You’ve spent years building towards retirement. You’re feeling mentally ready for the next chapter, but what about your finances? A solid retirement plan includes understanding Social Security retirement benefits so that you can maximize your income and investments.

At Stage Ready Financial Planning, we’re here to help. This article covers what you need to know to approach Social Security planning with confidence.

Key Takeaways

- Social Security Shouldn’t Be Your Only Source of Income: Think of Social Security as a helpful supplement, not your entire retirement plan. It’s designed to replace a portion of your pre-retirement income, and the exact amount depends on your earnings history.

- Timing Matters: You can start receiving benefits as early as 62, but your payments will be smaller. Waiting until your full retirement age (FRA) or even later means you’ll get a larger monthly check. Your FRA depends on the year you were born.

- Your Work History Counts: The Social Security Administration looks at your lifetime earnings to calculate your benefit amount. Generally, the more you’ve earned over your working years, the higher your benefit will be. To be eligible, you typically need 40 credits, which is about 10 years of work.

What Are Social Security Benefits?

Social Security benefits, officially the Old Age, Survivors, and Disability Insurance program (OASDI), were established in 1935 with the signing of the Social Security Act by Franklin D. Roosevelt. The program provides an income safety net for retirees, individuals with disabilities, and families of deceased workers.

The system is funded by the Social Security taxes you and your employers have paid over the years. In 2025, you will likely contribute 6.2% of your income on the first $176,100 that you earn to the OASDI trust funds. Your employer will also contribute a matching 6.2% to the OASDI trust funds on your behalf. If you are self-employed, you will contribute the full 12.4% yourself.

Instead of individual accounts, your contributions are pooled into the OASDI trust funds, which finance current benefits for retirees, their families, and those with disabilities.

Although not intended as your primary income source, Social Security remains an important part of a confident retirement income plan.

There are a few types of Social Security benefits:

- Retirement Benefits: These are what most people think of: Payments to retired workers.

- Disability Benefits: For those who can’t work due to a physical or mental disability and are not expected to recover for at least 12 months.

- Survivor Benefits: Paid to eligible family members of a deceased worker.

This article will focus primarily on Social Security retirement benefits, since that’s what’s top of mind for many of you planning your retirement.

Eligibility for Social Security Benefits

According to the Social Security Administration (SSA), to be eligible for retirement benefits, you need to have earned a certain number of credits. You earn these credits as you pay Social Security taxes while you are working.

To be eligible to receive retirement benefits, you need to have earned 40 credits from Social Security. In 2025, you earn 1 credit for each $1,810 of earnings that are subject to OASDI taxes. You can earn a maximum of 4 credits per calendar year ($7,240 of earnings), meaning it takes approximately 10 years of earnings to qualify for Social Security retirement benefits.

How Are My Social Security Benefits Calculated?

To calculate your Social Security retirement benefits, the SSA uses a formula that considers your average earnings over the course of your working years. Here’s a basic breakdown:

The SSA calculates your average indexed monthly earnings (AIME) based on your highest 35 years of earnings, and adjusts your earnings for inflation.

Your AIME is then used to determine your Primary Insurance Amount (PIA). This is the monthly benefit you’re eligible to receive at your full retirement age (FRA).

These numbers are then applied to a formula that includes “bend points” to determine your final primary insurance amount (PIA). “Bend points” are progressive calculations designed to provide a higher percentage of income replacement retirement benefits to lower-income earners.

Example: Let’s say an individual reaching full retirement age in 2025 has an AIME of $11,017 per month based on their highest 35 years of earnings. According to SSA calculations, their estimated final monthly benefit (PIA) would be $4,043 at FRA.

For more information on how bend points impact your primary insurance amount, check out this chart on SSA.gov.

Impact of Your Full Retirement Age (FRA)

You can begin drawing retirement benefits at age 62, however your full retirement age is the retirement age at which you’re entitled to receive benefits without earnings limits or reductions.

Your full retirement age increases gradually depending on the year you were born:

| Year You Were Born | Your Full Retirement Age (FRA) |

| 1943-1954 | 66 |

| 1955 | 66 and 2 Months |

| 1956 | 66 and 4 Months |

| 1957 | 66 and 6 Months |

| 1958 | 66 and 8 Months |

| 1959 | 66 and 10 Months |

| 1960+ | 67 |

*Data from SSA.gov

It’s important to understand how reaching your full retirement age impacts your retirement benefits.

Early vs. Delayed Retirement Benefits

You don’t have to claim your retirement benefits at your full retirement age (FRA). Depending on your situation, it might be wise to claim your social security retirement benefits as early as age 62 or as late as age 70.

Claiming Benefits Early (Age 62 – FRA)

You can start receiving social security benefits as early as retirement age 62, but they will be reduced by approximately .5% per month under your FRA. For example, if your FRA is age 67 and you claim your retirement benefits at age 62, you will receive approximately 70% of your FRA amount.

Waiting Until After Your Full Retirement Age

Reaching your full retirement age means you get your full retirement benefit without reductions or penalties. Waiting past your full retirement age increases your retirement benefit even further.

If you were born after 1943, for each year you delay past your full retirement age (FRA), your retirement benefit increases by 8% until retirement age 70. These increases are referred to as delayed retirement credits and are prorated per month if you delay your benefits beyond your FRA.

For example, if your FRA is age 67 and you are eligible for $1,500 but you wait to take your benefit until age 70, you might receive approximately $1,860 (24% more).

When Should I Start Collecting Social Security?

This is one of the most common questions we get at Stage Ready Financial Planning. The “best” retirement age to start collecting Social Security depends on your individual situation.

Some factors that influence the best time to draw your retirement benefits include:

- How much you’ve saved for retirement

- How much you plan to spend in retirement

- Whether you plan to work in retirement

- If you have a pension

- If you have a spouse with a pension or employment income

- Your health status and family history of longevity

For example, if you’ve saved far more than you need to live on in retirement, it might make sense to consider delaying your Social Security retirement benefits to increase their size and value. Alternatively, if you are in poor health or your retirement savings can’t sustain your lifestyle without help from Social Security, you may need to claim your benefits earlier.

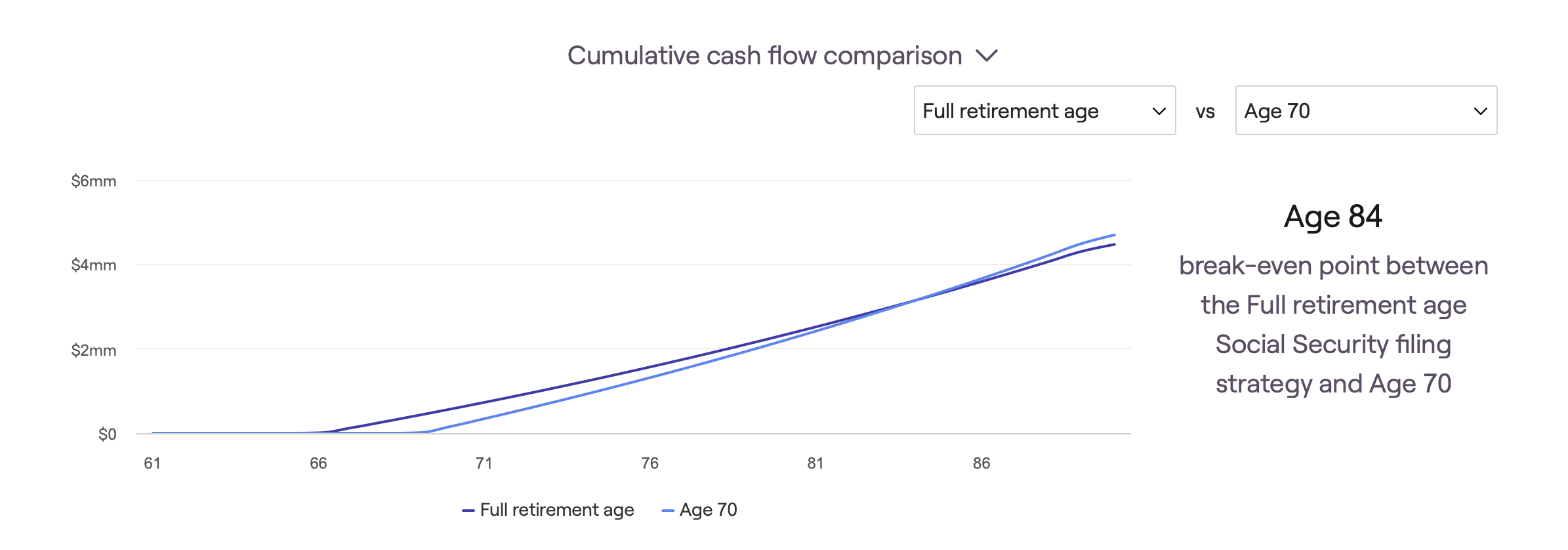

Break-Even Analysis

A common way of comparing your claiming options is to look at how long you need to live to “break even” by delaying your retirement benefits. We can illustrate this with a simplified example.

Example: Lets say you could claim $1,000/mo at age 67 or $1,240 at age 70. By waiting 3 years to take the higher income benefit, how long would you have to live to “break even?”

At age 84, you would have received a total of $204,000 if you claimed at age 67 ($12,000/yr x 17yrs). Alternatively at age 84, you would have received $208,320 by waiting and claiming at age 70 ($14,880/yr x 14yrs).

Every year you live beyond age 84, you would have accumulated more earnings from Social Security by delaying your benefit. On the other hand, if you were to pass away at age 82, you would have been better off claiming at age 67.

What Else Should I Consider?

One reason to maximize your Social Security benefits is to allow your spouse to draw a higher retirement benefit or survivor benefit if something happens to you.

Considerations for Married Couples

If you are married, you may be eligible to receive Social Security benefits based on your own record or based on a portion of your spouse’s earnings record. Married couples can claim the higher of either their own retirement benefit or 50% of their spouses primary insurance amount (PIA), adjusted for the age they file.

The spouse with the higher PIA amount must have filed for Social Security before their spouse can draw a spousal benefit. This also means that maximizing your own retirement benefit can impact the amount your spouse is entitled to.

Example: A married individual, at FRA age 67 is eligible to draw $1,000/mo in retirement benefits based on their own earnings history. If their spouse’s primary insurance amount (PIA) is $3,000/mo, they would instead be allowed to draw 50% of that amount: $1,500/mo.

When a spouse dies, the surviving spouse may be eligible for survivor benefits under the following common conditions:

- The surviving spouse is age 60 or older

- The surviving spouse is age 50 or older with a disability=

- The surviving spouse is carrying for a child under age 16 or disabled

These same rules typically apply to ex-spouses who were married for at least 10 years and haven’t remarried. Children under age 18 may also be eligible for survivor benefits, if they are in k-12 school. Disabled children under age 22 are eligible for survivor benefits as well.

Working While Receiving Benefits

If you decide to work after you’ve claimed early retirement benefits, you might experience penalties in the form of benefits reductions. Social Security will deduct $1 for every $2 you earn over the annual limit, which is $23,400 in 2025.

This reduction is modified in the year of your FRA as your benefits will be reduced by $1 for every $3 you earn over $62,160. Once you reach your FRA, your benefits will be recalculated and you will no longer face penalty reductions.

Tax Implications

You might be surprised to learn that your Social Security benefits may be taxable depending on how much “provisional income” you have in retirement. Your provisional income is calculated by combining your adjusted gross income + non-taxable interest + half of your Social Security retirement benefits.

In 2025, you will owe tax on the following portion of your Social Security based on these “provisional income” limits:

| Provisional Income | MFJ | Single |

| 0% Taxable | < $32,000 | < $25,000 |

| 50% Taxable | $32,000 – $44,000 | $25,000 – $34,000 |

| 85% Taxable | > $44,000 | > $34,000 |

* Data from SSA.gov

Social Security and Medicare: How They Work Together

Social Security and Medicare are related, but they aren’t the same. Medicare is health insurance for people 65 or older, and people with a physical or mental disability regardless of age.

While you are working and paying into the Social Security trust funds (OASDI), you are also paying separately into the Medicare trust fund. 1.45% of your earnings are contributed each year to the Medicare trust fund. Your employer also contributes 1.45% as a matching contribution. A Medicare surcharge of .9% will also be due if your wages exceed $250,000 MFJ or $200,000 filing single.

What Are The Parts of Medicare?

Part A (Hospital Insurance)

This covers your inpatient hospital stays, skilled nursing facility care, hospice care, and some limited home healthcare. Most people don’t pay a Medicare premium for Part A. It’s generally wise to enroll in this in the 7 month window surrounding your 65th birthday.

Part B (Medical Insurance)

This part covers your doctor’s visits, outpatient care, preventive services, and medical equipment. You will have a monthly Medicare premium for Part B. You can postpone enrolling in this at age 65 if you are still employed and covered by your employer’s health insurance plan.

Part C (Medicare Advantage)

This is offered by private insurance companies approved by Medicare. These plans provide you with all of the benefits of Part A and Part B, and often include additional coverage, such as prescription drugs and dental care.

Part D (Prescription Drug Coverage)

This is also offered by private insurance companies. These plans help cover the cost of your prescription drugs.

Medigap (Medicare Supplements)

These are offered by private insurance companies and are designed to be paired with Medicare part A,B, and usually D. These policies help reduce further out-of-pocket costs for things not covered in traditional Medicare.

Medicare Eligibility and Enrollment Periods

In most cases, you become eligible for Medicare at retirement age 65. This means that you are eligible for Medicare before your full social security retirement age.

Your Initial Enrollment Period (IEP) is your first window to sign up for Medicare. It is a 7-month period that begins 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

Premium Payments and Deductions

If you are drawing your Social Security retirement benefit, your Medicare premiums will likely be deducted from your Social Security check. If you enroll in Medicare at age 65 but have yet to file for Social Security, you will be billed separately until your retirement benefits begin.

Medicare is priced according to your income tax bracket. The more you make, the more you will pay for Medicare. The pricing for each year is based on your modified adjusted gross income from 2 years prior. These price increases are known as Income-Related Monthly Adjustment Amounts (IRMAA).

Here is a chart of the 2025 Medicare pricing based on your 2023 federal income tax return:

| Medicare in 2025 | 2023 MFJ MAGI

$0 – $212,000 |

2023 MFJ MAGI

$212,000 – $266,000 |

2023 MFJ MAGI

$266,000 – $334,000 |

2023 MFJ

MAGI $334,000 – $400,000 |

2023 MFJ

MAGI $400,000 – $750,000 |

2023 MFJ

MAGI $750,000 + |

| Part A | $0* | $0* | $0* | $0* | $0* | $0* |

| Part B | $185 | $259 | $370 | $480.90 | $591.90 | $628.90 |

| Part C | Varies** | Varies* | Varies* | Varies* | Varies* | Varies* |

| Part D | $36.78*** | + $13.70 | +$35.30 | +$57.00 | +$78.60 | +$85.80 |

* Most people who’ve paid into Social Security receive part A with no premium.

** These prices are set by private insurance companies and vary based on the plan and what it includes.

*** $36.78 is the 2025 national base price. Part D pricing varies depending on your plan and company offering the coverage.

Planning for the Future

Social Security can be an important part of your retirement income plan, but it was never meant to be your sole source. A holistic retirement plan maximizes Social Security benefits while also creating tax-efficient income from your savings and pensions. This is something we help our clients with at Stage Ready Financial Planning all the time.

Estimating Your Benefits

You can get a projected estimate of your Social Security benefits by creating a login to SSA.gov. This can be especially helpful if you are working with a financial planner as you can provide them with the information they need to help you plan.

The www.ssa.gov website also provides online calculators and tools to help you estimate your future Social Security benefits based on your earnings record.

Reviewing Your Social Security Statement

The Social Security Administration used to mail out statements that show your earnings history and estimated Social Security benefits. In recent years they’ve switched to only mailing statements for individuals over age 60 who don’t have an online account.

It is important to review your statements for accuracy as you have a limited window of time to correct errors that could negatively impact your retirement benefits. If you aren’t receiving paper statements from Social Security, be sure to sign up for a “My Social Security Account” online.

Maximizing Your Retirement Benefits

Here are some ways to optimize your Social Security payout:

- Delay Claiming: Waiting beyond your full retirement age (FRA) increases your benefit by about 8% per year until age 70. It’s important that you have retirement savings to live on in the meantime.

- Work For 35 Years: Social Security calculates your benefit based on your highest 35 years of earnings. If you have fewer, zeros will be factored in, reducing your benefit.

- Coordinate Spousal Benefits: If you’re married, you may be eligible for spousal or survivor benefits that maximize your overall household income.

Supplementing Social Security Income

As of 2025, the Social Security Administration reports that the average monthly income for all retirees receiving retirement benefits is $1,976/mo. For most people, this isn’t enough to cover the cost of living.

This is why it’s important for your retirement plan to include a mix of income sources, such as Social Security, pensions, and invested savings.

Working with a Professional

A financial planner can help you create a comprehensive retirement plan that maximizes your Social Security benefits. They can help you determine your optimal filing strategy and create an income plan that helps you live your ideal retirement with confidence.

Get More Personal Insight into Your Social Security Benefits with Stage Ready Financial Planning. Contact Us Today to Learn More

We know that understanding security retirement benefits can feel overwhelming. It’s not something you have to figure out on your own.

At Stage Ready Financial Planning, we’re here to help you make sense of it all and create a confident retirement plan:

- Personalized Analysis: We’ll take a close look at your specific situation, including your earnings history, your retirement goals, and your other assets. We will use this information to help you determine the optimal Social Security retirement benefit claiming strategy.

- Integration with Your Overall Plan: Social Security shouldn’t be reviewed in a vacuum. We’ll show you how it fits into a tax-efficient retirement income plan, along with your investments, savings, and any other income sources.

- Ongoing Support: Retirement planning is an ongoing process, even after you’ve stopped working. We provide ongoing support to help you adjust your strategy as your circumstances change or as Social Security laws evolve.

If you’re in the Dayton or Southern Ohio area and want to take the guesswork out of Social Security, we’d love to hear from you. Let’s work together to make sure you’re truly READY for the next STAGE of life. Schedule your complimentary intro call today!

FAQs

How do Social Security payments work when you retire?

Once you become eligible and start your retirement benefits, you’ll generally receive monthly payments. You can choose to receive them via direct deposit into your bank account, which is the most common and secure way. The amount you receive is based on those factors we talked about earlier: your earnings history, when you start taking your retirement benefits, and so on. We typically encourage our clients to contact the Social Security Administration 3-4 months before they want to receive income as it takes some time to complete.

Is it better to collect Social Security at 62 or 67?

Sadly, there are no universal strategies for claiming Social Security. It really depends on you, your health, and your financial situation. Claiming at retirement age 62 gets you payments sooner, but they’re significantly lower than if you had claimed at your FRA. Waiting until your full retirement age or even later gets you delayed retirement credits, but you need to live longer for the strategy to pay off. There’s no one-size-fits-all answer for the best retirement age.

Can you draw Social Security at 62 and still work full-time?

You can, but it will likely affect your Social Security benefits. If you’re younger than your full retirement age, your Social Security benefits could be reduced if your earnings go over a certain limit. Once you reach your full retirement age, you can generally earn as much as you want without affecting your retirement benefits.

About the Author

Joseph A. Eck, CFP®, is a financial planner passionate about helping retirement savers achieve their financial goals with a clear and confident income plan. With years of experience in retirement planning, and investment management, Joseph provides personalized guidance and support to clients in Dayton and Southwest Ohio. He believes that everyone deserves to have clarity and peace of mind knowing they’ve made the best decisions surrounding their Social Security and retirement income. Click here to learn more about Joseph.

Article References

- “Brief History of the Social Security Act,” Social Security Administration, ssa.gov: https://www.ssa.gov/history/briefhistory3.html

- “Understanding the Benefits,” Social Security Administration Publication, ssa.gov: https://www.ssa.gov/pubs/EN-05-10024.pdf

- “Cost-of-Living Adjustment (COLA),” Social Security Administration, ssa.gov: https://www.ssa.gov/OACT/COLA/Benefits.html

- “Maximum Social Security Benefit Examples,” Social Security Administration, ssa.gov: https://www.ssa.gov/OACT/COLA/examplemax.html

- “Working While Receiving Benefits,” Social Security Administration, ssa.gov: https://www.ssa.gov/benefits/retirement/planner/whileworking.html

- “Delaying Retirement,” Social Security Administration, ssa.gov: https://www.ssa.gov/benefits/retirement/planner/delayret.html

- “Survivor Benefits Eligibility,” Social Security Administration, ssa.gov: https://www.ssa.gov/survivor/eligibility

- “Spousal Benefits Calculator,” Social Security Administration, ssa.gov: https://www.ssa.gov/oact/quickcalc/spouse.html

- “Social Security Statement,” Social Security Administration, ssa.gov: https://www.ssa.gov/myaccount/statement.html

- “General Social Security FAQs,” Social Security Administration, ssa.gov: https://www.ssa.gov/faqs/en/questions/KA-02603.html

Benefit Formula Bend Points”, Social Security Administration, ssa.gov: https://www.ssa.gov/oact/cola/bendpoints.html

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.