If you are considering hiring a financial advisor that is a fiduciary, then you might consider looking for a fee-only professional. Fee-only financial planning benefits include fee transparency, no commission based selling, and a strict fiduciary duty to clients.

Below, we’ll explore the reasons why hiring a fee-only financial planner might be the right choice for you.

What Is a Fee-Only Financial Planner?

A fee-only financial planner is a financial professional who is compensated solely through fees paid by their clients. They do not receive commissions or incentives for selling financial products. This fee model improves the likelihood that your advisor provides you with objective advice that aligns with your goals.

Fee-only advisors usually charge the following types of financial planning fees:

- Flat fees

- Annual retainers

- Hourly fees

- A percentage of assets under management (AUM) deducted out of your investment accounts.

In each of these fee structures, you pay directly for advice. You can transparently see the fee on your statement or as a deduction from your bank account.

However, paying your fee-only advisor directly does not eliminate all conflicts of interest. Fee-only advisors charging a percentage of AUM may face conflicts when making recommendations that could decrease your investment balances, ultimately lowering their fee.

What Are the Different Types of Financial Planners?

Before we dive into the benefits, it’s helpful to understand the common types of financial advisors you will likely come across:

Fee-Only Financial Planners:

- You pay them directly for financial planning or investment management. They don’t earn commissions from selling you products and act solely as fiduciaries.

- If your advisor is fee-only, they will likely advertise this on their website and marketing materials.

Fee-Based Advisors:

- They are able to charge fees for financial planning or investment management but also earn commissions for selling products including life insurance policies and annuities.

- When they are acting as sales professionals, fee-based advisors are usually not acting in a fiduciary capacity. This rotation between being a fiduciary and not being a fiduciary is commonly referred to as the “dual hat” situation.

- Without asking directly, you might not know if your advisor is fee-based instead of operating under the fee-only model.

Commission-Based Advisors:

- These advisors make money by selling financial products, which can create additional conflicts of interest. These advisors commonly sell life insurance, long-term care insurance, annuities, and sales-loaded mutual funds.

- A commission-based advisor will typically offer advice around the purchase of a particular product. When the product sale is completed, a third-party company will pay the advisor instead of you.

- Without directly asking them, you may not know if your advisor is commission-based.

While a great financial advisor of any fee model can offer valuable advice, fee-only financial advisors stand out for their dedication to acting in your best interest. They adhere to the fiduciary standard, ensuring that your financial plan is not influenced by product sales.

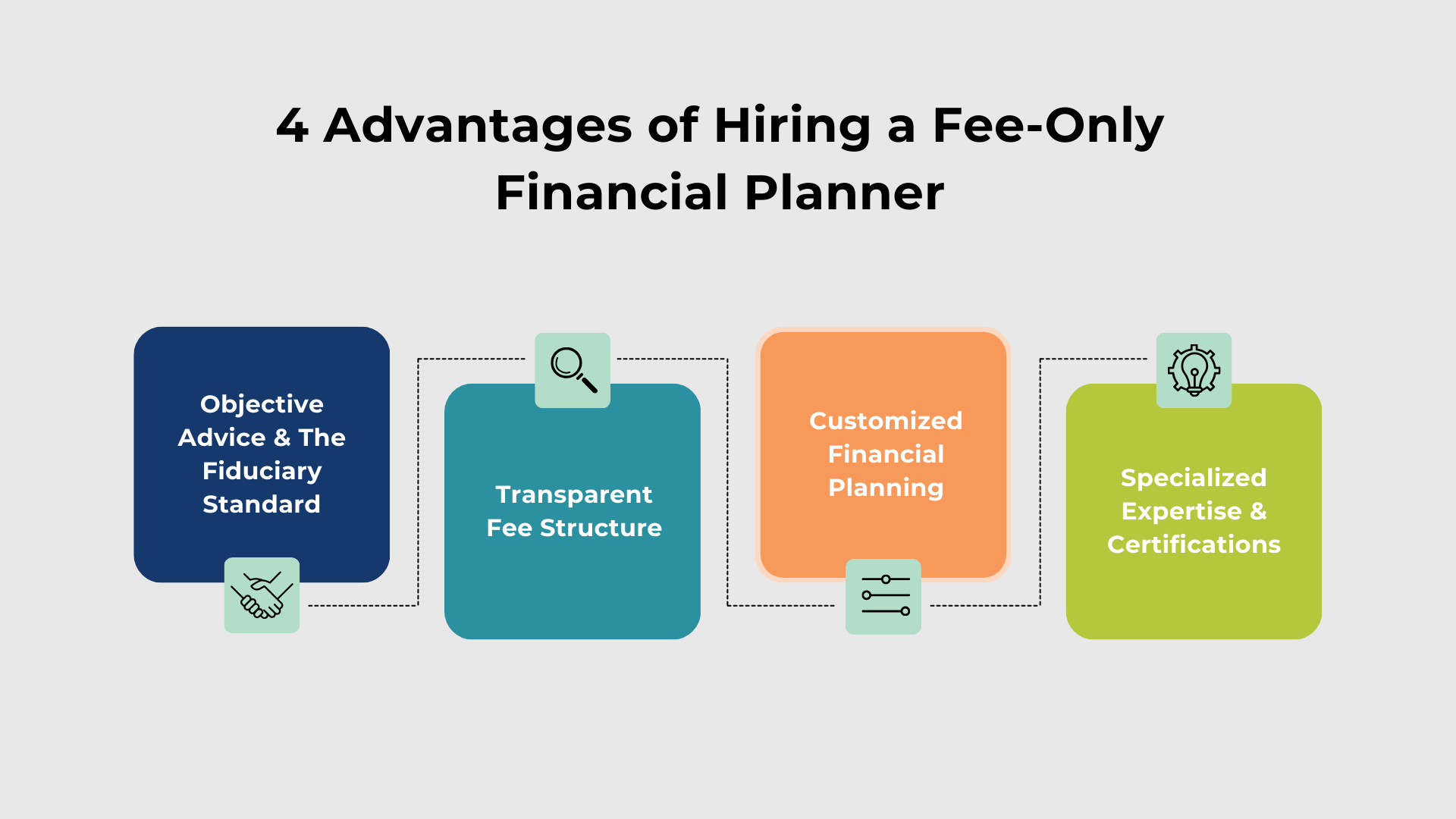

4 Advantages of Hiring a Fee-Only Financial Planner

1. Objective Advice & The Fiduciary Standard

One significant advantage of hiring a fee-only financial advisor is their commitment to the fiduciary standard. They are legally required to provide advice that serves your best interest.

Fee-only planners do not earn commissions for selling products. This enhances the likelihood that your advisor offers objective advice, especially regarding risk management and insurance planning.

As noted earlier, fee-only advisors may collect fees from your investment accounts. Therefore, conflicts of interest can still arise when recommending actions that might reduce your investment balances.

2. Transparent Fee Structure

Another reason to choose a fee-only financial planner is their clear fee structure. Fee-only financial advisors typically charge a flat fee, annual retainer, hourly fee, or a percentage of your assets under management (AUM). This transparency allows you to know precisely what you’re paying and for what services.

In contrast, advisors who earn commissions are compensated by third parties after a sale, which can complicate and confuse clients.

3. Customized Financial Planning

A fee-only advisor doesn’t sell products for a living, instead they primarily offer comprehensive financial planning. Financial planning is a service designed to help you reach your goals and includes advice on your:

- Spending & saving

- Debt elimination

- Retirement planning

- Investments

- Tax planning

- Risk management & insurance

- Employer benefits

- Estate planning

- And more…

Comprehensive financial planning services ensure that all aspects of your financial life are aligned with what matters most to you.

4. Specialized Expertise & Certifications

Many fee-only financial planners specialize in serving specific client demographics. For instance, some may focus on divorced women over 50 and hold the Certified Divorce Financial Analyst (CDFA®) certification.

Others may specialize in advanced tax planning for tech employees with complicated stock options and carry designations like Enrolled Agent (EA) or Certified Public Accountant (CPA).

Every financial situation is different, which is why it’s so important to have a personal financial advisor who customizes advice specifically to your life.

How to Choose the Right Fee-Only Financial Planner for You

Now that you know some benefits of hiring a fee-only financial planner, how do you find the right one? Here are a few tips to consider:

See How Stage Ready Financial Planning Can Offer Services Tailored to You

At Stage Ready Financial Planning, we specialize in fee-only financial planning for individuals and couples over age 50 in Dayton & Southwest, Ohio. We prioritize objective advice and your best interest at every step of your retirement journey.

With our transparent fee structure, there are no surprises. We help you create a clear and easy to understand plan so that you can retire with confidence, align your investments with your goals, and live your ideal retirement lifestyle. Schedule your intro call today!

FAQs

Is a fee-only financial advisor better?

The quality or your financial advisor is driven by their experience and training. In any fee model, you can receive great recommendations from your financial advisor.

A fee-only financial advisor can be better for those seeking objective, transparent advice and are not looking to have their advisor sell them financial products, such as insurance policies.

Is a 1% fee high for a financial advisor?

A 0.5% to 1.5% annual fee based on AUM is common among many financial advisors. It’s important to consider what services you’re receiving for that fee, especially if you have large investment account balances.

A 1% fee could be considered high if the only services provided were investment selection and asset allocation. If you are receiving comprehensive financial advice in every area of your financial life, this cost may be more reasonable.