Are you a high-income Ohio taxpayer, over 50, who’s been diligently saving for retirement? Maybe you’re retired and are looking for smart ways to help your children or grandchildren with their college savings. If that sounds like you, you might be happy to learn that a 529 plan isn’t just a college savings tool. It’s also a tax savings vehicle, which can be especially helpful if you are in a high income tax bracket.

In this article, we will explore how the Ohio 529 deduction works and how you can leverage the buckeye state’s college savings tool.

Key Takeaways

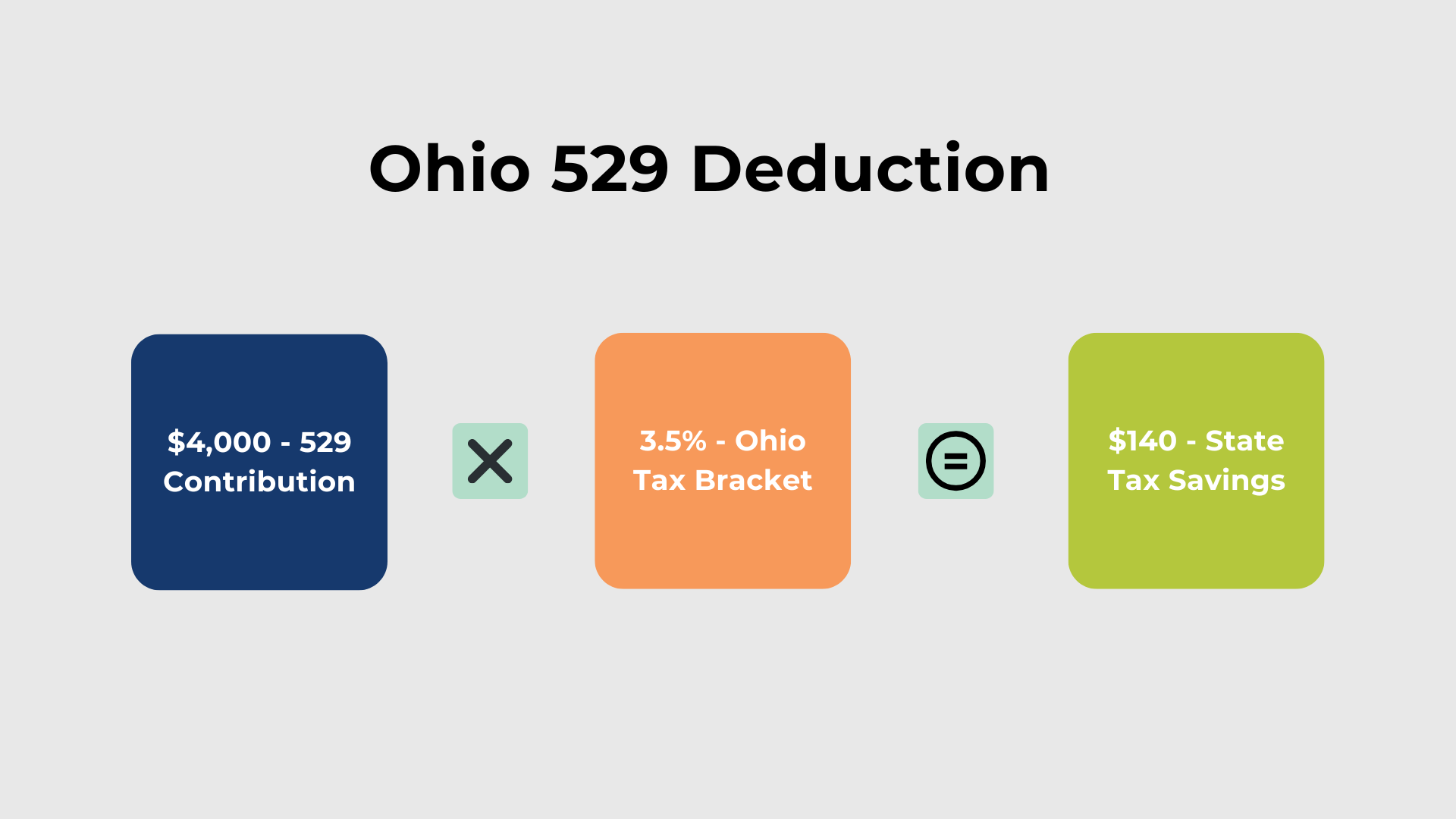

- Ohio 529 Deduction Benefits: Ohio taxpayers can deduct up to $4,000 per beneficiary annually. This 529 plan contribution deduction lowers their Ohio state income tax.

- Strategic Tax Planning: The 529 plan can be used for strategies like “bunching” contributions. You can also name multiple beneficiaries to maximize your tax savings.

- State Parity Advantage: As of tax year 2023, Ohio taxpayers can claim the tax deduction for contributions made to any state’s 529 plan.

Why High-Income Ohioans Should Care About the 529 Deduction

You’ve worked hard to build your nest egg. Every dollar saved on taxes can benefit your retirement lifestyle. The good news is that a 529 plan isn’t just about saving for your kids’ or grandkids’ college; it’s about maximizing your tax savings.

As an Ohio taxpayer, contributing to a 529 plan offers you a way to reduce your state taxable income. This happens through a state tax deduction for a portion of your contributions per beneficiary. Your kids or grandkids might start college soon. Even so, adding money to a 529 plan can offer additional tax savings if you plan to help them with their college expenses.

Ohio’s 529 Plan, CollegeAdvantage, consistently ranks among the nation’s best. It’s known for its long-term performance and cost-efficiency. This makes it a solid college savings vehicle. Also, the Ohio 529 deduction now applies regardless of which state’s 529 plan you contribute to.

How Does Ohio’s 529 Work?

Ohio offers two main 529 plan options:

- CollegeAdvantage Direct 529 Savings Plan: This is a do-it-yourself investing vehicle. It features investment options including age-based portfolios and risk-based portfolios using Vanguard and DFA (Dimensional Fund Advisors) funds. It also includes FDIC-insured deposit accounts through Fifth Third Bank.

- CollegeAdvantage Advisor 529 Savings Plan: This plan is offered through a financial advisor and features a range of target date and risk-based mutual fund and ETF options offered by BlackRock.

Each 529 plan offers potentially tax-free earnings, a diverse range of investment options, and professionally managed funds. You can typically open a 529 plan with as little as $25, or $500 for the Fifth Third CD option. This makes starting a college savings plan extremely easy.

How Does the 529 Tax Deduction Work?

As of 2023, Ohio offers a state tax deduction for contributions to any state’s 529 plan, helping to reduce your state income tax liability. The maximum tax deduction you can claim is $4,000 per beneficiary, per year. Any excess you’ve contributed can be carried forward indefinitely until the full amount is deducted.

The deduction amount is $4,000 per beneficiary, regardless of your filing status (single or married filing jointly). This means a married couple filing jointly can deduct $4,000 per year per beneficiary, just like a single taxpayer.

Example: Suppose you are an Ohio taxpayer, close to retirement, and want to help your two adult children with their current college tuition. Instead of paying the tuition bill directly, consider this:

- If you contribute $4,000 to each of their 529 plans, you could deduct $8,000 ($4,000 x 2) from your state taxable income. If you contributed $6,000 to each of their 529 plans, you would still be able to deduct $8,000 from your state taxable income in the current year and then carry forward $4,000 to deduct in future years.

In order to claim the deduction, you need to keep record and receipt of your contributions and report them to your tax professional. It’s important to understand that this tax deduction is for your Ohio state income tax, not your federal income tax. The 529 plan federal tax benefits are limited to the tax deferral inside the 529 account and the tax-free earnings on distributions for qualified educational expenses.

Who Can Claim It?

If you’re an Ohio taxpayer who contributes to a 529 plan, you’re generally eligible to claim the tax deduction, regardless of your income tax bracket. The Ohio Revised Code 5747.70 explains that this applies whether you’re contributing to a 529 plan for your child, grandchild, or even yourself.

Parents, grandparents, other family members, and friends can all contribute to the same 529 plan even if they aren’t the account owner and deduct contributions from their state taxable income up to the $4,000 limit, per beneficiary.

Tax Planning Strategies with 529 Contributions

To maximize potential tax savings, the Ohio 529 deduction can be planned strategically, especially if you are approaching or in retirement. Consider the following:

- Stack Deductions by Naming Multiple Beneficiaries

- Bunching Contributions

- End-of-Year Planning Tool

1. Stack Deductions by Naming Multiple Beneficiaries

You can claim the $4,000 state income tax deduction per beneficiary, per year. This means if you have multiple children or grandchildren with their own 529 plan, you can potentially multiply your state tax deduction.

Example: If you contribute to each of your two grandchildren’s 529 plans, you could potentially deduct up to $8,000 from your Ohio taxable income in a single year. This lets you maximize tax savings while also funding their education.

2. Bunching Contributions

If you have a particularly high income tax year, “bunching” contributions to a 529 plan can be a helpful strategy. While the annual tax deduction limit is $4,000 per beneficiary, per year, you can contribute more than that amount in a single year.

If you contribute more than $4,000 to a 529 plan, Ohio allows you to carry forward the excess indefinitely. You can deduct these contributions in future tax years until the entire contribution has been deducted.

Example: It’s 2025 and you plan to retire next year and know that your high income will drop when your employment ends. To increase your retirement tax savings, you contribute $19,000 to your adult child’s 529 plan, staying under the gift tax return limit. On your 2025 Ohio tax return you would be able to deduct $4,000 of your $19,000 and carry the remaining $15,000 forward to be deducted over the next 4 years.

This strategy lets you front-load your 529 plan college savings while you have excess cash. You can then take advantage of the tax deduction over several years, helping to manage your state income tax more effectively.

3. End-of-Year Planning Tool

The Ohio 529 deduction can be an effective end-of-year tax planning tool. If you anticipate a high state income tax bill, making a last-minute contribution to a 529 plan before year-end can help reduce your Ohio taxable income for that income tax year. The deductible contribution deadline varies per state but is December 31st in Ohio.

Be sure to coordinate with your tax professional and your financial advisor to avoid unnecessary tax consequences as you make these year end planning decisions.

Common Misunderstandings

Here are a few common misunderstandings about the Ohio 529 deduction:

Federal vs. State Tax Benefits: |

The Ohio 529 tax deduction is for your Ohio state income tax only, not your federal income tax. While 529 plans offer federal tax benefits (tax-deferred growth and tax-free withdrawals for qualified higher education expenses), the income tax deduction for contributions is state-specific. There are currently no federal income tax deductions for 529 contributions. |

Contribution vs. Deduction Limits: |

You can generally contribute any amount to a 529 plan, but the maximum amount you can deduct on your Ohio income taxes is $4,000 per beneficiary, per year. Any contributions above this amount can be carried forward indefinitely to future years for tax deduction purposes. |

Qualified Education Expenses vs Other Expenses: |

Funds from a 529 plan can be used tax-free (federal income tax and state income tax) for a wide range of qualified higher education expenses, including tuition, fees, books, supplies, equipment, and room and board for students enrolled at least half-time at an eligible educational institution. They can also be used for K-12 tuition expenses, up to $10,000 per year. Other qualified education expenses for 529 plans also include costs associated with apprenticeship programs registered and certified by the Secretary of Labor under the National Apprenticeship Act, and to pay principal and interest on certain qualified student loans. Consult your tax professional and financial advisor if a school counts as an eligible educational institution. |

The Ohio 529 Plan vs. Other 529 Plans: |

Beginning with tax year 2023, contributions to any state’s 529 plan are eligible for the Ohio tax deduction. It’s important to note that a “non qualified” rollover or withdrawal from the Ohio 529 plan may be subject to recapture of any Ohio state income tax deductions claimed in prior years. Be sure to work with your tax professional and financial advisor to avoid unexpected tax consequences. |

Final Thoughts: Use a 529 Plan as a Tax Strategy, Not Just a College Plan

For many Ohio taxpayers, particularly those who have been diligent savers and are looking ahead to retirement, a 529 plan can be more than just a way to pay for college. A 529 plan features federal tax benefits (tax-deferred growth and tax-free withdrawals for qualified education expenses) and an Ohio state tax deduction.

By understanding how the state income tax deduction works, you can maximize your tax savings while also helping to support your children and grandchildren.

Benefits of Expert Advice

Navigating tax laws and education savings investment strategies can be complicated. A financial advisor specializing in tax planning, along with your CPA, can help you understand how the Ohio 529 deduction fits into your financial plan. They can work with you to integrate 529 contributions with your current retirement plan and help you to take advantage of as many federal tax benefits and state tax savings as possible.

Ohio’s 529 Plan customer service can answer basic questions, but they can’t offer investment or tax advice. A knowledgeable financial advisor can provide the personalized investment guidance you need for your college savings and coordinate with your CPA to maximize your income tax planning.

Looking for Tax and Financial Planning Help? Discover How Stage Ready Financial Planning Can Help You

At Stage Ready Financial Planning, we understand the financial goals and concerns of retirement savers over age 50 in Dayton & Southern Ohio. We specialize in helping taxpayers like you ensure their investments (including 529 savings) are set up correctly for their goals and to pay less in income tax over the course of retirement.

If you’re looking for personalized tax and financial planning to help you successfully retire and live your ideal lifestyle, we’re here to help. Click here to schedule your intro call today!

Frequently Asked Questions (FAQs)

Are 529 contributions tax deductible in Ohio?

As an Ohio taxpayer, contributions to any state’s 529 plan are tax deductible on your Ohio state income tax return. You can deduct contributions up to $4,000 per beneficiary, per year. You can carry excess contributions forward for deductions in future years.

The 529 plan tax deduction is exclusive to your Ohio state income taxes, not your federal income taxes. Be sure to consult your tax professional and financial advisor to avoid negative tax consequences as you plan your contributions and deductions.

How much can I deduct on my Ohio taxes for 529 contributions?

You can deduct contributions up to $4,000 per beneficiary, per year, on your Ohio state income tax return. If you contribute more than this amount in a year to any 529 plan, you can carry forward the excess contributions to deduct contributions in future tax years. Consult your tax professional and financial advisor to make sure you are taking full advantage of your deductible contributions.

Can I contribute to multiple 529 plans and still get the deduction?

Yes, you can contribute to multiple 529 plans for different beneficiaries and claim the tax deduction for each. You can claim a deduction for contributions up to $4,000 per beneficiary, per year.

“Bunching contributions” and can be a great way to boost your tax savings. Your tax professional and financial advisor can guide you on the complexities of contributing to multiple 529 plans.

What is the cut-off for 529 contributions?

To claim the Ohio state income tax deduction for a given tax year, contributions to a 529 plan must generally be made by December 31st. Some states allow contributions up to the income tax filing deadline. If you aren’t sure about your state’s contribution rules, consult your tax professional and financial advisor.

Do I have to be the account owner to deduct 529 contributions?

No, you don’t have to be the account owner on a 529 plan to deduct your contributions from your Ohio taxable income. This makes it easy for family members like grandparents to take advantage of the tax deduction in retirement. Whether you are the account owner or not, be sure to keep records and receipts of your contributions to validate your deduction.

About the Author

As a financial planner at Stage Ready Financial Planning, Joseph A. Eck, CFP®, understands that for Ohioans diligently saving for retirement, minimizing taxes is just as important as growing their investments. He specializes in helping retirement savers in Dayton and Southwest Ohio leverage smart strategies, including the Ohio 529 plan tax deduction, to reduce their state income tax burden. He’s committed to helping you pay less in income tax and secure the retirement you’ve been hoping for. Click here to learn more about Joseph.

Article References

- Ohio’s 529 Plan: Mutual Fund Based Plans – CollegeAdvantage. https://www.collegeadvantage.com/plans/mutual-fund-based-plans

- General and Tax Questions – CollegeAdvantage. https://www.collegeadvantage.com/faq/general-and-tax-questions

- Learn About Ohio’s 529 Plan – CollegeAdvantage. https://www.collegeadvantage.com/learn-about-ohios-529-plan

- Ohio’s 529 Plan, CollegeAdvantage Review – SavingForCollege.com. https://www.savingforcollege.com/529_plan_details/ohio-s-529-plan-collegeadvantage

- BlackRock CollegeAdvantage Advisor 529 Savings Plan – SavingForCollege.com. https://www.savingforcollege.com/529_plan_details/ohio/blackrock-collegeadvantage-advisor-529-savings-plan

- Plan Your Ohio 529 – CollegeAdvantage. https://www.collegeadvantage.com/plan-your-ohio-529

- Ohio (OH) 529 College Savings Plans – SavingForCollege.com. https://www.savingforcollege.com/529-plans/ohio

- Income – 529 Plan Account Deduction (Ohio Department of Taxation FAQ) – Ohio Department of Taxation. https://tax.ohio.gov/help-center/faqs/income-529-plan-account-deduction/income-529-plan-account-deduction

- Ohio Revised Code Section 5747.70 – Ohio Laws and Rules. https://codes.ohio.gov/ohio-revised-code/section-5747.70

- Happy New Year from Ohio 529 (2024 Tax Deadline Reminder) – CollegeAdvantage Blog. https://www.collegeadvantage.com/blog/blog-detail/posts/2024/12/30/happy-new-year-from-ohio-529

- 529 Plans: Questions and Answers – Internal Revenue Service (IRS). https://www.irs.gov/newsroom/529-plans-questions-and-answers

- Apprenticeship Job Finder – Apprenticeship.gov. https://www.apprenticeship.gov/apprenticeship-job-finder

- Unique Non-Qualified Withdrawals Lead to Unique Exceptions – CollegeAdvantage Blog. https://www.collegeadvantage.com/blog/blog-detail/posts/2023/10/10/unique-non-qualified-withdrawals-lead-to-unique-exceptions

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.