would need to reduce your withdrawal by 10% (down to $45,000) for the year.

By making a small, objective adjustment, you might prevent a damaging sequence of returns loss, allowing your tax deferred retirement accounts to have enough fuel to recover when the market turns back around.

7. Time Social Security Wisely

Claiming your Social Security benefits at the right time can help you reduce long-term withdrawal pressure on your investments and make your plan less vulnerable to the unpredictable swings of the stock market.

While delaying benefits past your full retirement age can increase your monthly check by 8% for each year you wait (up to age 70), this decision should be balanced against your life expectancy and your portfolio size. You need to have enough savings to support your lifestyle while waiting for a higher benefit.

Example: If your benefit at age 67 is $2,800, waiting until age 70 increases that to roughly $3,472 a month.

By securing a higher floor of income from Social Security, you may be able to lower your retirement withdrawal rate from your tax deferred retirement accounts later in life.

This doesn’t just benefit you. It potentially increases the survivor benefit for your spouse, acting as a hedge against the risk of outliving your money.

8. Account for Required Minimum Distributions (RMDs)

When you reach age 73 (or 75 if you were born in 1960 or later thanks to the Secure Act 2.0), the IRS requires that you take Required Minimum Distributions (RMDs) from your tax-deferred retirement accounts. To make your life easier, you can integrate your RMD amount into your monthly income to simplify your lifestyle and avoid heavy tax penalties for failing to take them.

Example: You reach age 73 and your RMD is going to be $24,000 for the year.

If your planned annual income is less than $24,000, consider increasing your spending to match your RMD. This way you’ll satisfy the IRS, avoid the 25% missed distribution penalty, and keep your total tax liability as low as possible.

If you are still in your 60s, you can reduce these future withdrawals by performing Roth conversions now. Moving money from your IRA to a Roth IRA today might help you lower your eventual RMD amounts, and give you more control over your tax bracket.

Be sure to consult your tax professional to see if this strategy is right for your specific situation.

A Pro-Tip for the Generous: Qualified Charitable Distributions (QCDs)

If you don’t need your full RMD for living expenses and you have a heart for your local church or nonprofit, a QCD can be a powerful tool. It allows you to send up to $105,000 (per person) directly from your IRA to a qualified charity. This synchronizes your giving with your tax obligations.

Because the money goes straight to the charity, it doesn’t count as taxable income for you. This can keep your adjusted gross income lower, which might help you stay in a lower tax bracket or even reduce your Medicare premiums. It’s a way to ensure your legacy performs well for the causes you care about while keeping the IRS out of the front row.

9. Automate Withdrawals for Consistency

Retirement should be about enjoying the music, not stressing about trading and bookkeeping. One of the most efficient ways to create a steady retirement paycheck is to automate your income. If you are invested in a model portfolio, a target-date fund, or a total market index fund, your financial professional can usually set up automatic monthly, proportional withdrawals.

This means that instead of you or your advisor manually deciding which stock or ETF to sell each month, the system automatically sells a tiny, equal percentage of every holding in your portfolio. Automation helps you maintain your target asset allocation and provides a consistent monthly transfer to your bank.

However, if you simply own a bundle of individual stocks or ETFs that aren’t part of a coordinated model, you may not have this automated option and might be forced into manual, and often stressful trading.

Example: Instead of logging in every month to decide which of your stocks or bonds to sell, your advisor sets up a systematic $4,500 monthly transfer from your retirement accounts.

The money arrives in your bank account on the same day each month just like your old paycheck.

You can even automate your tax withholding at the same time, avoiding the emotional stress of market timing and keeping your portfolio in sync with your long-term goals.

10. Revisit Your Withdrawal Plan Every Year

Your retirement withdrawal strategy is not a set it and forget it project. Your life, tax laws, and the market are constantly changing. At Stage Ready Financial Planning, we meet with our clients each spring to look at spending goals for the year ahead and update their Income Guardrails plan.

Revisiting your plan allows you to adjust your withdrawal rate or your asset allocation based on the previous year’s performance and any recent life transitions.

Example: Imagine you decide to downsize your home in Kettering, Ohio this year.

This move is projected to lower your property taxes and maintenance costs, and provide you with a significant influx of cash.

During our spring meeting, we would update your retirement withdrawal rate to account for your new, lower expenses and determine the most tax-efficient use of that extra cash. Maybe that’s refilling your bond bridge or consider a strategic Roth conversion since you have extra cash to pay the taxes.

You stay on track with confidence that your retirement savings are working as hard as possible for your new lifestyle.

Final Thoughts

Transitioning from a lifetime of saving to a lifetime of spending is one of the most significant mental shifts you will ever make. If you orchestrate and maintain a strong asset allocation, build strong cash reserves to weather down markets, time your Social Security income well, and stay flexible, you can improve the likelihood that your hard-earned savings will provide the lifestyle you’ve been hoping for.

Customize Your Retirement Withdrawal Strategy. Contact Stage Ready Financial Planning Today for a Free, No-Commitment Consultation

You’ve worked too hard to spend your retirement worrying if you’re pulling from the wrong account or paying the IRS too much. At Stage Ready Financial Planning, we specialize in helping Dayton area savers, just like you navigate these complex rules with a down-to-earth approach.

We’ll help you orchestrate a confident income plan that’s in sync with your goals. Our mission is to handle the technical details, so you can stop worrying about the math and start enjoying your ideal retirement.

Schedule your intro call today!

Frequently Asked Questions (FAQs)

How do I know if my withdrawal rate is sustainable?

Depending on the source you check and your current asset allocation, a starting withdrawal rate might be sustainable if it falls between 3.9% and about 5.5% annually. If your current spending requires more than 5% of your retirement savings annually, you might need to look at building in dynamic withdrawal rules for adjusting your income when markets dip. Always consider consulting a financial professional to help you fine tune and maximize your retirement income.

What’s the difference between fixed and dynamic withdrawal strategies?

A fixed distribution strategy means taking a set amount every year from your retirement savings regardless of the market. It also usually assumes you increase your income annually based on an inflation benchmark. Alternatively, a dynamic withdrawal strategy, like the Guyton-Klinger Guardrails approach, suggests that you adjust your income based on portfolio performance over time according to a certain set of cues.

How does the bucket strategy work for retirement income?

You arrange your asset allocation into different “buckets” based on when you plan to spend the money. Bucket 1 is for immediate cash (such as 1-3 years), Bucket 2 is for generating income using bonds or a balanced portfolio with dividend paying stocks, and Bucket 3 is for long-term growth (such as 10+ years).

When the market is strong, you could take extra earnings from your growth oriented investments in bucket 3 and refill your first and second buckets. When the market is struggling, you would only withdraw from your cash bucket (1) to allow your third bucket to recover without selling while investments are down.

Should I change my withdrawal strategy during a market downturn?

It depends. If you are taking a low withdrawal rate from your investments and you are well diversified, you may not need to adjust. On the other hand, strategies like the Guyton-Klinger “Preservation Rule” suggest reducing withdrawals by 10% if your withdrawal rate exceeds your upper guardrail due to market losses. The best course of action is to partner with a financial professional who can help you monitor your distribution strategy so that you can enjoy a comfortable and sustainable income.

Does Ohio tax retirement income from IRAs and 401(k)s?

Yes, Ohio treats distributions from your tax deferred accounts as taxable income. This includes income from your Traditional IRA, 401(k), 403(b), 457, and Thrift Savings Plan. However, Ohio does not tax your Social Security benefits.

For more information on navigating Ohio taxes in retirement consider checking out our recent blog: Ohio Retirement Tax Strategies to Optimize Your Budget

How does Ohio’s cost of living affect safe withdrawal rates in retirement?

Because Ohio’s cost of living is lower than the national average, your retirement savings might go further here, allowing for a more comfortable spending plan. That said, your withdrawal rate should be based on your spending needs.

For more information on the current cost of living in Ohio for retirees, check out our recent blog: 2026 Dayton, Ohio Cost of Living Guide (and What That Means for Retirees)

About the Author

Joseph A. Eck, CFP®, is the owner and lead financial advisor at Stage Ready Financial Planning in Dayton, Ohio. He is dedicated to helping retirement savers find their rhythm by creating personalized retirement withdrawal strategies. Joe provides guidance on tax-efficient withdrawals, required minimum distributions, and synchronizing your plan with your CPA to manage lifetime taxes. A proud member of the Dayton community, he brings the discipline of a conductor to the complexity of retirement planning, helping savers enjoy the performance they’ve spent decades preparing for.

Article References

- Morningstar. “The State of Retirement Income: 2024.” Accessed January 26, 2026. https://www.morningstar.com/business/insights/research/the-state-of-retirement-income

- T. Rowe Price. “Tax-Efficient Retirement Income.” Accessed January 26, 2026. https://www.troweprice.com/content/dam/iinvestor/planning-and-research/t-rowe-price-insights/retirement-and-planning/pdfs/tax-efficient-withdrawal-strategies.pdf

- Charles Schwab. “Phasing Retirement with a Bucket Drawdown Strategy.” Accessed January 26, 2026. https://www.schwab.com/learn/story/phasing-retirement-with-bucket-drawdown-strategy

- Fidelity. “How bond and CD ladders can help you: A bond bridge to your independence.” Fidelity Viewpoints. Accessed January 26, 2026. https://www.fidelity.com/learning-center/personal-finance/bond-bridge

- Vanguard. “The total-wealth approach to retirement income: A dynamic spending strategy.” Vanguard Research. Accessed February 2, 2026. https://advisors.vanguard.com/iwe/pdf/ISGTWAR.pdf

- Social Security Administration. “Delayed Retirement Credits.” SSA.gov. Accessed February 2, 2026. https://www.ssa.gov/benefits/retirement/planner/delay.html

- Fidelity. “SECURE 2.0: Key changes to RMDs and more.” Fidelity Viewpoints. Accessed February 2, 2026. https://www.fidelity.com/learning-center/personal-finance/secure-act-2

- Edelman Financial Engines. “Personalizing Your Retirement Withdrawal Strategy.” Accessed January 26, 2026. https://www.edelmanfinancialengines.com/education/retirement/retirement-withdrawal-strategy/

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.