Updated: October 23rd, 2025

As a financial planner in Ohio, I regularly get questions about estate taxes. My clients often ask how estate taxes might impact their families and savings.

Let’s demystify the Ohio estate tax and explore how to align your estate plan with your intentions!

Article Key Takeaways

- Ohio eliminated its estate tax: This is the most important takeaway for you to understand. It was repealed in 2013.

- The federal estate taxes still applies: Even though Ohio doesn’t have its own estate tax, the federal estate tax rules still apply if you have a very large estate.

- Estate planning is important: It ensures that your assets are distributed according to your wishes and helps minimize potential burdens for your family and loved ones.

What is an Estate Tax?

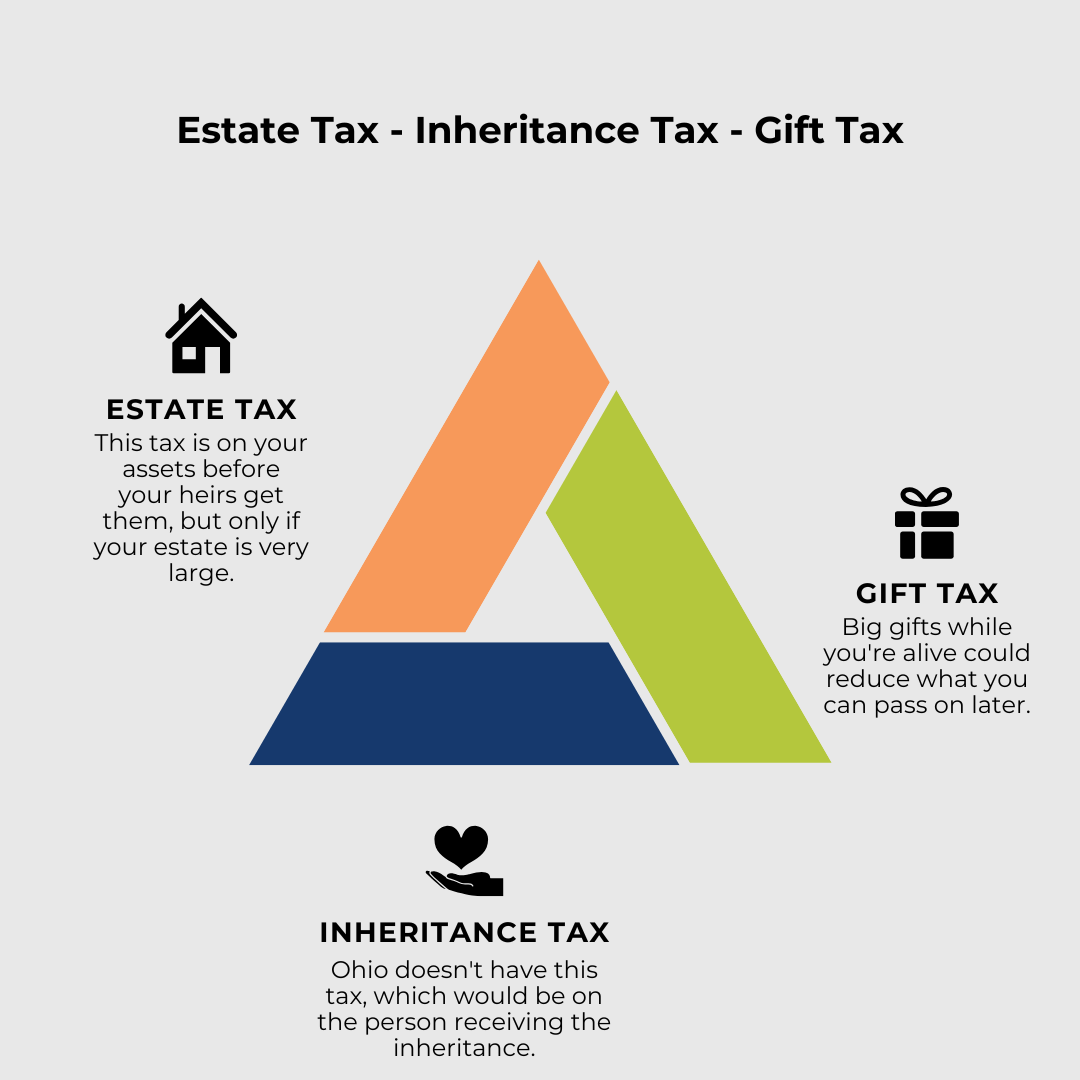

Before diving into the specifics of Ohio’s estate tax, let’s discuss what an estate tax is in the first place. An estate tax, sometimes referred to as a “death tax,” is a tax on the transfer of your property when you pass away.

An estate tax aims to limit the unchecked transfer of vast wealth. Essentially, it’s a way for the government to redistribute concentrated assets. Similarly, gift taxes exist to prevent you from circumventing potential estate taxes by giving away all of your assets before death. These taxes typically apply to substantial gifts made during your lifetime.

The estate tax is paid from your assets before your heirs receive their share, based on the fair market value of your ‘gross estate.’ Your ‘gross estate’ differs from your ‘probate estate,’ which includes only assets distributed by your will. The ‘gross estate’ also includes assets that bypass probate, such as investments with named beneficiaries, real estate, and personal belongings.

In most cases an estate tax is due when an estate hits a certain size. For example, in 2025, the federal estate tax doesn’t apply until your individual estate exceeds $13,990,000. This means that if you are married, your estate would have to have to be larger than $27,980,000 ($13,990,000 for each spouse) before estate taxes kick in.

Estate Tax vs Inheritance Tax: What’s the Difference?

Another common confusion is the difference between an “estate tax” and an “inheritance tax.” Estate taxes are levied on your estate when you pass away, whereas an inheritance tax is levied on the person who inherits your assets.

Does Ohio Have an Estate Tax?

Get ready for some good news! Ohio does not currently have its own estate tax. It was repealed in 2013. However, it’s important to note that the federal estate tax rules still apply to Ohio residents.

Ohio’s Estate Tax History

You might be wondering what Ohio’s estate tax used to be. Prior to 2013, Ohio excluded the first $338,333 in your estate from its estate tax. Everything over that amount was subject to the repealed tax.

Here’s a chart that breaks down the repealed Ohio estate tax system:

| Size of Your Ohio Estate (Prior to Repeal in 2013) | Ohio’s Estate Tax Rate |

| $0 – $338,333 | 0% |

| $338,333 – $500,000 | 6% |

| More than $500,000 | 7% |

Ohio Inheritance and Gift Tax

While Ohio has no inheritance tax, it’s important to be aware that other states do. For example, if you inherit assets from someone who lived in Pennsylvania, you may be subject to Pennsylvania’s inheritance tax, even if you live in Ohio.

Substantial gifts you make during your lifetime can affect your estate taxes. The federal gift tax exemption and the federal estate tax exemption are unified. This means that if you use some of your gift tax exemptions by making large gifts, you’ll have less estate tax exemption available when you pass away. For example, if you give more than $19,000 to a single person in one year (the 2025 annual gift tax exclusion), the excess amount will count against your $13,990,000 lifetime estate tax exemption.

It’s a good idea to consult with a financial advisor or tax professional to understand the potential tax implications of inheriting assets from another state.

Explain the Federal Estate Tax

Even though Ohio doesn’t have its own estate tax, it’s important to understand the federal estate tax, as it still applies to Ohio residents.

The federal estate tax has its own set of rules and exemptions. For 2025, the federal estate tax exemption is $13,990,000 per individual. This means that if your estate’s value exceeds this amount, your heirs may be subject to federal estate taxes. The exemption amount is portable from one spouse to another. In practical terms, a married couple’s estate generally needs to exceed $27,980,000 before federal estate taxes apply.

The 2017 Tax Cuts and Jobs Act increased the federal estate tax exemption to the current amount with a sunset of that provision at the end of 2025. Unless congress extends the current laws, the exemption per person is set to drop to $5,490,000 (adjusted for inflation) in 2026.

In 2025, the federal estate tax rates range from 18% to 40% with its highest rate for taxable estates exceeding $1,000,000. Your taxable estate is calculated by subtracting your federal exemption from your gross estate.

| Your Taxable Estate as of October 2024 | Federal Estate Tax Rates |

| $0 – $10,000 | 18% |

| $10,000 – $20,000 | 20% |

| $20,000 – $40,000 | 22% |

| $40,000 – $60,000 | 24% |

| $60,000 – $80,000 | 26% |

| $80,000 – $100,000 | 28% |

| $100,000 – $150,000 | 30% |

| $150,000 – $250,000 | 32% |

| $250,000 – $500,000 | 34% |

| $500,000 – $750,000 | 37% |

| $750,000 – $1,000,000 | 39% |

| $1,000,000+ | 40% |

Example: If you pass away in 2025 with a gross estate of $15,000,000, your taxable estate would be approximately $1,010,000 ($15,000,000 – federal exemption of $13,990,000). Because your taxable estate is larger than $1,000,000, it would fall into the maximum 40% estate tax bracket.

Ohio’s Overall Tax Makeup: What to Know

Because most people won’t deal with estate taxes, it’s helpful to understand the taxes that you will likely pay as an Ohio resident. In 2025, Ohio’s tax system includes a mix of state and local income taxes, property taxes, and sales taxes.

Income Tax in Ohio

The state’s income tax rates are progressive, meaning that higher earners pay a higher percentage of their income in taxes. Ohio’s income tax brackets are based on your “adjusted gross income” instead of your federal “taxable income.”

According to the Ohio Department of Taxation, your state income tax brackets are the same whether you are working or retired:

| Ohio Taxable Income (For Tax Year 2025) | Rate |

| $0 – $26,050 | 0% of Ohio taxable nonbusiness income |

| $26,051 – $100,000 | $342.00 + 2.75% of excess over $26,050 |

| $100,001 + | $2,394.32 + 3.125% of excess over $100,000 |

For example, if you file your taxes as Married filing jointly and have an adjusted gross income of $120,000, you will be in Ohio’s 3.125% state income tax bracket.

Local Income Tax in Ohio

If you are employed, you may also have to pay local income taxes to your city or your employer’s city. Once you retire, you won’t need to worry about this form of tax.

City income tax rates in Ohio tend to range between 0-3% with some municipalities having no local income tax. These taxes don’t apply to your pension, retirement account distributions, or Social Security benefits.

Property Tax in Ohio

Property taxes are based on the value of your property and are used to fund local services such as schools and libraries. According to SmartAsset, Ohio’s average property tax rate is approximately 1.41%, which is above the national average.

The good news is that this rate is offset by Ohio’s low cost of housing. Ohio’s median home price in 2025 is approximately $240,000, well below the national median of $422,600.

Sales Tax in Ohio

According to the Tax Foundation, Ohio has a 5.75% state sales tax. When you include local sales tax in Ohio, the combined state and local sales tax is approximately 7.24%.

The good news is that certain common items are exempt from sales tax in Ohio including: most groceries, prescription drugs, and newspapers!

Estate Planning Tips

Estate planning is an important element of your financial health even if you aren’t subject to estate taxes. Here are a few strategies to consider:

- Create a Will

- Update Your Power of Attorney, Living Will, Health Care Proxy

- Review Your Beneficiary Designations

- Calculate Your Net Worth

- Determine Your Life Insurance Needs

- Explore the Benefits of a Trust

- Stay Organized and Communicate with Your Loved Ones

1. Create a Will

Your will is the foundational estate planning document that stipulates who receives your assets when you are gone. Your will governs the “probate” process. It ensures that your assets are distributed according to your wishes.

2. Update Your Power of Attorney, Living Will, Health Care Proxy

In addition to having an updated will, it’s important that you create a power of attorney document that allows your loved ones to financially act on your behalf if you become incapacitated.

Creating a living will arrangement tells your family and healthcare providers what you want to happen if you are ever put on life support with no prospect of recovery.

Your Health Care Proxy is a document outlining who you want to help you with medical decisions if you are unable to make them yourself.

3. Review Your Beneficiary Designations

Naming a beneficiary allows your heirs to directly receive your money without going through the probate process.

Make sure your beneficiary designations are up to date for all your retirement accounts, investment accounts, and life insurance policies. You can even add a beneficiary in the form of a transfer on death (TOD) or payable on death (POD) designation on your bank accounts and property titles.

4. Calculate Your Net Worth

To effectively plan your estate, you should have a clear understanding of your net worth and how your different assets are treated for estate tax purposes. For example, some assets, like your retirement accounts, may be subject to both estate taxes and income taxes.

Working with a financial advisor can help you determine your net worth and develop strategies to minimize your potential estate tax liabilities.

5. Determine Your Life Insurance Needs

Life insurance can provide funds to cover estate taxes or other expenses when you’re gone. Not everyone needs life insurance, so be sure to consult a fee-only financial planner to assess your specific needs. Since fee-only financial planners don’t earn commissions, they can provide objective advice about whether you need life insurance.

6. Explore the Benefits of a Trust

A trust is a financial document that can own and distribute your assets instead of having them pass through probate. Just like your will, a trust can direct who receives your estate, however unlike your will, a trust can control “when” and “how” the money is distributed.

7. Stay Organized and Communicate with Your Loved Ones

Keep your important documents organized in a secure location, whether it’s a physical file or a digital space. This includes your estate documents, financial records, and account information.

You might consider openly communicating with your spouse and heirs about the location of these documents. It’s important to have conversations with your loved ones about your estate plan so that they’re prepared and informed.

Explore Strategies to Reduce Potential Estate Taxes

There are a number of strategies to reduce your potential estate taxes, including gifting a portion of your assets during your lifetime or setting up an irrevocable trust. There are many different types of irrevocable trusts that remove assets from your estate and can still benefit your heirs or preferred charities.

Contact Stage Ready Financial Planning to See How We Can Help with Your Ohio Estate Planning and More

Have you been putting off estate planning for a while? Don’t worry! You don’t have to navigate this complex world alone.

At Stage Ready Financial Planning, we’re here to help. We can guide you through the entire process, from reviewing your estate documents to helping you minimize potential estate taxes, and ensuring a smooth transition of your assets to your family.

Schedule your complimentary intro call today and let us help you feel confident about how you are protecting your loved ones!

Frequently Asked Questions (FAQs)

What is the estate tax rate in Ohio?

Ohio no longer has an estate tax. It was repealed in 2013. However, federal estate tax rules still apply even if you are an Ohio resident.

Is inheritance money taxable in Ohio?

Ohio doesn’t have state inheritance taxes, estate taxes, or gift taxes. That said, federal estate and gift tax laws still apply even as an Ohio resident.

Besides estate and gift taxes, your loved ones may still have to pay taxes on specific assets they inherit including your 401(k), Traditional IRA, and Tax Deferred Annuities.

What assets are included for estate tax?

For the federal estate tax, assets included can vary, but typically encompass all of your real estate, investments, bank accounts, and personal property including cars and physical items.

What are the common estate planning mistakes to avoid?

As a financial planner, I’ve seen firsthand the consequences of estate planning oversights. Here are some common mistakes I encourage my clients to avoid:

- Procrastinating on creating your will: It’s easy to put this off, but having a will is important to ensure your wishes are honored.

- Overlooking beneficiary updates: Many people forget to update beneficiaries after major life events, which can lead to unintended distributions.

- Not having ‘the talk’ with your family: Open communication about your estate plan can save your loved ones a lot of stress and potential conflict.

About the Author

Joseph A. Eck, CFP®, is a financial planner dedicated to helping retirement savers achieve their financial goals. With years of experience in estate planning and retirement planning, Joseph provides personalized guidance and support to clients in Dayton and Southwest Ohio. He believes that everyone deserves to feel confident living their ideal retirement. Click here to learn more about Joseph.

Article References

- Internal Revenue Service. (2024, October 22). IRS releases tax inflation adjustments for tax year 2025. https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025

- Internal Revenue Service. (2024, October). Instructions for Form 706 (2023). https://www.irs.gov/instructions/i706

- Ohio Department of Taxation. (n.d.). Annual tax rates. https://tax.ohio.gov/individual/resources/annual-tax-rates

- Ohio Department of Taxation. (n.d.). Ohio estate tax – prior to 2013. https://tax.ohio.gov/professional/estate/prior2013

- SmartAsset. (n.d.). Ohio property tax calculator. https://smartasset.com/taxes/ohio-property-tax-calculator

- Tax Foundation. (n.d.). Ohio. https://taxfoundation.org/location/ohio/#:~:text=Ohio%20has%20a%205.75%20percent,estate%20tax%20or%20inheritance%20tax.

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.