If you are like many of our clients, you’re probably close to or already in retirement and want to make sure your investment portfolio is set up right. You might be asking yourself questions like: How do you rebalance your portfolio for retirement? Should you rebalance your portfolio in retirement or before, or both?

To figure out if your investments are set up correctly, you need to determine your current asset allocation. From there, you’ll consider your income needs, risk capacity, and risk tolerance. With this information in hand, you can choose a target asset allocation and rebalance your portfolio to align with it.

In the grander scheme of things, rebalancing is a basic part of the ongoing process known as portfolio management. It involves regularly evaluating your financial situation, figuring out your investment objectives, and making sure your portfolio is aligned with the asset allocation that is right for you. This continuous process helps you stay on track with your goals, even as your life circumstances and the market change.

In this article, we will dive into exactly what it means to rebalance your portfolio, exactly how to do it, and important tax and timing considerations.

Key Takeaways

- Rebalancing isn’t about chasing returns, it’s about managing risk. Your investment portfolio can become unbalanced over time as some assets perform better than others, which can increase your risk exposure. Rebalancing helps you get back to a comfortable level of risk, especially as you approach or enter retirement.

- The ‘when’ is just as important as the ‘how’. You can rebalance your portfolio on a set schedule (e.g., annually), when it drifts from a target percentage, or using a hybrid approach. The right strategy depends on how hands-on you want to be.

- A “buffer” of conservative assets can protect you in retirement. As you move into retirement, consider shifting some money from riskier assets like stocks into bonds, CDs, and cash. This creates a buffer that allows you to withdraw income without having to sell investments at a loss during a market downturn.

What Is Portfolio Rebalancing?

Think of your investment portfolio like your childhood playground seesaw, with different asset classes on each side. Asset classes include things like stocks, bonds, and cash. Your portfolio usually starts with a target asset allocation. For example, maybe a 60% stock and 40% bond fits your retirement goals and risk tolerance.

Over time, that balanced seesaw can get thrown off as different assets grow at different speeds. If the stock market has a really good run, the stock side of your seesaw might get much heavier than the bond side. Your investment portfolio could shift to something like 70% stocks and 30% bonds. While that might seem good, it also means your investment portfolio has taken on more risk than you originally intended.

Rebalancing is simply getting back to your desired asset allocation. To do this, you’ll need to sell investments that have outperformed and use that money to buy more of the asset classes that haven’t done as well.

It might feel a bit strange to sell what’s working and buy what isn’t, but the purpose of rebalancing isn’t specifically to chase returns. Rebalancing is meant to help you manage risk and maintain diversification. That said, when you rebalance you’re usually selling some of your best-performing assets. In this way, the process of rebalancing forces you to sell high and buy low, a key concept in investment management.

Why Does Rebalancing Matter?

Rebalancing your portfolio is a way to keep your financial plan on track. By making these periodic adjustments, you can:

- Manage Risk: An unbalanced investment portfolio can expose you to more risk than you’re comfortable with. If your stock holdings have grown too large, a sudden market downturn right at the beginning of your retirement could have a bigger impact on your savings than you’re prepared for.

- Keep Your Portfolio on Track: When you rebalance your portfolio, you increase the likelihood that you’ll maintain the level of risk and growth potential you’ve specified with your investment objectives. This is especially important as you get closer to retirement, or after you’ve entered it.

- Stay Disciplined: It helps you avoid making emotional decisions based on short-term market movements. Instead of chasing daily returns, rebalancing helps you stick to your long-term investment strategy.

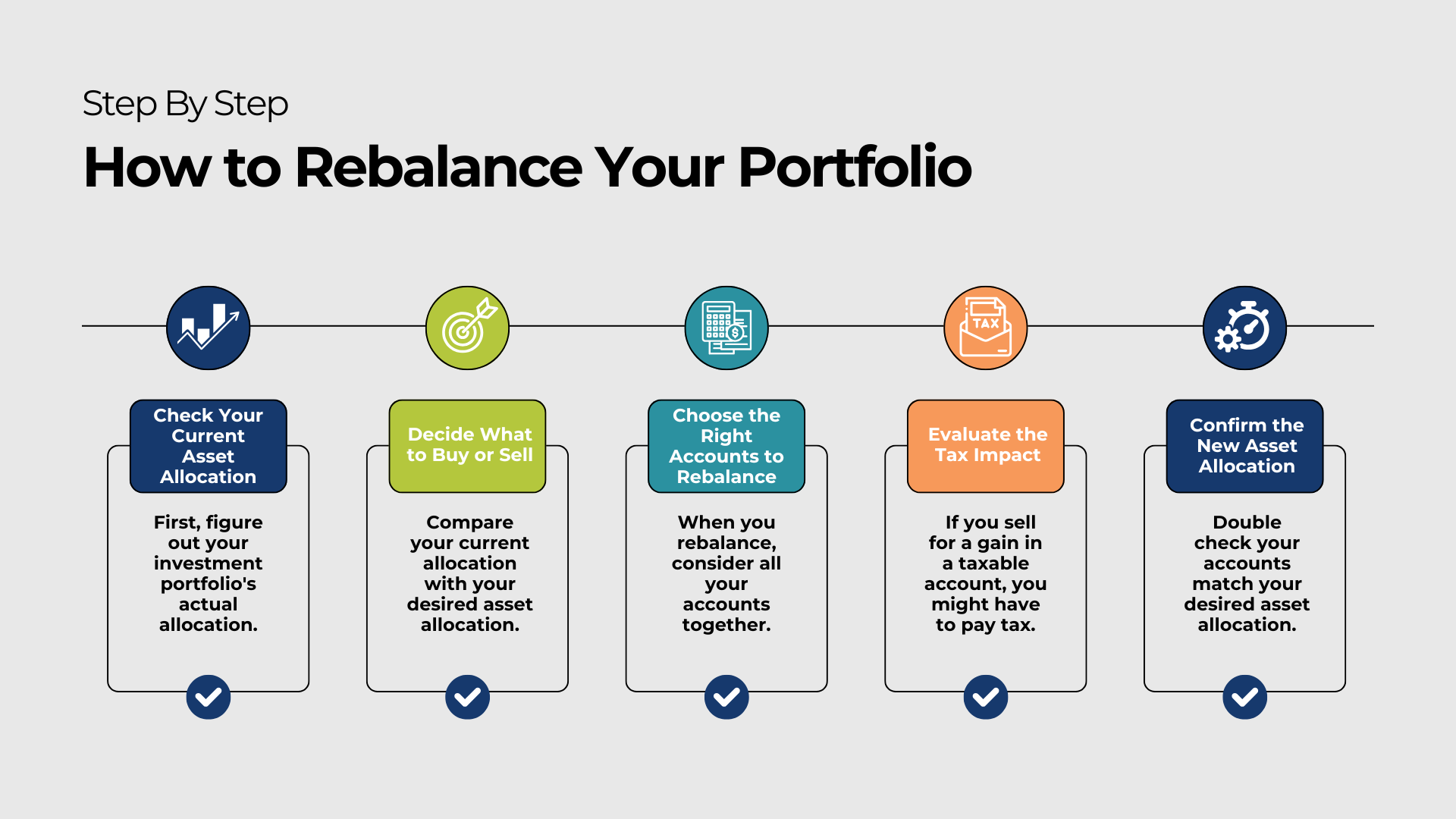

How to Rebalance Your Portfolio Step by Step

Rebalancing on your own might sound complicated, but you can break it down into a few easier steps.

1. Check Your Current Allocation

First, you need to figure out your investment portfolio’s actual allocation. This means looking at all of your accounts including your 401(k), IRA, Roth IRA, and taxable account to see what percentage you have in stocks, bonds, and cash.

Once you’ve gathered the big picture asset allocation data, then consider figuring out how much you have allocated to:

- Domestic Stocks vs. International Stocks

- Domestic Stock Breakdown: Large Cap Stocks vs. Mid Cap Stocks vs. Small Cap Stocks

- International Stock Breakdown: Developed Markets vs. Emerging Markets

- Domestic Bonds vs. International Bonds

- Domestic Bond Length Breakdown: Short Term Bonds vs. Intermediate Term Bonds vs. Long Term Bonds

- Corporate Bonds vs. Government Bonds

2. Decide What to Buy and Sell

Next, compare your current allocation with your desired asset allocation.

- If your stock holdings have grown too large: You would need to sell some of your shares and use the proceeds to buy more of your bond asset classes. Especially if you are in retirement, this keeps your “buffer” filled so that you have conservative assets to draw on in down markets.

- If you’ve become too conservative: You would need to consider selling investments in your bond asset classes and buy more stocks. This is important to help your portfolio continue to have enough growth potential to last throughout your retirement.

If you are unsure about the target asset allocation that you should be using, this is where hiring a professional can be powerful. Alternatively, many large investment companies will provide risk tolerance questionnaires that spit out template asset allocations. Keep in mind that these questionnaires only consider your response to risk questions.

3. Choose the Right Accounts to Rebalance

When you rebalance your portfolio, it’s helpful to consider all your accounts together. You might find that your overall asset allocation is off even if an individual retirement account looks okay.

Example: Let’s say your 401k is close to matching your target asset allocation of 70% stocks and 30% bonds but you have an old Roth IRA you forgot about. If that Roth IRA has been sitting and growing for years, you might find that its asset allocation is more aggressive than your target asset allocation. If you were to up all of your accounts, you might find that your overall asset allocation is more aggressive than you realized.

This is a big reason why we regularly recommend our clients simplify the number of accounts they have. It makes managing their asset allocation and rebalancing much easier.

4. Evaluate the Tax Impact

Selling investments inside your 401(k), IRA, and Roth IRA won’t create tax consequences unless you choose to withdraw money. Unfortunately that’s not true if you have after-tax accounts such as taxable brokerage accounts.

If you sell a security for a gain inside a taxable account, you might have to pay capital gains tax. You can also sell investments for a loss, creating a capital loss that can offset capital gains. It’s always smart to consult your tax professional and financial planner before submitting trades in taxable accounts.

For more information on capital gains taxes, check out our recent article: 2025 Guide to Capital Gains Tax in Ohio

5. Confirm the New Asset Allocation

After you’ve evaluated your current allocation, made a plan for the trades, and considered the tax impact with your tax professional, you’re likely ready to rebalance your accounts.

When you place a trade, the timing of the update depends on if they are ETFs, individual stocks and bonds, or mutual funds. Always double check your work to confirm that your settled trades have rebalanced your accounts to your desired asset allocation.

How Often Should You Rebalance Your Portfolio?

There are a few different methods of timing to rebalance your portfolio, and the right one for you likely depends on how involved you want to be.

Calendar-Based Approach

This is a simple method where you rebalance your portfolio on a pre-determined schedule, like once a year. Many financial advisors suggest reviewing your investment portfolio every six to 12 months. According to a recent research study by Vanguard, an annual review and rebalance can be a good option because it’s not too frequent, leading to excessive transaction costs or taxes. Rebalancing on a set annual schedule can help you avoid making emotional moves during periods of short-term market volatility.

Threshold-Based Approach

With a threshold-based approach, you only rebalance when your asset allocation drifts by a certain amount from your target. For example, you might decide to rebalance if your stock asset allocation moves more than 5% away from your target. The challenge here is that it requires you to monitor your portfolio regularly.

Example: Let’s say you want an asset allocation of 70% stocks and 30% bonds. If your stocks do well, your portfolio might shift to 76% stocks and 24% bonds. Since this exceeds your 5% drift threshold, you would rebalance back to your original 70/30 allocation.

Hybrid Approach

This strategy combines both of the above methods. You make a plan to review your investment portfolio on a set schedule, say annually, but only rebalance if your asset mix has drifted by a certain percentage. This strategy can be a nice middle ground. It saves you from unnecessary adjustments while keeping your portfolio on track and helping you manage risk.

When Should I Rebalance My Investments: Before vs. During Retirement

The timing of when and how you rebalance your portfolio may change as you get closer to needing to spend your invested savings.

Before Retirement

One of the most important parts of investing is to match your investment strategy to your investment objectives. While you’re still saving for retirement, your main goal is likely growth. If you have a longer time horizon before needing to live on your investments, you may be able to take on more risk by having a higher percentage allocated to domestic and international stocks in your investment portfolio. Additionally when you are in the accumulation stage of life, rebalancing periodically can also be helpful to maintain your growth strategy when certain types of stocks outperform others over long periods of time.

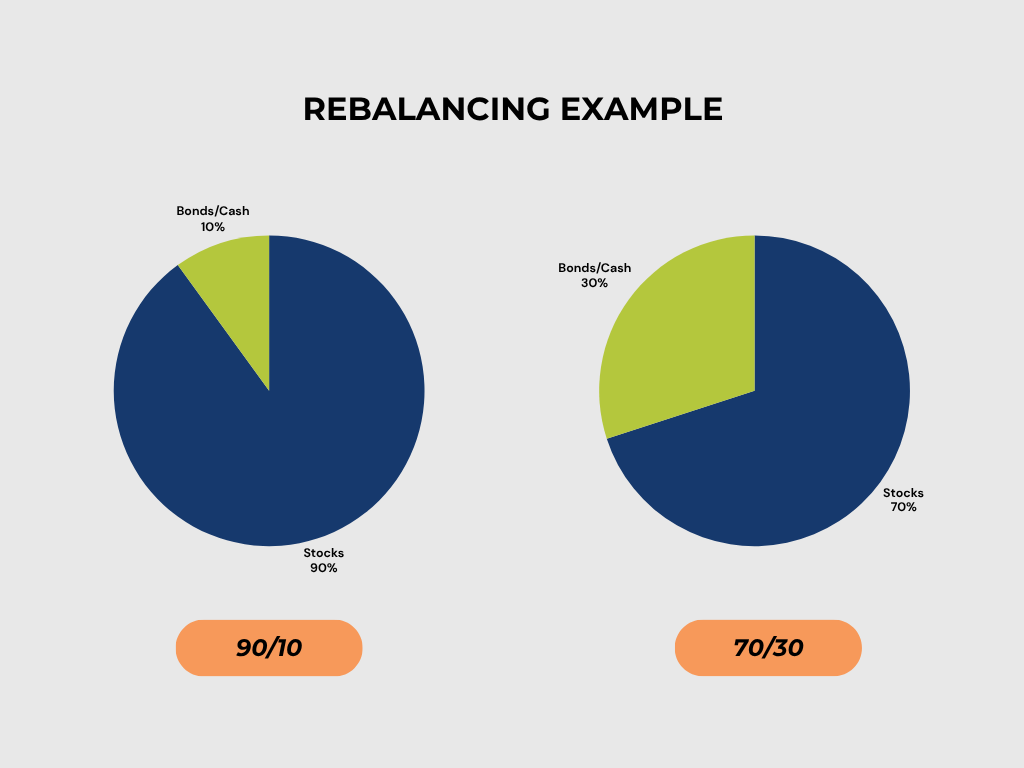

As you approach retirement, you may want to gradually shift some of your riskier asset classes, such as domestic and international stocks, to incorporate a percentage of safer investments. This means gradually moving money from stocks into less risky asset classes like bonds, CDs, and cash.

We like to help our clients think of bonds and cash as being meant to generate retirement income from your accounts when stocks are struggling. Including them in your asset allocation helps protect your nest egg from significant market downturns right as you are about to retire. This is usually referred to as “sequence-of-returns risk.” A large market downturn right as you begin withdrawing money could seriously damage the longevity of your investments.

It’s worth noting that a market downturn of 10% to 20% is often called a market correction, while a drop of 20% or more for a sustained period of time is a bear market. Both can impact your portfolio and your risk exposure.

Example: Let’s say you maintained a 90% stock and 10% bond asset allocation in your 50s. You might gradually rebalance it to something slightly more conservative, like 70% stocks and 30% bonds or even 60% stocks and 40% bonds, as you approach retirement in your 60s.

During Retirement

Once you’re in retirement and living off your savings, your investing goals will probably shift from maximizing growth to preserving your principal and generating a reliable income stream. You’ll want to rebalance to make sure you generate enough growth for income and cost of living raises.

At this stage of life, you’ll likely benefit from keeping a ‘conservative buffer’ to protect your spending money from market volatility. This means setting aside multiple years worth of living expenses in cash or short-term bonds within your accounts. When a down market hits, you won’t have to sell stocks at a loss to cover your regular bills. Instead, you can simply withdraw from your bonds and cash.

Example: To put this in real terms, if you have a $1,000,000 portfolio and a target asset allocation of 30% conservative assets, that means you have $300,000 in bonds, CDs, or cash. If you are withdrawing $40,000 a year for living expenses, this buffer would cover your withdrawals for approximately 7.5 years without you having to sell any stocks.

If you are on the verge of retirement and aren’t sure where to start with this concept, consider exploring the following with the help of your financial advisor. To help protect against the possibility of selling stocks at a loss in a market downturn, a good rule of thumb is to create two safety nets in your retirement portfolio. The first is a year’s worth of spending cash. The second is an additional minimum of two to four years’ worth of living expenses in short-term bonds or certificates of deposit (CDs). This strategy gives you enough time to ride out a typical bear market, which has historically had an average recovery time of around two and a half years.

As you spend down your investment portfolio, you’ll want to regularly re-evaluate your asset allocation to make sure it still aligns with your income buffer preferences and rebalance periodically to maintain that allocation.

Tax-Efficient Rebalancing Strategies

Taxes can be a big concern for the clients we work with. Here are a few ways to rebalance your portfolio while keeping taxes in mind.

Rebalance in Your Tax-Deferred Accounts First

Whenever possible, rebalance within a tax-advantaged account like your 401(k) or IRA. Transactions inside these accounts don’t trigger capital gains or taxes unless you withdraw money. This is often the simplest and most tax-friendly way to get your portfolio back in line. A tax advantaged account is a great place to rebalance because you won’t have to worry about the tax implications of selling investments.

Rebalance Using New Money

If you’re still making contributions to your investment accounts, you can rebalance by directing new money to the underweighted asset classes. This is a great way to get back to your desired asset allocation without selling investments.

Also, when using new money to rebalance your portfolio, you may want to strategically direct those contributions toward certain types of stocks or bonds. For example, if you’re approaching retirement and your portfolio has a high concentration of high-growth tech stocks, you might use new contributions to invest in dividend-paying value stocks. Value stocks tend to be slightly less volatile and provide a higher stream of income, which might be an important part of your retirement income plan.

Use Withdrawals Strategically

When you start taking withdrawals from your investment portfolio, you can use that as an opportunity to rebalance your portfolio. Instead of taking your income proportionally across your portfolio, you could withdraw money only from your overweighted asset classes. For example, if your stock holdings have grown significantly, you could take your withdrawals from the stock portion of your account, bringing your asset allocation back in line.

Rebalance Using Required Minimum Distributions (RMDs)

If you are over the age of 73, you may have to take a Required Minimum Distribution (RMD) from your retirement accounts. This withdrawal can be a great opportunity to rebalance your portfolio. Instead of just withdrawing cash, you can choose to take the RMD from an overweighted asset class. For example, if stocks have outperformed and now represent a larger portion of your portfolio than you intended, you could take your RMD from your stock holdings. This helps you rebalance your portfolio while meeting your distribution requirements. To learn more about Required Minimum Distributions (RMDs), check out our recent article.

Harvest Tax Losses When Possible

If you have investments in a taxable account that have lost value, you could explore selling investments with a loss and use those losses to offset capital gains from other investments that you’ve sold at a gain. This is a more advanced investment strategy that can help reduce your tax burden. There are many pitfalls here to avoid including wash-sale rules, so be sure to consult your tax professional and financial advisor.

Common Rebalancing Mistakes to Avoid

Investing involves risk and it’s easy to make some mistakes when rebalancing.

Rebalancing Too Frequently

Rebalancing too often can lead to higher transaction costs if your investment platform has trading fees. It might also cause you to make emotional trades in periods of volatility if for example the bond market swings quickly in one direction or the other. For most people, an annual review and rebalance is more than enough.

Ignoring Your Risk Tolerance and “Keeping Up with the Jones’s”

Your asset allocation should be based on your individual situation, including your comfort with volatility, known as your risk tolerance, as well as your long-term goals. Maybe seeing the market swing dramatically bothers you. This is important because a great allocation is one you can stick with long-term. You might need to rebalance to a more modest asset allocation to improve your likelihood of not making dramatic trades in down markets.

A diversified portfolio that works for one person might be all wrong for someone else. If your neighbor says they do ‘x’ with their investments, don’t feel like that should apply to you. Everyone’s situation is different. If you have doubts about your strategy, be sure to consult with a financial advisor or financial planner to make sure you’re on the right track.

Forgetting to Adjust as Your Time Horizon Gets Shorter

As your goal time horizon changes over time, your investment portfolio should too. A retirement savings portfolio that was perfect in your 40s likely won’t be the right fit as you get closer to or enter retirement. Gradually reducing your risk exposure might be a smart way to prepare for this life transition, depending on where your asset allocation started.

Should You Use a Target-Date Fund or Automated Fund?

For those who prefer a “set it and forget it” approach, target-date funds and robo-advisors can be a good choice.

Pros of Target-Date Funds or Automated Fund

- Automatic Rebalancing: Target-Date funds automatically adjust their asset mix for you based on the date in the fund’s name. They gradually shift from a more aggressive asset allocation to a more conservative one as you get closer to the target retirement account date.

- Simplicity: Robo-Advisors and automated funds can take the guesswork and the heavy lifting out of managing your investment portfolio. They will automatically manage a portfolio for you based on the criteria you initially select.

Cons of Target-Date Funds or Automated Fund

- Rebalancing When You Don’t Need It: Target-Date funds keep becoming more conservative over time, even if you don’t want your accounts to keep shifting.

- Narrow Focus: Your automated or Robo-Advisor doesn’t know your overall asset allocation, only that specific account. The more complex your financial picture, the more helpful it can be to have a financial planner involved. They can help you manage your assets and liabilities across multiple platforms.

- Fees and Risk: There are costs for using automated investments and you still bear the risk of evaluating if you are in the right investments over time.

When Manual Rebalancing May Be Better

While automated options are great, they might not be the right fit for everyone. If you have multiple retirement accounts such as a 401(k), an IRA, and a taxable account, you might benefit from a more hands-on approach to your overall asset allocation. Working with a financial advisor can help you manage risk and all of these pieces in one place.

Keep Your Investments Balanced, Not Complicated

Remember, a rebalancing strategy is not a race to a finish line. It’s a tool you use to stay on a path that’s right for you. The goal is to create a plan you can stick with through all market conditions and life changes. This is where a personalized approach with a trusted financial planner can make all the difference, helping you avoid emotional decisions and stay focused on your unique retirement goals.

If you’re looking for someone to help you review your investment portfolio and create a plan that fits your individual situation, we’re here to help.

Want Personalized Portfolio Advice? Contact Stage Ready Financial Planning for a Free, No-Commitment Consultation

Thinking about retirement shouldn’t be a source of worry. You’ve spent a lifetime building your savings, and our goal is to help you feel confident that your investments are working as hard as you did to earn them. We specialize in helping people just like you, hardworking retirement savers and retirees in Southern Ohio. We understand that you want a secure future without the flashy, complicated advice.

We’ll take a look at your current investment strategy and your goals for retirement. We’ll help you find a path that simplifies your financial life while managing risk and keeping taxes in mind. Our approach is personalized, and it’s all about providing you with the peace of mind you deserve. Ready to get a clear picture of your investments and feel confident in your retirement plan? Schedule your intro call today!

Frequently Asked Questions (FAQs)

Should you rebalance your portfolio in retirement?

Yes, it’s smart to rebalance your portfolio regularly in retirement. In fact, it becomes even more important as your goals shift from growth to preserving your savings and generating income. Rebalancing helps your investment portfolio maintain your preferred percentage of stock exposure for growth while keeping a healthy amount of conservative assets to help you avoid selling stocks for income in significant market volatility.

What is the 5/25 rule for rebalancing?

This slightly more complicated rule suggests you rebalance when any single asset class is 5% above or below its target allocation. You’ll also rebalance if a single security has increased by 25% or more relative to its original portfolio allocation.

Example of the 5% Portion of the Rule: You start with a mix of 70% stock and 30% bonds. If your portfolio shifts to 75% stocks and 25% bonds, you would rebalance back to your original asset allocation.

Example of the 25% Portion of the Rule: Within your stock allocation, you’ve allocated 15% to international developed markets. If that position becomes 18.75% of your portfolio, you would rebalance back to 15% as it’s increased 25% or more from its original target.

While some people use a similar threshold-based approach, it’s not a hard-and-fast rule, and a professional can help you decide what method is best for you.

What is a good portfolio balance for retirement?

There is no one-size-fits-all portfolio balance for retirement. What’s right for you depends on your age, financial goals, risk tolerance, and how you plan to use your money in retirement. If you don’t need to live on your investments in retirement, you might be able to stay aggressive. If you are living on your savings, you might incorporate more conservative assets into your accounts.

We encourage our clients to consider their retirement asset allocation based on:

- How much their investments need to earn to generate their desired income

- How many years of their income they’d like to have parked in their “buffer” of bonds and cash

Let’s say a client is comfortable with 5-6 years of income in their “buffer.” If we are using a 4.6% withdrawal rate, we might use a 70% stock and 30% bond/cash asset allocation to meet this goal.

How often should you rebalance your retirement account?

A recent study from Vanguard recommends rebalancing annually or every six months but likely not any more frequently. An annual review and rebalance schedule is a good approach for most people who don’t use a threshold approach or tax loss harvest. It is frequent enough to keep you on track without incurring unnecessary transaction costs. A preplanned schedule can also help you avoid being emotionally swayed by short-term market volatility.

What are the disadvantages of rebalancing a portfolio?

Common disadvantages of rebalancing include the potential for transaction costs and taxes. Unlike in tax advantaged accounts, rebalancing in a taxable account can trigger capital gains taxes. Rebalancing too often can also lead to potentially higher transaction costs.

It’s also important to note that rebalancing is all about managing risk. Sometimes rebalancing can limit your exposure to high growth areas of the market so rebalancing does have the potential to reduce short term returns.

How do I avoid taxes when rebalancing my portfolio?

There are a few common ways to avoid taxes when rebalancing. First, any rebalancing you perform within tax advantaged accounts, such as a 401(k), IRA, or Roth IRA do not create a taxable event.

Second, you can use new contributions to your accounts to rebalance your portfolio instead of selling investments that have capital gains. An example of this might be adding cash your investment account and then purchasing securities that are underweight instead of selling assets that are overweighted.

Third, if you do create capital gains when rebalancing, you could work with your tax professional and financial planner to figure out how much you could realize in capital gains and stay in the 0% capital gains tax bracket. This might mean rebalancing your portfolio over the course of a few years to avoid capital gains tax.

How to rebalance a portfolio as you age?

Many people push the idea of gradually shifting your portfolio from riskier asset classes like stocks and international stocks to more conservative asset classes like bond funds and government bonds when you get older.

At Stage Ready Financial Planning, we like to think of controlling your asset allocation based on your investment goals, not your age. We encourage our clients to annually re-evaluate their asset allocation according to their goal time horizon, their income needs, their comfort for risk, and their preferred amount of bond/cash buffer.

For example, let’s say you retire at age 65 with a 70% stock and 30% bond/cash asset allocation. Just because you hit age 70 or 75, we would argue that you shouldn’t make your accounts more conservative if your goals and risk tolerance haven’t changed.

About the Author

Joseph A. Eck, CFP®, is a financial planner dedicated to helping retirement savers achieve peace of mind through a comprehensive approach to wealth management. With years of experience in creating robust financial plans, Joseph helps clients implement a sound investment strategy, including implementing regular portfolio rebalances to keep their plan on track and navigate market volatility. He provides personalized guidance to clients in Dayton and Southwest Ohio, believing that everyone deserves to feel confident that their finances are set up correctly to live their ideal retirement. Click here to learn more about how Joseph helps clients in Dayton and Southwest Ohio.

Article References

- Simplicity OID. “Understanding and Managing Sequence of Returns Risk.” Accessed October 13, 2025. https://simplicityoid.com/wp-content/uploads/2021/08/20210820-EFLS-A033_UnderstandingandManagingSOR.pdf

- The Wall Street Journal. “The Purpose of Bonds in Retirement.” Accessed October 13, 2025. https://www.wsj.com/articles/BL-258B-7456

- The White Coat Investor. “5/25 Rebalancing Rule.” Accessed October 13, 2025. https://www.whitecoatinvestor.com/rebalancing-the-525-rule/

- Stage Ready Financial Planning. “2025 Guide to Capital Gains Tax in Ohio.” Accessed October 13, 2025. https://stagereadyfp.com/blog/ohio-capital-gains-tax-guide/

- Vanguard. “Rational rebalancing: An analytical approach to multiasset portfolio rebalancing decisions and insights.” Accessed October 13, 2025. https://corporate.vanguard.com/content/dam/corp/research/pdf/rational_rebalancing_analytical_approach_to_multiasset_portfolio_rebalancing.pdf

- RBC Global Asset Management. “When to Review and Rebalance Your Portfolio.” Accessed October 13, 2025. https://www.rbcgam.com/en/ca/learn-plan/investment-basics/when-to-review-rebalance-your-portfolio/detail

- Investopedia. “Rebalance Your Portfolio to Stay on Track.” Accessed October 13, 2025. https://www.investopedia.com/investing/rebalance-your-portfolio-stay-on-track/

- Nasdaq. “How Long Do Bear Markets Last? Here’s What History Tells Investors.” Accessed October 13, 2025. https://www.nasdaq.com/articles/how-long-do-bear-markets-last-heres-what-history-tells-investors

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.