You’ve saved and planned for a comfortable retirement and now you want to enjoy your money for as long as possible. Unfortunately, paying for care later in life can be incredibly expensive. And if you are like most retirees, you probably don’t want to see your money significantly reduced by unexpected long-term care costs. To protect your money from these long-term care expenses, you might be tempted to give your assets to your family instead. But if you don’t know the specific Medicaid gifting rules, this strategy can seriously backfire. You could then face unexpected penalties and significant delays in getting the Medicaid coverage you need.

In this article, we’ll discuss the specific Medicaid gifting rules that you need to know to potentially protect the assets you’ve worked so hard to save without jeopardizing your care.

Key Takeaways

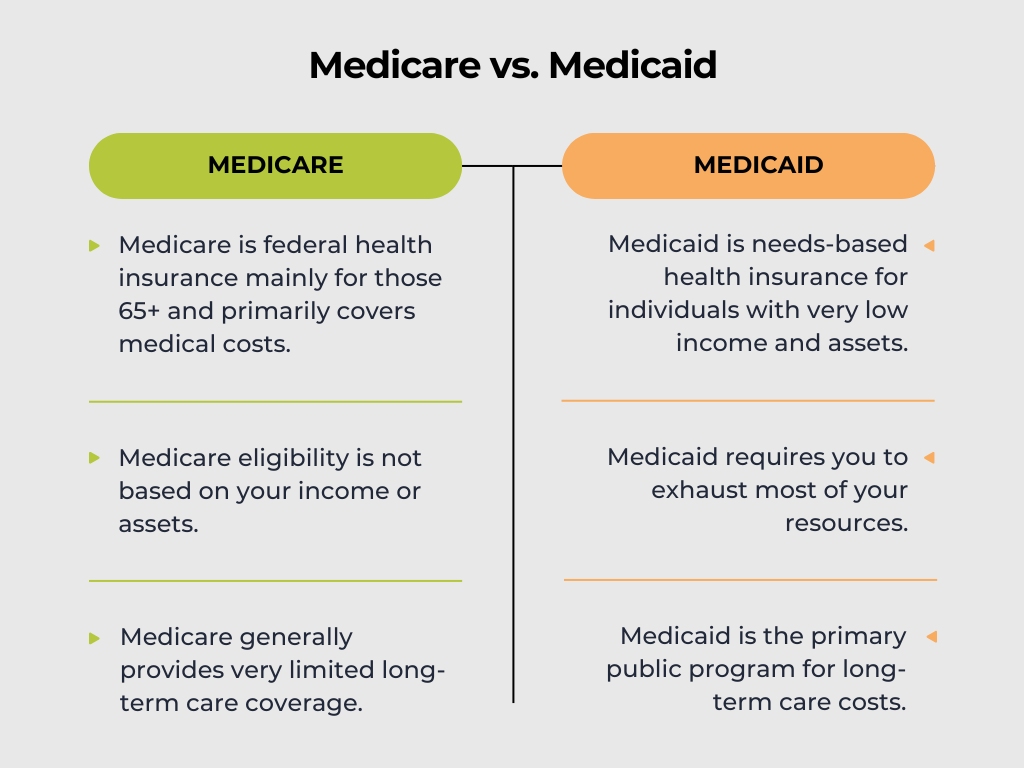

- Medicaid vs. Medicare: Know the Difference. Medicaid is a needs-based government health program for those with limited income and assets, that can help cover the cost of long-term care. Medicare, in contrast, is health insurance mainly for individuals over 65, regardless of wealth.

- The 5-Year Look-Back is Critical for Gifting. Medicaid examines asset transfers made within five years of your application. Gifting during this “Look-Back Period” can result in a penalty period of ineligibility for Medicaid benefits.

- IRS Gift Tax Rules Don’t Affect Medicaid. A gift that’s tax-free by the IRS can still lead to Medicaid ineligibility. Proper Medicaid planning, especially involving asset transfers, demands proactive strategies and guidance from financial and legal professionals.

What Exactly Is Medicaid?

The Medicaid program is a joint federal and state government health insurance program. It’s designed to provide healthcare coverage for individuals with very low income and assets. It’s often the primary public program that can help cover the costs of long-term care. This includes care in a nursing home when you run out of money.

Medicaid is sometimes confused with Medicare, which is the government health insurance program for individuals over age 65. Medicaid, on the other hand, is specifically designed to assist those who need help managing healthcare expenses once most of their resources have been exhausted.

For a Medicaid applicant to qualify, they must meet specific financial Medicaid eligibility requirements. Individuals over age 65, seeking long-term care coverage via Medicaid in Ohio, can typically only have around $2,000 or less in assets and generally have very limited monthly income. For those with income above the standard Medicaid limits, Ohio offers options like using Qualified Income Trusts (QITs) to help meet the various program eligibility requirements. Be sure to reference Medicaid.ohio.gov for more information.

Why Does Gifting Matter When Applying for Medicaid?

To qualify for government assistance for long-term care costs, there are strict Medicaid rules about your assets and income. If you’ve recently given away money, whether to family members or others, Medicaid can deny or delay your coverage. In Ohio and in many states, Medicaid examines your gifting dating back 5 years from your application. This is called a “Look-Back Period.”

Medicaid’s primary concern is that you might transfer assets to your family and friends solely to qualify for assistance, instead of paying for your own care when you have the means. This is why understanding the “Medicaid gifting rules” is so important. You want to make sure your financial planning aligns with the guidelines. This way, you aren’t caught off guard when you need Medicaid assistance most.

Understanding the Medicaid Look-Back Period

What Is the Look-Back Period?

Think of the Medicaid look-back period as a financial magnifying glass. When you submit a Medicaid application to cover long-term care services, the state will review your financial transactions for a specific period.

The Ohio Administrative Code, Rule 5160:1-6-06, explains that this look-back period is the 60 months, or 5 years prior to your Medicaid application date. Medicaid will examine all of the asset transfers you’ve made during those five years. An asset transfer includes gifts or transfers of property for less than their fair market value.

What Happens If You Gift During This Period?

If Medicaid discovers that you’ve made gifts or transferred assets for below market value during the 60-month look-back period, it doesn’t automatically disqualify you from Medicaid forever. Instead, they impose what’s called a “penalty period,” also known as a Divestment Penalty Period. This is a determined amount of time where you’d be ineligible for Medicaid benefits.

The length of your penalty period is typically calculated by dividing the total amount of asset transfers in the look-back period by the average cost of nursing home care in your state. Essentially, Medicaid determines how many months that gifted money would have paid for your care. That’s how long you’re ineligible.

When Does Medicaid Count as a Gift?

This is where it gets a little murky. A “gift” in the eyes of Medicaid is broader than you might think.

Common Examples

Medicaid generally considers any transfer of assets for less than fair market value as a gift. There are many exceptions and carveouts, especially for an applicant’s spouse. Some basic examples include:

- Cash Gifts: Direct monetary gifts to family members or friends for any reason, including holidays and birthdays.

- Property Asset Transfers: Selling or giving your home or other real estate assets to a loved one for significantly less than its fair market value. There can be exceptions here for title transfers to an applicant’s spouse or caretaker.

- Transferring Titles: This means putting bank accounts, investment accounts, or vehicle titles into someone else’s name. This applies when you don’t receive equal fair market payment in return.

- Payments For Services: Paying a family member for caregiving services without a legal contract and proof of services rendered at a fair market rate.

- Adding Names to Deeds or Accounts: Even adding an adult child to your bank account or home deed can be seen as a gift if they didn’t contribute equally.

Gift Tax Exclusion Doesn’t Equal Medicaid Exemption

Here’s a common point of confusion, especially if you are mindful of tax laws. The IRS’s annual gift tax exclusion is completely separate from the Medicaid gifting rules.

IRS vs. Medicaid

You might be aware that the IRS allows you to give a certain amount each year without having to file a gift tax return. In 2025, the IRS annual gift tax exclusion is $19,000 per person, meaning you can give this amount to as many people as you choose without having to file a gift tax return. If you are married, you each can give $19,000 to an individual or $38,000 as a couple.

Even if you give more than those amounts in a calendar year, you likely still won’t have to pay gift taxes. You simply have to file a gift tax return. In 2025, the IRS allows you a lifetime gifting exclusion amount of $13,990,000 per person or $27,980,000 per couple. Any gifts over $19,000 per person get subtracted from your $13,990,000 lifetime exclusion amount. If you gift more than that amount over the course of your life, then taxes may apply.

You might assume that if a gift falls under the federal gift tax exemption, it’s also exempt from Medicaid’s gifting look-back rules. Unfortunately this is not the case. The IRS and Medicaid are two different organizations with different objectives. The IRS is concerned with taxation and whether you need to file a gift tax return. Medicaid is concerned with determining your financial eligibility and need for low-income healthcare assistance.

Even if a gift doesn’t require you to file a gift tax return, it doesn’t mean it won’t be considered a disqualifying transfer by Medicaid. Generally speaking, every dollar you give during the look-back period can potentially trigger a penalty period for Medicaid eligibility. This applies regardless of the gift tax implications.

How Medicaid Calculates the Penalty Period

The penalty period length is directly tied to the value of the gifts you made during the look-back period. Here’s a closer look at the calculation:

- Total Value of Gifts: Medicaid sums up all the assets transferred for less than fair market value during the 5-year look-back period.

- State’s Average Nursing Home Cost: Each state determines a daily or monthly “divisor.” This “divisor” represents the average cost of nursing home care within that state. The American Council on Aging states that Ohio’s 2025 average nursing home cost is $7,787 per month.

- The Basic Calculation: The total value of the gifts made is divided by the state’s average monthly nursing home cost. The result is the number of months you’ll be ineligible for Medicaid benefits in the form of a penalty period. The penalty period starts when the Medicaid applicant would otherwise be eligible. It doesn’t necessarily start when the gift was made.

Example: Let’s say you applied for Medicaid on January 1, 2025 and you gifted $100,000 to an adult child on January 1 of 2023. If the average monthly cost of nursing home care in Ohio is $7,787, your penalty period of Medicaid ineligibility would be 12.84 months. The calculation is $100,000 / $7,787 = 12.84. During those months, you would have to find another way to pay for your long-term care.

Are There Any Exceptions to the Gifting Rules?

Medicaid assigns a caseworker when you apply to help you sort through all of the various factors that could impact your eligibility. Medicaid’s gifting rules are usually strict. However, there are a number of potential exceptions where asset transfers might not trigger a penalty period. Here are some common examples:

- Transfers to a Community Spouse: Asset transfers to an applicant’s spouse (known as your “community spouse”) can usually occur without a penalty. This is allowed to ensure they have enough resources to live on.

- Transfers to a Disabled Child: Assets can often be transferred to a child who is legally blind or permanently disabled without incurring a penalty period. In Ohio, the definition of legally blind or permanently disabled must align with Section 1614 of the Social Security Act.

- Transfers to a Caretaker Child: If an adult child has lived with the parent for at least two years immediately before the parent moved to a nursing home, assets can sometimes be transferred to that adult child without a penalty period. This is true if that child provided care that delayed the parent’s need for nursing home care. Proper documentation is needed.

- Transfers into Specific Trusts: Certain types of irrevocable special needs trusts or pooled trusts may allow assets to be protected without a penalty period if established correctly and well in advance of a Medicaid application. In Ohio, it’s common to use a Qualified Income Trust (QIT) to help individuals meet the income eligibility requirements for Medicaid, but this is distinct from avoiding asset transfer penalties. These trusts are highly complex and require expert legal guidance.

- Fair Market Value Transfers: If you sold an asset and received its fair market value in return, it’s not considered a gift for Medicaid.

These exception examples are interpreted very narrowly by Medicaid and your assigned caseworker. Attempting to utilize them without legal or tax advice can lead to significant problems including Medicaid ineligibility.

Can You Still Do Medicaid Planning with Gifts?

Potentially yes, but it requires careful, proactive, and knowledgeable planning. Asset protection starts by understanding your state’s look-back period and beginning your planning well in advance of a potential need for long-term care. Gifting more than five years before you anticipate needing Medicaid benefits is generally the safest approach.

If you anticipate a future need for Medicaid coverage, be sure to speak to a knowledgeable elder care attorney and Medicaid case manager.

Why Work with a Financial Advisor for Medicaid Planning?

Navigating the complexities of your state’s Medicaid laws can feel overwhelming. You don’t just need to learn the Medicaid rules. You also need to structure your finances to align with your retirement goals while considering potential significant healthcare needs. A fee-only financial advisor, like Stage Ready Financial Planning, can help you:

- Understand Your Options: We will help you project the impact of a long-term care event on your retirement plan. We’ll explain how different asset transfer strategies might impact Medicaid eligibility.

- Work With Your Attorneys: We collaborate with legal professionals specializing in elder Medicaid law to ensure all of your asset transfer strategies are done legally.

- Protect Your Assets: We strive to help you make decisions that safeguard your hard-earned savings.

Make the Most of Medicaid and Your Financial Future with Stage Ready Financial Planning

Planning for retirement means looking at the big picture. This includes your investments, your taxes, and even potential nursing home costs.

At Stage Ready Financial Planning, we understand the concerns of retirement savers over age 50 in Southern Ohio. We believe in clear and actionable advice that helps you feel confident about your retirement plan. Our goal is to help you protect the assets you’ve worked so hard for.

If you’re wondering how gifting might affect your resources for a long-term care event, we invite you to connect with us. Let’s work together to make sure you are READY to live your best retirement STAGE of life. Schedule your intro call today!

Frequently Asked Questions (FAQs)

What is the gift rule for Medicaid?

The “gift rule” for Medicaid refers to the policy that any assets transferred for less than fair market value within your state’s “look-back period” before submitting a Medicaid application for long-term care can result in a penalty period of Medicaid ineligibility.

How do I avoid the Medicaid 5-year look-back?

The most straightforward way to avoid the Medicaid 5-year look-back and potential penalty period is to finish any asset transfers or gifting more than five years before you anticipate needing to apply for Medicaid benefits.

Additional options might include establishing certain types of irrevocable trusts. These are complex and require legal guidance. You might also explore common exceptions like transfers to an applicant’s spouse or a disabled child. Proactive planning with your financial advisor and a knowledgeable elder Medicaid law attorney is extremely important.

What are the asset limits for Medicaid in Ohio?

Medicaid asset limits vary by state. They also depend on the specific Medicaid program you are applying for. For individuals seeking long-term care Medicaid in Ohio, the asset limit for the Medicaid applicant is generally quite low (e.g., $2,000 for a single individual). However, there are Medicaid rules to protect assets for an applicant’s spouse, also known as a “community spouse.”

The asset and income limits can change. Therefore, it’s important to consult current Ohio Medicaid guidelines or a qualified attorney regarding your Medicaid eligibility. Other great resources on Medicaid planning include:

- The American Council on Aging

- Ohio Department of Aging

- National Academy of Elder Law Attorneys (NAELA) Ohio Chapter

- AARP Ohio

How much can you give someone tax free in Ohio?

The amount you can give someone “tax-free” refers to the federal gift tax exemption. This exemption is set by the IRS, not by the state of Ohio. For 2025, this amount is $19,000 per recipient per year. This means you can give up to $19,000 to as many individuals as you wish in a calendar year without incurring federal gift tax or needing to file a gift tax return.

This IRS rule is separate from and does not exempt gifts from Medicaid’s look-back period. So, while you might not file a gift tax return, a gift in the 5-year look-back period can still negatively impact your Medicaid eligibility.

About the Author

Joseph A. Eck, CFP®, is a financial planner dedicated to helping retirement savers achieve their financial goals and plan how to handle potential long-term care costs. With years of experience in retirement planning and navigating complex topics like the Medicaid gifting rules, Joseph provides personalized guidance and support to clients in Dayton and Southwest Ohio. He believes that everyone deserves to feel confident living their ideal retirement with an investment portfolio built to last. Click here to learn more about Joseph.

Article References

- “Who Qualifies,” Ohio Department of Medicaid, medicaid.ohio.gov: https://medicaid.ohio.gov/families-and-individuals/coverage/who-qualifies/who-qualifies

- “Aged, Blind, or Disabled Individuals,” Ohio Department of Medicaid, medicaid.ohio.gov: https://dam.assets.ohio.gov/image/upload/medicaid.ohio.gov/Families%2C%20Individuals/Programs/whoQualifies/Aged_Blind_Disabled_Individuals.pdf

- “Ohio Department of Medicaid,” Ohio Department of Medicaid, medicaid.ohio.gov: http://Medicaid.ohio.gov

- “Rule 5160:1-6-06,” Ohio Administrative Code, codes.ohio.gov: https://codes.ohio.gov/ohio-administrative-code/rule-5160:1-6-06

- “Penalty Period Divisor,” MedicaidPlanningAssistance.org, medicaidplanningassistance.org: https://www.medicaidplanningassistance.org/penalty-period-divisor/

- “Gifts & Inheritances: FAQs,” Internal Revenue Service, irs.gov: https://www.irs.gov/faqs/interest-dividends-other-types-of-income/gifts-inheritances/gifts-inheritances-1

- “What’s New – Estate and Gift Tax,” Internal Revenue Service, irs.gov: https://www.irs.gov/businesses/small-businesses-self-employed/whats-new-estate-and-gift-tax

- “Title XVI – Part B – 1614 (42 U.S.C. 1382c),” Social Security Administration, ssa.gov: https://www.ssa.gov/OP_Home/ssact/title16b/1614.htm

- “Rule 5160:1-3-05.2,” Ohio Administrative Code, codes.ohio.gov: https://codes.ohio.gov/ohio-administrative-code/rule-5160:1-3-05.2

- “Ohio Department of Aging,” aging.ohio.gov: https://aging.ohio.gov/

- “Ohio Chapter,” National Academy of Elder Law Attorneys, ohionaela.org: https://ohionaela.org/

- “Ohio,” AARP, states.aarp.org: https://states.aarp.org/ohio/

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.