Thinking about retirement and wondering if your nest egg is ready to support the lifestyle you're looking forward to? Or maybe you're already retired but sometimes second-guess your current investment strategy? If you've been managing your own savings and haven't worked with a professional before, you might also find yourself asking: "What exactly is investment management?"

If that question sounds familiar, or even if you're simply curious about how professional guidance works, this guide is designed to bring clarity. We'll explain how professional investment management works, what it involves, focusing specifically on how it aims to align your savings with what matters most to you and create reliable income possibilities – helping you feel more secure about your retirement.

Key Takeaways

- Align Your Investments with Your Retirement Vision - Think of investment management as tailoring your financial strategy. An investment manager will help ensure your portfolio is specifically designed to support your ideal retirement. They accomplish this by matching a strategy to your comfort level with market swings, and fit your timeline for needing the funds.

- Benefit from Ongoing Professional Guidance - Partnering with an investment professional, like a CFP® professional, means you're not alone. You have an expert continuously watching over your portfolio, making adjustments as needed, and applying key strategies like asset allocation and risk management to help keep your retirement plan on track.

- Make Informed Choices About Your Advisor - Choosing who manages your hard-earned money is a big decision. Make sure you really understand your costs and use official resources like BrokerCheck and IAPD to confirm you're partnering with a qualified professional committed to your best interests. Keep in mind that no one can guarantee market performance or help you dodge market downturns.

What Is Investment Management?

For the purpose of this article, we are going to discuss investment management services that are offered to you, the individual investor. An entirely different discussion can be had about how investment management firms offer services to corporations or institutions.

Investment management in this context refers to the service of buying, selling securities with the goal of achieving specific investment outcomes. The most common financial securities used in investment management are stocks, bonds, real estate holdings, mutual funds, and exchange traded funds (ETFs).

Professional investment managers will help you select an investment strategy that aligns with your:

- Risk tolerance - your comfort with risk

- Goals - what you want to achieve

- Investment time horizon - how soon you might need to spend your invested savings

An investment advisor works to make sure that your portfolio is aligned your goals and earns an appropriate rate of return. As your life evolves, they will adjust your strategy as necessary to respond to market conditions and your changing needs.

How Does Investment Management Work?

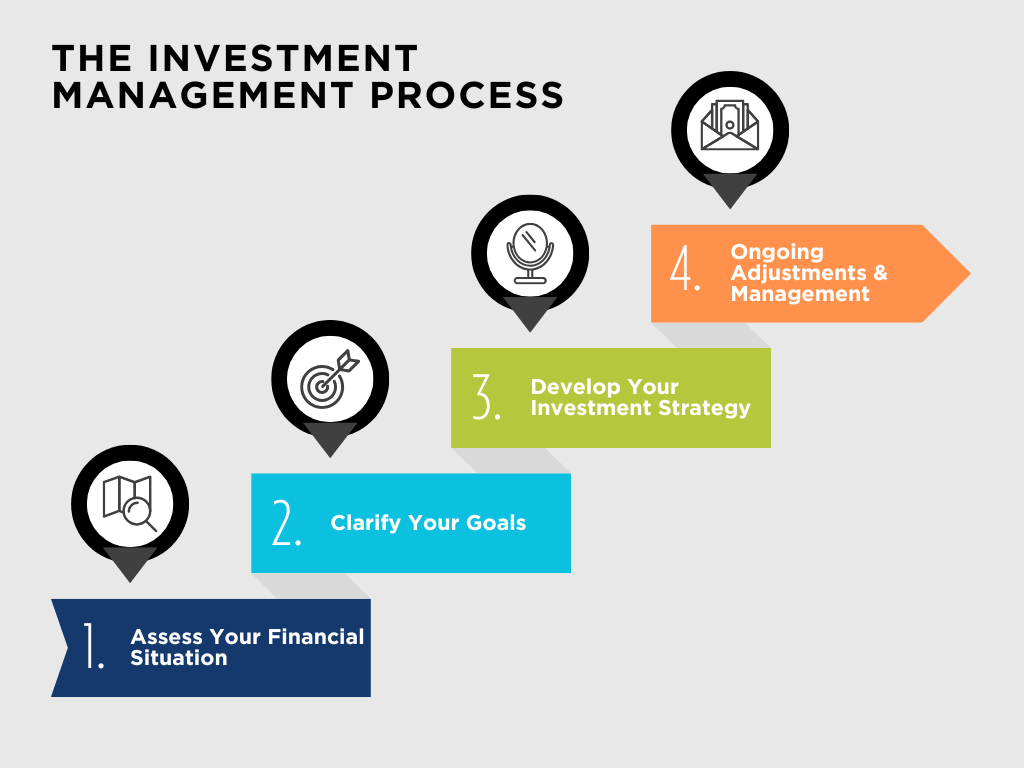

Client-facing investment management typically involves these key steps:

-

Assess Your Financial Situation

This step involves your advisor gathering comprehensive information about your current financial situation. Data gathering helps your investment manager understand how much risk is appropriate or suitable for you.

-

Clarify Your Goals

Investment advisors, specifically those who have financial planning expertise, such as CERTIFIED FINANCIAL PLANNER™ (CFP®) professionals, will work with you to identify and outline your goals.

Maybe your goals include saving to buy a new home or saving for retirement planning. The time horizon of your goals (how soon you will need to spend your savings) will guide the risk profile of the investment strategy your advisor selects.

-

Develop Your Investment Strategy

An investment manager develops a strategy for you that takes into account your risk tolerance, time horizon, and financial goals. The investment manager uses this information to determine your target asset allocation. They will then select the specific securities that they feel match your target asset allocation in order to reduce any unnecessary risks while maintaining an appropriate return.

Example: If you have a low risk tolerance and a short time horizon, an investment manager might recommend a portfolio with a higher allocation to bonds and cash equivalents.

-

Ongoing Adjustments & Management

Once your investment advisor has created your initial strategy, they will need to monitor and adjust it as your life evolves and market conditions change. They will help you make adjustments as needed to keep your savings aligned with your goals.

What Does My Investment Manager Actually Do?

When implementing the investment management process, your investment manager will likely help you with the following:

Responsibility |

What it Does and Why it Matters |

| Asset Allocation | This is arguably the most important variable that impacts your long-term investment returns, with studies consistently showing its significance (Brinson et al., 1986). Asset allocation is the intentional mixture of different securities in your accounts.

Each type of asset you own should have a specific role. Some assets are more risky and are included for long-term growth. Other assets are more conservative and are designed to lower your risk and volatility. |

| Investment Selection | Most people hire an investment advisor for help selecting the right investments. Your investment manager will help you filter thousands of investment options to choose what fits your situation best. |

| Risk Management | Risk management ensures your portfolio is prepared to weather market downturns without jeopardizing your financial goals. Risks can be broadly categorized into two main areas:

Systematic This type of risk cannot be reduced through diversification. Examples of systematic risk include:

Unsystematic This type of risk generally can be reduced with proper diversification. Examples of unsystematic risk include:

|

| Rebalancing | This tactic keep your portfolio aligned with your asset allocation targets as the market moves. Your investment advisor may manually rebalance your account periodically or they might automate this on an annual or more frequent basis. |

| Tax Planning Strategies | Investment tax planning means coordinating your investments based on your tax situation to reduce what you owe in taxes long-term. Some examples of tax planning strategies that your investment advisor might use would be:

|

Example of Investment Management in Action

Imagine you're 58, with retirement on the horizon in the next 7 to 10 years. You’ve built up a large nest egg, but you’re unsure if your portfolio is positioned well. After assessing your situation and clarifying your goals, investment management for your situation might include:

- Diversifying your portfolio to include income-producing assets and low-risk holdings for stability during down markets

- Replacing your expensive mutual funds with low cost ETFs to improve your returns and taxes

- Creating a tax-efficient withdrawal strategy

A professional investment manager can help you move forward with confidence instead of second-guessing every market movement.

What Other Investment Management Concepts Should I Know?

Here are a few concepts that you might hear about when working with an investment advisor:

Diversification

This is a risk management strategy that involves spreading investments across various sectors, industries, and asset classes. It helps to minimize your risk by ensuring that poor performance in one area does not overly impact your portfolio. The term is sometimes used interchangeably with asset allocation, however diversification can be more complex.

Example: An investment manager can build you an asset allocation that is 60% stocks and 40% in bonds. To fill that asset allocation, the manager could choose 1 stock holding and 1 bond holding.

The asset allocation above would not be diversified. Success or failure of an individual holding could make an outsized impact on the portfolio return.

Active Investing

This involves regular buying and selling of securities with the goal of outperforming a specific market benchmark. An investment manager that attempts to predict the future performance of individual companies is likely an active investment manager. This type of investing tends to involve a high level of research and higher fees from your advisor.

Passive Investing

This strategy starts with the belief that predicting the future is impossible. Instead of trying to predict the returns of individual companies, a passive investor will likely purchase exchange traded funds (ETFs) that track major market indexes. There is no regular buying and selling in this approach and therefore less need for your advisor to charge high fees.

What Are the Common Forms of Investment Management?

Client-facing Investment management comes in a few common forms:

Traditional Investment Management

Investment management has traditionally been provided to individual investors by financial advisors. The financial advisor builds portfolios for you using securities like stocks, bonds, and exchanged traded funds (ETFs). They focus on achieving appropriate returns for you over time given your comfort with risk and your goals.

Historically, the traditional investment management advisor-client relationship has been centered around investment portfolios. Other types of financial planning advice can be included but often aren't.

Traditional Investment Management vs. Financial Planning, Wealth Management, and More

While investment management focuses on growing and protecting your investment portfolio, it's just one part of your overall financial picture. Here's how it compares to other financial services:

- Financial Planning - A comprehensive approach that includes retirement planning, tax strategies, budgeting, estate planning, and more. In many cases this service does not specifically include investment management.

- Wealth Management - Combines investment management with broader financial planning, often tailored to high-net-worth individuals.

- Brokerage Services - Features a platform to buy and sell investments but typically lacks personalized strategy or ongoing advice.

Understanding the differences between the various investment management services can help you choose the right program for your goals.

Institutional Investment Management

While this article focuses on investment management services tailored for you, the individual investor, it's worth noting the field also includes managing large institutional portfolios. Some examples of these include:

- Endowment or Pension Fund Management - Investment management can be performed for organizations like universities or charities that have a large endowment as well as private and public pensions.

- Hedge Funds - These are alternative investment vehicles for high-net-worth and institutional investors. They use pooled funds to employ advanced strategies including short-selling to achieve active returns. Because of their risk profile, they often charge high fees and have liquidity restrictions.

- Private Equity - This involves investing in private companies or buying out public companies to restructure and improve them. Private equity investments are illiquid and have a long-term focus. They aim for substantial returns through the growth and sale of businesses.

How Do Investment Managers Make Money?

Client-facing investment managers typically bill using the following fee structures:

Assets under Management Fees

Instead of charging commissions for individual transactions, this is a common way that fiduciary investment advisors bill for their services. An assets under management (AUM) fee is a stated annual percentage of the total assets that you invest with your advisor.

Example: If you invest $750,000 and your investment manager charges a 1% assets under management (AUM) fee, then you will pay $7,500 in a given year.

Fees are usually paid quarterly by dividing the annual percentage into 4. They are directly withdrawn from your invested accounts to cover the cost of investment management services.

According to the SEC, registered investment advisors have a fiduciary duty to act only in your best interest. The AUM billing model helps fulfill this duty by removing conflicts of interest around commissions for investment transactions.

Flat Fees & Annual Retainers

Growing in popularity and offered by investment managers that include financial planning services, your fees may be billed as a flat fee or annual retainer. This approach often covers both the cost of investment management and financial planning advice.

Flat fees or retainers can be $8,000+ and are often billed directly from your bank account in monthly or quarterly installments. Retainers tend to work well if you have a high amount of income and are willing to pay directly for advice.

Flat fees and retainers are typically charged by investment advisors who serve as fiduciaries similarly to those mentioned above who bill based on AUM.

Commissions & 12b-1 Fees

An older and less common method of charging for investment services is when an investment professional is paid in the form of commissions.

Investment professionals who are selling mutual funds may receive commissions and a small amount of recurring revenue in the form of 12b-1 fees. Often these investment professionals are not acting as fiduciaries. This means they are not acting in your best interest, instead serving as a sales professional.

What Are the Benefits of Investment Management?

Investment management offers several benefits:

Improved Financial Outcomes

Research from Vanguard suggests that professional investment advice including asset allocation, cost-effective implementation, and behavioral coaching, can potentially add about 3% in net returns annually over time. That’s a powerful difference, especially when compounded across a multi-decade retirement.

Professional Expertise

A well equipped investment advisor can provide you with the specific type of advice you are looking for. If you are in a high tax bracket, you might need an investment advisor who has a deep level of tax knowledge and experience with managing large portfolios. Alternatively, you may be in a low tax bracket, and benefit from working with an advisor who specializes in wealth accumulation and debt reduction.

As you look for an investment advisor, be sure to ask about their level of experience and training to make sure you are aligned with the right professional. Advisors that carry the following designations have undergone considerable training in investment management and personal finance:

- CERTIFIED FINANCIAL PLANNER® (CFP®)

- Chartered Financial Analyst® (CFA®)

- Certified Investment Management Analyst® (CIMA®)

Time Efficiency & Peace of Mind

Delegating investment management to a professional can save you time and mental stress. Your investment manager takes on the responsibility of research and trading, allowing you to enjoy more of your ideal retirement. It can be a relief knowing that your financial advisor is looking out for your best interest as they guide your investment strategy.

Contribution & Withdrawal Strategy

Your financial advisor can help you determine how much to contribute or withdraw from your portfolio as well as the potential tax impacts of these transactions. Managers can be very helpful in monitoring your withdrawals to make sure your income doesn’t run out.

What Are the Drawbacks of Investment Management?

While professional investment guidance has many advantages, keep these points in mind:

Costs vs. Value

Be sure that you understand all of the fees you will pay when working with your investment advisor. Ask about your AUM fees, any flat fees or retainers for financial planning, and your underlying investment expenses. The value of your personalized investment strategy, potential for appropriate returns, and behavioral coaching needs to justify the cost.

No Performance Guarantees

Past performance doesn't predict your future results. Even the most skilled investment managers cannot eliminate market risk or guarantee specific outcomes. Be extremely cautious if you hear an advisor promise specific returns or imply that they can help you predict future market downturns.

Finding the Right Fit

Trusting a professional with your life savings is a huge decision. You should choose an advisor whose philosophy, expertise, communication style, and fee structure align with your needs. Take your time and use tools like BrokerCheck® and the Investment Advisor Public Disclosure (IAPD) websites to review the regulatory history of any advisor you plan to hire.

Why You Need Professional Investment Management

Whether you are in your 60s and recently retired, or in your 50s and dreaming about when you can stop working, an investment advisor can help you with these challenges and opportunities:

- Reduce your exposure to unnecessary risk as you shift from saving to spending

- Build an income strategy to support you for 30+ years

- Help you avoid costly mistakes during critical retirement years

- Coordinate your investments with tax planning and Social Security timing

- And more...

Having a financial advisor during this phase can make a huge difference in your confidence and peace of mind.

Are you curious about what you should be considering with your investment portfolio? We've got you covered! Download our free checklist, "What Issues Should I Consider When Reviewing my Investments?"

Contact Stage Ready Financial Planning Today for Professional Insight on Your Wealth Goals

Now that you understand the key components of investment management, here’s how we can partner with you to simplify the process and bring clarity to your financial life.

At Stage Ready Financial Planning, we specialize in fee-only financial planning and investment management for retirement savers over age 50 in Dayton & Southwest, Ohio. Explore our full range of investment management services here.

Ready to take control of your investments? Take the first step toward confident investing and schedule your free intro call today.

FAQs

What is the main goal of investment management?

The primary goal of investment management is to achieve appropriate returns on investments relative to your goals and comfort with risk. Investment managers assist you with navigating contributions, withdrawals, and their tax impacts.

Is investment management the same as investment banking?

No, investment management focuses on managing client investment portfolios. Investment banking deals with raising capital, underwriting, and facilitating mergers and acquisitions for corporations.

About the Author

Joseph A. Eck, CFP®, is a financial planner and investment advisor passionate about helping retirement savers achieve their financial goals. With years of experience in retirement planning, and investment management, Joseph provides personalized guidance and support to clients in Dayton and Southwest Ohio. He believes that everyone deserves to have clarity and peace of mind knowing they’ve made the best decisions surrounding their investments and retirement income. Click here to learn more about Joseph.

Article References

- "Quantifying the evolution of advice and its value to investors," Vanguard, corporate.vanguard.com: https://corporate.vanguard.com/content/corporatesite/us/en/corp/articles/quantifying-evolution-advice-and-value-investors.html#:~:text=Unfortunately%2C%20it%20has%20also%20led%20many%20to,annual%20fees%20deducted%20for%20the%20advisory%20relationship.&text=Using%20the%20framework%20for%20advisors%20outlined%20in,help%20advisors%20differentiate%20their%20skills%20and%20practice.

- "Overview of the Regulation of Investment Advisers (April 2012)," U.S. Securities and Exchange Commission, sec.gov: https://www.sec.gov/about/offices/oia/oia_investman/rplaze-042012.pdf

- "CFP Board | Certified Financial Planner Board of Standards, Inc.," CFP Board, cfp.net: https://www.cfp.net/

- "CFA Institute | Empowering Investment Professionals," CFA Institute, cfainstitute.org: https://www.cfainstitute.org/

- "Determinants of Portfolio Performance," Gary P. Brinson, L. Randolph Hood, & Gilbert L. Beebower (1986), Financial Analysts Journal (via JSTOR), jstor.org: https://www.jstor.org/stable/4478947

- "Investment Adviser Public Disclosure (IAPD) - Homepage," U.S. Securities and Exchange Commission (SEC), sec.gov: https://adviserinfo.sec.gov/

- "BrokerCheck Report," FINRA, finra.org: https://brokercheck.finra.org

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.