You’ve built a life, a career, and maybe even a family. You’ve worked hard, saved where you could, but as you look at your investments and the looming question of retirement, do you feel a sense of clarity or a knot of uncertainty?

Many people approach their financial lives without a clear roadmap. They make decisions in isolation, reacting to the market or the latest financial news, instead of following an intentional plan. Sadly, reacting can lead to missed opportunities, unnecessary risks, and a constant worry that you’re not doing enough.

But what if you could change that? What if you could move from a state of anxiety to one of confidence? This is the promise of financial planning. Planning is not just about projecting numbers. Done right, it’s about aligning your money with what you really care about, turning your financial hopes into an actionable plan.

This article will pull back the curtain on financial planning, revealing what it is, why it’s important, and the specific steps involved in building a secure financial future. By the end, you’ll understand why this process isn’t just for the wealthy. Financial planning is for anyone who wants to take control of their future and retire with confidence.

Key Takeaways

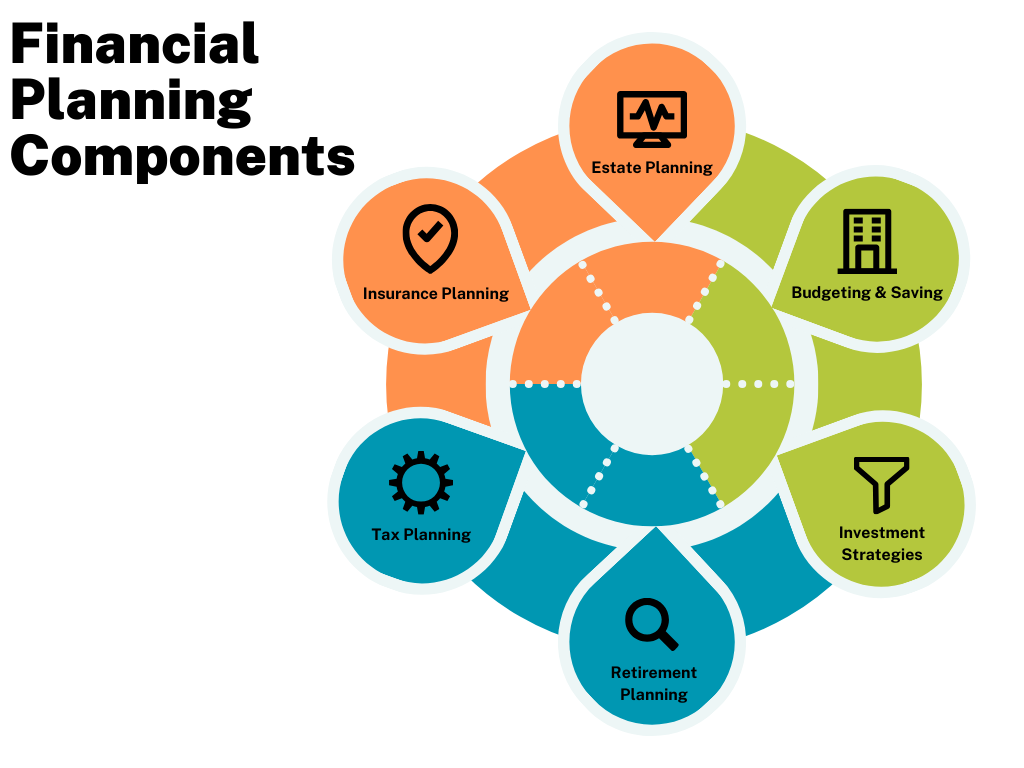

- Financial Planning is a Comprehensive Roadmap: It goes beyond simple budgeting to include investment strategies, retirement planning, tax planning, insurance, and estate planning. It’s the process of aligning your money with your life.

- A Financial Plan is a Living Document: It’s best done not as a one-time event, but an ongoing process that starts with understanding your current situation, setting clear goals, and creating an actionable plan. Regular monitoring and adjustments are the most important part as your life and goals evolve.

- The Right Expertise Matters: There are different types of financial advisors, including fee-only, fee-based, and commission-based. Understanding these models is your path to finding a professional that will always act in your best interest, minimizing conflicts of interest and provide objective advice.

What Exactly Is Financial Planning?

Have you ever wondered if you’re on track to achieve your financial goals, or if there’s more you could be doing with your money? Financial planning is all about figuring out where you are today, where you want to go, and creating a roadmap to get there.

Here are the topics that you might see included in financial planning services:

- Budgeting & Saving

- Investment Strategies

- Retirement Planning

- Tax Planning

- Insurance Planning

- Estate Planning

- And more

What Is a Financial Plan?

Sometimes, a financial plan can look like building a roadmap for your money. Alternatively, a financial plan might look like a list of action items to better align your money with your financial goals.

A solid financial plan should show you where you are now, where you want to go, and the best way to get there. Learn more about what Stage Ready Financial Planning includes in your plan: Here.

Why Is Financial Planning Important?

Planning is important because it helps you take control of your money. By creating awareness, planning helps you to make informed decisions.

A strong plan can provide you with peace of mind knowing that you’ve been intentional with your money.

Wondering what your financial plan should look like? Schedule your intro call today with Stage Ready Financial Planning to learn more!

What Does Financial Planning Include?

Budgeting and Saving

Budgeting and Saving

Also known as cash flow planning, budgeting means making a plan for how you’d prefer to spend and allocate your money. The process of building a budget and sticking to it can be eye opening.

Spending and savings goals in a financial plan often include:

- Building a healthy emergency fund to protect yourself against unexpected expenses

- Achieving goals such as buying a new car, a new home, or taking a vacation

- Securing your future by having enough savings to live on in retirement

Investment Strategies

These are the different ways of growing your money by investing in assets like stocks, bonds, or exchange traded funds (ETFs). Investment strategies are tailored approaches to grow your wealth over time.

Your portfolio should match your:

- Risk Tolerance – Your mental comfort with taking risk

- Risk Capacity – How much risk you can actually afford to take to reach your goals

Diversifying your investments can help you reduce risk. It can also increase the likelihood that your returns will match what you need to achieve your goals. For instance, younger investors might focus on high-growth stocks, while retirees may prefer more conservative options like bonds.

It’s always important to remember that investing involves risk. Plan carefully and be sure to speak with an expert about your particular situation.

Retirement Planning

The process of retirement planning usually begins by painting a vision of what you would like life to look like. Then you start estimating your retirement expenses based on your ideal future.

Once you know how much income you need, you can adjust your investments accordingly. This will also help you figure out the right timing for drawing pensions and your Social Security benefits.

Tax Planning

A common goal for retirees is to minimize the amount of taxes due in retirement. Tax planning involves structuring your money to minimize your tax liabilities. For example, contributing to a retirement account like a Traditional IRA can lower your taxable income.

Common tax planning strategies include:

- Choosing tax-efficient investment vehicles

- Tax-efficient investment withdrawals

- Timing income and expenses to lower your bracket

- Savings through contributions to tax deferred accounts,

- Converting your pre-tax investments to Roth

- Qualified Charitable Distributions (QCD) from pre-tax accounts

- And more

Insurance Planning

Also referred to as risk management, this type of planning focuses on protecting you and your loved ones from financial loss.

Insurance planning usually includes assessing your:

- Life Insurance

- Health Insurance

- Disability Insurance

- Property & Casualty Insurance

- Long-Term Care Insurance

Having adequate insurance coverage can provide you with peace of mind.

Estate Planning

This form of planning helps ensure that your assets go to the people you want after you’re gone.

It commonly involves:

- Creating a will

- Naming or updating beneficiaries on accounts that bypass your will

- Setting up trusts to control the timing and method of your estate plan delivery

- Updating your durable and medical power of attorney documents and living will directives

If you have a large estate, this type of planning can help you minimize potential estate tax costs.

What Are the Steps in Financial Planning?

1. Understanding Your Personal & Financial Circumstances

The first step in financial planning is to get a clear picture of your financial situation. It starts by creating a balance sheet and statement of cash flow.

The initial planning process also usually includes documenting all of your current investments, insurances, and estate documents.

2. Identify & Set Goals

The next step in financial planning is to help you identify and set clear financial goals. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

Client goals often include:

- Saving for retirement,

- Buying a new house,

- Paying off high interest debts including credit cards,

- Building an emergency fund

- Paying less in taxes

- Growing investments

- And more

3. Analyze Potential Recommendations & Courses of Action

Analysis is an essential part of the financial planning process. It allows your financial advisor to test scenarios with your current financial strategies.

Your advisor will be trying to determine what adjustments need to be made to help reach your goals.

4. Developing Financial Planning Recommendations

Creating a financial plan can involve recommendations in only certain topic areas or creating a comprehensive financial plan.

Experienced advisors know that things will change over the course of your life. Recommendations are usually focused on the near term actions that will help you move closer to where you want to be. It’s important for planning to be flexible and account for possible changes as your life evolves.

5. Presenting the Financial Planning Recommendations

Once the recommendations are developed, your financial advisor will present your financial plan. They will collaborate with you on finalizing your next action steps.

Some advisors prefer to pre-determine your planning recommendations and provide them as a set of deliverables. Other advisors prefer to provide clients options and collaborate on recommendations live in the client delivery meeting.

6. Implement the Financial Plan

Putting your financial plan into action is the most important part of the process.

It often means taking steps such as:

- Opening and updating your investment accounts

- Purchasing needed insurances

- Adjusting your spending & savings habits

- Establishing or updating your estate documents

- And more

7. Monitor and Adjust

Financial planning is an ongoing process. Reviewing and adjusting your financial plan regularly ensures it stays relevant and effective.

Your financial situation and goals will likely change over time, so it’s important to annually update your plan.

Why Is It Worth It to Have a Professional Financial Planner?

A professional financial planner provides you with expertise and personalized advice. As an outsider looking into your life, they can offer objective guidance and help you navigate complex financial matters.

Types of Financial Planning Help

Fee-Only Advisors

This is an advisory service where the advisor is compensated solely by you, the client. The fee-only compensation model aims to minimize conflicts of interest.

Fee-only advisors are paid directly by you and they do not receive commissions, improving the likelihood that you receive objective advice.

Fee-only financial planners typically charge:

- An hourly rate

- A flat fee or annual retainer

- Or a percentage of assets under management (AUM) deducted from your investment accounts

These financial advisors commonly offer both financial planning and investment management services. Individuals who are fee-only and also CERTIFIED FINANCIAL PLANNER® professionals are held to the highest fiduciary standard in the industry.

Fee-Based Advisors

These advisors charge a mix of fees for financial planning and also have the ability to receive commissions from selling financial products.

Because fee-based financial advisors can get paid by selling you products, you should pay attention to advice recommending the purchase of large insurance policies or products. It’s possible that these recommendations are legitimate, but be sure to ask lots of questions to understand their rationale.

Commission-Based Advisors

These advisors earn money exclusively from the financial products they sell. Products include insurance policies, investment products, and loan products. These advisors do not work as fiduciaries.

The client does not pay the advisor directly. The advisor is paid by the companies whose products they sell. This often means the client is paying internal product fees that indirectly compensate the advisor.

Learn More about Financial Planning (and Why It’s Worth It for You) by Contacting Us Today

At Stage Ready Financial Planning, we specialize in fee-only financial planning for individuals and couples over age 50 in Dayton & Southwest, Ohio.

We help you create a clear and easy to understand plan so that you can retire with confidence and afford your dream lifestyle. Schedule your intro call today!

FAQs

What is the main purpose of financial planning?

The main purpose of financial planning is to help you organize and align your financial life with what matters most. It helps you make informed decisions about your money. Financial planning puts you in the driver’s seat instead of the passenger’s seat.

What exactly does a financial planner do?

A planner helps you create a customized financial plan to achieve your financial goals. They offer advice on all areas of your financial life including help with retirement planning, investment planning, risk management, estate planning, and more.

About the Author

Joseph A. Eck, CFP®, is a financial planner committed to helping people create a holistic vision for their retirement. He understands that where you live significantly affects your overall retirement satisfaction and financial well-being. With extensive experience in retirement planning, Joseph offers personalized guidance and support to clients in Dayton and Southwest Ohio. He empowers retirement savers to achieve their financial goals and build a fulfilling life in their ideal Ohio community. Click here to learn more about Joseph.

Article References

- https://www.cfp.net

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.