You’ve seen it firsthand with an aging parent or family member. They insisted on staying in their home while their ongoing health needs became too great. Experiencing the stress of a rapid health decline, you probably faced a painful dilemma. How do I help them find the right long-term care and afford it without depleting their savings? The financial and emotional burden of moving a loved one in a nursing home or care facility can be incredibly overwhelming.

After a lifetime of hard work and proper planning, the last thing you want is for your own ideal retirement to be derailed by that same scenario. If that thought resonates with you, know that this is a common worry for many Ohio residents. This article is meant to help you tackle that fear more confidently. We’ll walk you through the major considerations around planning for long-term care in Dayton, Ohio, so you can protect your savings and keep your independence and dignity.

Key Takeaways

- Don’t wait to plan for long-term care: Most people over 65 will need some form of long-term care. Starting a plan when you are healthy in your late 50s or early 60s can give you more options, like finding affordable insurance or using your savings effectively. It might also help you protect your assets from a costly “nursing home spend-down.”

- Long-term care costs in Dayton, Ohio can quickly deplete your savings: In-home care, assisted living, and nursing home costs in the Dayton area are expensive. This makes it important to have a strategy, whether it’s self-funding, purchasing insurance, or asset restructuring.

- Medicare isn’t a long-term solution: A common misconception is that Medicare will cover your long-term care costs. Unfortunately, it only provides temporary assistance after a hospital stay. Your plan should account for the fact that you will need to pay for most long-term care yourself.

What Is Long-Term Care and Who Needs It?

According to the National Institutes of Health, Long-term care includes a range of human services for people who need help with everyday tasks due to a chronic illness or disability. The basic daily tasks that are used to assess whether someone needs long-term care are known as “Activities of Daily Living,” and include:

| Basic Activities of Daily Living (ADLs) | What they Mean |

| Bathing | The ability to get in and out of the shower, wash oneself, and maintain basic hygiene |

| Dressing | Refers to the ability to dress oneself and navigate items like buttons and zippers |

| Eating | The ability to feed oneself using basic items like plates and utensils |

| Transfering | This means the ability to get from one body position to another such as standing from a sitting position, and walking |

| Toileting | Toileting includes the ability to successfully get in and out of a bathroom and use the facilities |

| Continence | The ability to control one’s bowel movements and bladder |

If you have long-term care insurance, a doctor typically needs to certify that you need help with a certain number of these daily activities. Only then will the policy begin paying out.

Genworth’s Cost of Care study found that about 70% of people age 65 and older will need some form of care during their lifetime. It’s a common misconception that long-term care or sometimes known as chronic care, is only provided in a nursing home. It can be administered in your own home, in an assisted living facility, or at an adult day care center.

Long-Term Care Costs in Dayton, Ohio

One of the biggest concerns for many retirement savers is the cost of long-term care. This is for a good reason as it’s an expense that can quickly deplete a lifetime of savings.

Average Local Costs by Care Type

According to Care Scout and Genworth, here is a general look at what Dayton residents (Data reported from Dayton, Kettering, and Beavercreek) can expect to pay as of 2024:

| Type of Care | Dayton, Ohio Median | Ohio Median | USA Median |

| In-Home Care* | $6,197/month | $6,292/month | $6,483/month |

| Assisted Living** | $6,798/month | $5,500/month | $5,900/month |

| Nursing Home*** | $11,285/month | $10,038/month | $10,646/month |

*In-Home Care: Pricing based on the use of a home health aide for 44hrs/week, 52 weeks/yr

**Assisted Living: Pricing based on full time residence in an assisted living community

***Nursing Home: Pricing based on full time residence in a private room

It’s important to remember that nursing home costs have significantly increased over time. For example, the Genworth study estimates suggest that long-term care rates increased between 3%-10% depending on the type of care and service between 2023 and 2024.

Costs for Continuing Care Retirement Communities (CCRCs)

Another popular option for long-term care planning is to move into a Continuing Care Retirement Community (CCRC). These communities are designed for individuals and couples over a certain age, and typically offer a tiered system of care. They allow you to initially live independently in an apartment or cottage and then transition to assisted living facility or skilled nursing facility care as your health changes.

CCRCs typically have two types of costs:

- An upfront entrance fee

- An ongoing monthly fee

The entrance fee can range from a few hundred thousand dollars to over a million. Sometimes, this fee is refundable to the family or estate if the resident passes away within a short timeframe. The price of the upfront fee depends on:

- The specific community (For-Profit vs Non-Profit)

- The size of the living units and amenities

- The type of long term contract you agree to

The monthly fee commonly covers services like dining, housekeeping, landscaping, and maintenance. For example, Family Assets states that in the Dayton area, monthly fees for Bethany Village average around $5,300 with refundable entrance fees if a resident passes away within 100 months.

Why Medicare Falls Short

You might assume that Medicare will cover your long-term care needs, but outside of some small temporary help, that’s not quite right. Medicare’s primary purpose is to cover medically necessary care that helps you recover from an illness or injury. It does not cover most custodial long-term care services, including help with activities of daily living.

For example, Medicare Part A may pay or partly pay for skilled nursing facility care for up to 100 days after a hospital stay. However, this type of health insurance will not pay for long term stays in a nursing home or for ongoing in-home care.

When and Why to Start Planning Early

Proper planning for long-term care means starting earlier than you’d normally think to keep options on the table. We regularly suggest that Ohio residents start thinking about a long-term plan in their 50s or early 60s. Age and health are huge factors that impact the cost of long-term care insurance. Planning in your 50s and 60s might also allow you more time to accumulate resources to pay for care, such as max funding and investing your Health Savings Account (HSA).

Avoiding a “Nursing Home Spend-Down”

Without a clear gameplan, you might be forced into a “nursing home spend-down”. This is when you use up most of your savings to pay for a nursing home or long-term care facility. Only then can you qualify for government assistance, in the form of Medicaid services.

This scenario is all too common, especially for those that don’t have private long-term care insurance or significant savings. If you are like the clients we work with, this outcome is what you likely want to avoid. It can completely eliminate the hard-earned savings you hoped to leave some of to your children or grandchildren. With proper planning, you might be able to protect more of your assets and still receive the long-term care you need.

The Five-Year Medicaid Look-Back Rule

If you suspect you might need to qualify for Medicaid someday, understanding the state’s “look-back” period is a big part of planning ahead. For Ohio residents, this means the state will review your financial records for the previous five years for any significant gifts or asset transfers. If they find that you’ve given away assets to reduce your net worth, you could be temporarily ineligible for Medicaid benefits.

It is a common myth that you have to completely spend down all of your money to qualify. For instance, there are complex legal rules that can help a married couple protect a certain amount of assets.

By planning early, you can make sure your assets are structured in a way that aligns with these rules. We recently published an article about Medicaid planning and the five-year lookback rule as it relates to long-term care if you’d like to learn more about this type of planning!

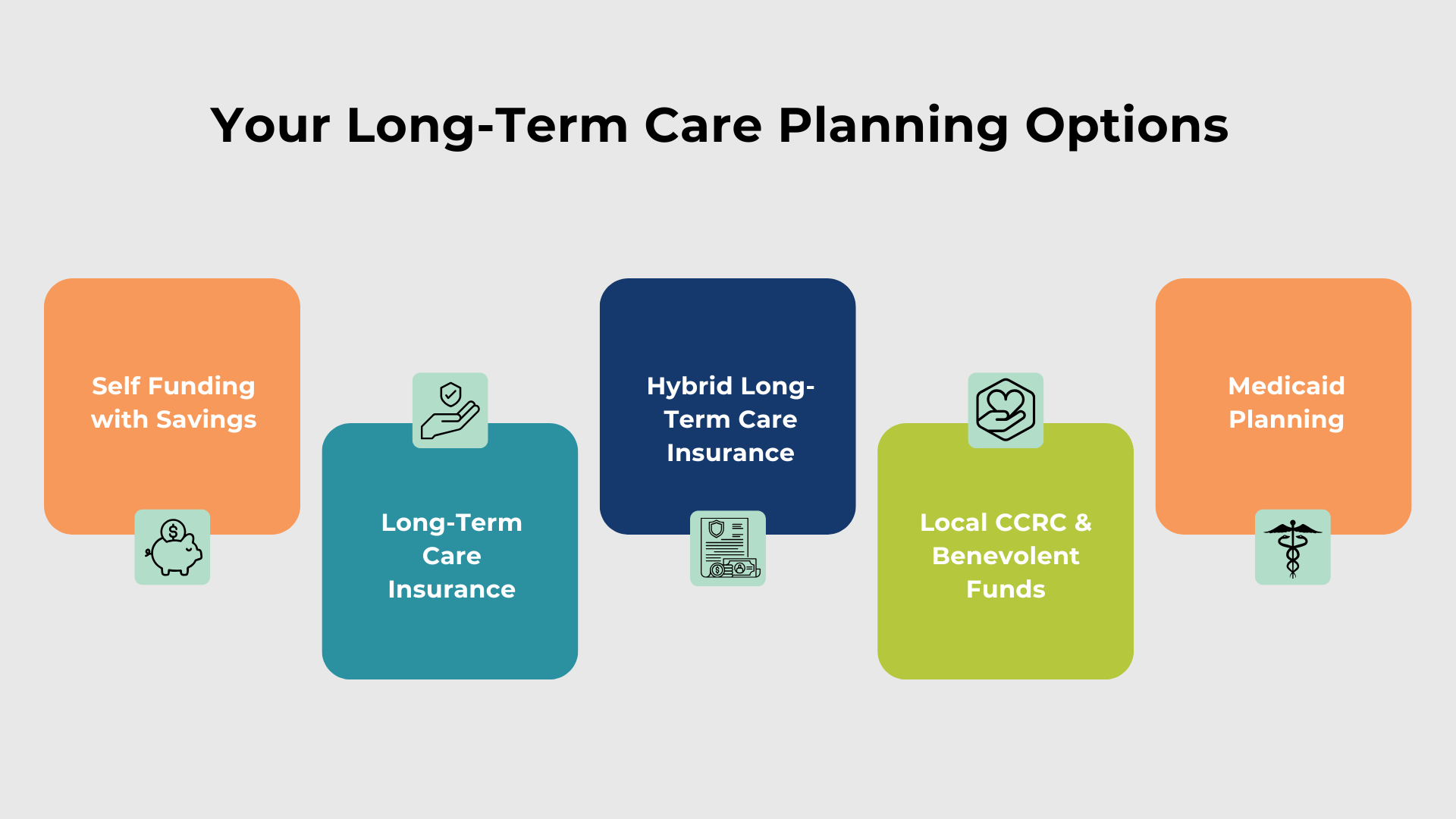

Your Long-Term Care Planning Options

There are several ways to pay for long-term care. The best option for you will depend on your family situation, health, and finances.

Self-Funding with Retirement Assets and Health Savings Accounts (HSAs)

Using your retirement savings and potentially your invested Health Savings Account (HSA) is an option for covering long-term care costs. This option might be successful if you have a significant amount of invested savings that you aren’t living on thanks to a long term retirement income source like a pension.

Example: If you are retired with plenty of invested savings and living fully on a pension and Social Security benefits, you could earmark a Roth IRA or Health Savings Account to one day be a resource to pay for your long-term care needs. You would then intentionally grow this money based on your time horizon and future needs and plan to not touch the account for anything else.

When you decide to self-fund, you are essentially betting that you won’t need long-term care, or that if you do, your investments will be enough to cover the costs without jeopardizing your lifestyle.

This approach requires careful consideration and self-reflection as recent government studies show the following statistics around paying for long-term care:

- A 65 year old today has a 70% likelihood of needing some form of long-term care support

- Women tend to need care longer than men due, likely due to their increased longevity

- 20% of 65 year olds today may need long-term care for 5 or more years

Long-Term Care Insurance

Long-term care insurance is an option meant to cover the custodial costs that health insurance and Medicare won’t. By purchasing insurance, you are transferring the risk of funding long-term care costs to an insurance company. These policies can be a way to protect your assets and help you have access to high quality long-term care, assuming you can afford the cost of insurance.

Long-term care insurance can be extremely expensive, and premiums can vary significantly based on your age and health. SmartAsset states that the average annual premium for a traditional policy for a healthy 65-year-old is around $3,135 for a single male and $5,265 for a single female, with premiums increasing sharply with age.

Another thing to note is that you will have to pay premiums on your long-term care insurance to keep it in force whether you need the care or not. Many traditional long-term care policies feature a “use-it or lose-it” approach to premiums. Just like your home and auto insurance, if you end up not needing to claim on your insurance, you and your family can’t get your premiums back.

Example: If you paid premiums of $5,000/yr in long-term care insurance for a 25 year retirement, you would have paid $125,000 to the insurance company. Alternatively, if you had invested $5,000/yr for 25 years at 5%, you might have accumulated a total of approximately $240,000. These are important numbers to understand when buying long-term care insurance. You might end up paying these costs but never using the insurance.

Hybrid Long-Term Care Insurance

In recent years, hybrid long-term care policies have become a popular alternative to traditional long-term care. These policies combine a long-term care or chronic care benefit with a life insurance policy. If you don’t end up needing long-term care, your beneficiaries will still receive a tax-free death benefit from the life insurance portion of the policy. This eliminates the “use it or lose it” concern, making it an attractive option.

As you can imagine, you will pay higher premiums for a policy that offers multiple forms of protection. This is because the insurance company is guaranteed to pay out claims either to you or your family.

Example: A hybrid policy might look something like this:

- You purchase and pay premiums on a policy that has a $200,000 Life Insurance Death Benefit that can be used:

- By your beneficiaries when you pass away

- Or by you for long-term care or chronic care, assuming you meet the medical qualifications

- If you use $100,000 of your $200,000 benefit for long-term care and then pass away, your family would still receive the balance of $100,000 as a death benefit

Local Dayton-Area Continuing Care Retirement Communities (CCRCs) and Benevolent Funds

When considering a CCRC for long-term care, it’s a good idea to research their financial assistance programs. Some non-profit CCRCs, including a few in the Dayton area, have a “Benevolent Care Fund.” These funds are designed to help residents who have outlived their financial resources but still need long-term care. The fund allows you to remain in your home within the community even if you can no longer afford to pay. This can offer significant peace of mind if you are worried about depleting your retirement savings.

Here are a few prominent CCRCs in and around Dayton:

- Bethany Village (Centerville): A part of Graceworks Lutheran Services, Bethany Village supports a Compassion Fund that helps residents who cannot fully pay for the long-term care they need.

- St. Leonard (Centerville): A part of CommonSpiritHealth, St. Leonards is a faith based community that features a Benevolent Care Fund to protect residents that exhaust their resources paying for care.

- Trinity Community (Beavercreek): A part of United Church Homes, the Trinity Community of Beavercreek is a popular CCRC in Dayton that features a Benevolent Care Fund for residents who run out of money paying for care.

Medicaid Planning

If you run out of money paying for your own care, Medicaid coverage can be a lifesaver, but the qualification rules can be complicated. Medicaid planning involves restructuring your assets to meet the medicaid eligibility requirements for medicaid benefits well in advance of a potential need.

As an Ohio resident, you may be able to purchase a traditional long-term care policy that features an “Ohio Partnership” benefit. The Ohio Partnership is a government program in conjunction with for-profit insurance companies that allows policy holders who’ve used and exhausted their long-term care insurance to qualify for Medicaid without spending down all of their assets.

A knowledgeable professional can help you navigate features like the Ohio Partnership to protect as much of your wealth as possible if you ever need to obtain medicaid benefits.

Working with a Financial Planner and Elder Law Attorney

For families who have saved and invested well, a comprehensive long-term care strategy often requires a coordinated approach. As your financial planner, my expertise is in helping you build and manage a financial plan to fund your retirement and future care needs. However, legal issues like asset protection and Medicaid eligibility are often best handled by a qualified elder law attorney.

At Stage Ready Financial Planning, we believe in a strong partnership between your financial advisor and attorney. This team strategy helps to make sure your financial strategy and legal documents are perfectly aligned.

Want to Create a Comfortable Long-Term Care and Retirement Plan? Contact Stage Ready Financial Planning for a Personalized, No-Commitment Consultation

You’ve worked hard to build a comfortable financial situation and a retirement you can be proud of. Long-term care planning is a sometimes overlooked piece of that puzzle, but it’s just one part of your overall retirement strategy. We know that you want to be sure your investments are set up right, pay less in taxes, and create an income that comfortably supports your lifestyle. At Stage Ready Financial Planning, we specialize in helping people over 50, just like you navigate these important challenges.

We invite you to schedule a no-commitment introductory consultation! If we work together, we can discuss your situation, review your options, and help you understand how long-term care planning fits into your bigger retirement picture. It’s a chance to get your questions answered and start building a roadmap for a secure and comfortable future. Schedule your intro call today!

FAQs

What types of long-term care are available in Dayton?

Dayton residents have many great long-term care options, including in-home care from a home health aide, care in an assisted living facility, or a nursing home. Dayton also features a number of high quality Continuing Care Retirement Communities (CCRCs) that bundle these options in a single community so that as you age, you can continue to receive the support you need while staying in one place. See our list above for popular CCRCs that feature benevolent care funds.

What is the average cost of long-term care in Ohio?

According to Genworth and Care Scout, the current average cost of a private room in a nursing home in Ohio is over $100,000 per year. Ohio’s cost for a nursing home is generally in line with the national average. Dayton, Ohio averages appear to currently be a bit higher. Click here to examine average costs for different types of care in your area.

What is the average cost of long-term care in Dayton, Ohio?

According to Care Scout and Genworth, here is a general look at what Dayton residents (Data reported from Dayton, Kettering, and Beavercreek) can expect to pay for long-term care as of 2024:

| Type of Care | Dayton, Ohio Median | Ohio Median | USA Median |

| In-Home Care* | $6,197/month | $6,292/month | $6,483/month |

| Assisted Living** | $6,798/month | $5,500/month | $5,900/month |

| Nursing Home*** | $11,285/month | $10,038/month | $10,646/month |

*In-Home Care: Pricing based on the use of a home health aide for 44hrs/week, 52 weeks/yr

**Assisted Living: Pricing based on full time residence in an assisted living community

***Nursing Home: Pricing based on full time residence in a private room

Does Medicare pay for long-term care in Ohio?

No, Medicare does not cover most long-term care services. It may partially cover a short stay in a skilled nursing facility after a hospitalization, but it does not cover extended care. Medicare typically will cover up to 20 days post hospitalization, and then only partially cover days 21-100. After day 100, you are required to fully fund your own custodial care.

When should I start planning for long-term care?

The best time to start planning is while you are still healthy and getting close to retirement. This might be in your late 50s or early 60s, while you are still in good health. This gives you more options, particularly for things like finding affordable long-term care insurance or restructuring your assets without worrying about a look-back period.

About the Author

Joseph A. Eck, CFP®, is a financial planner dedicated to helping retirement savers achieve peace of mind by creating robust plans that account for unexpected costs, including long-term care. With years of experience in asset protection strategies, long-term care planning, and comprehensive retirement planning, Joseph provides personalized guidance and support to clients in Dayton and Southwest Ohio. He believes that everyone deserves to feel confident that their finances are set up correctly to live their ideal retirement, free from the worry of unforeseen medical expenses. Click here to learn more about Joseph.

Article References

- Administration for Community Living (ACL). “How Much Care Will You Need?” https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

- American Association for Long-Term Care Insurance (AALTCI). “Homepage.” https://www.aaltci.org/

- Bethany Village. “Homepage.” https://bethanylutheranvillage.org/

- CHI Living Communities. “St. Leonard.” https://www.chilivingcommunities.org/locations/ohio/st-leonard

- CHI Living Communities. “About Us – Make a Gift.” https://www.chilivingcommunities.org/locations/ohio/st-leonard/about-us/make-a-gift

- Genworth. “Cost of Care Survey.” https://www.genworth.com/aging-family/managing-senior-care/cost-of-care.html

- Genworth. “2024 Cost of Care Survey Report” (PDF). https://pro.genworth.com/riiproweb/productinfo/pdf/282102.pdf

- Graceworks Lutheran Services. “Support.” https://graceworks.org/support/donate/

- Medicare. “Skilled Nursing Facility Care.” https://www.medicare.gov/coverage/skilled-nursing-facility-care

- National Association of Insurance Commissioners (NAIC). “Homepage.” https://www.naic.org/

- National Council on Aging (NCOA). “How to Plan for Long-Term Care.” https://www.ncoa.org/adviser/long-term-care/how-to-plan-for-long-term-care/

- National Institute on Aging (NIA). “What is Long-Term Care?” https://www.nia.nih.gov/health/long-term-care/what-long-term-care

- Ohio Department of Insurance. “Ohio’s Partnership for Long-Term Care Insurance.” https://insurance.ohio.gov/consumers/long-term-care/partnership-ltc-ltc4me

- Seniorly. “The 9 Best Continuing Care Retirement Communities in Dayton, OH.” https://www.seniorly.com/continuing-care-retireme-nt-community/ohio/dayton

- SmartAsset. “How Much Does Long-Term Care Insurance Cost?” https://smartasset.com/insurance/how-much-does-long-term-care-insurance-cost

- Stage Ready Financial Planning. “Medicaid Gifting Rules Guide.” https://stagereadyfp.com/blog/medicaid-gifting-rules-guide/

- St. Leonard Faith Community. “Justice and Service.” https://stleonardfaithcommunity.org/justice-and-service/

- United Church Homes. “Trinity Community at Beavercreek.” https://www.unitedchurchhomes.org/communities/trinity-community-at-beavercreek/

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.