Dreaming of how free you’ll feel if you can pay off your car and mortgage before you retire? Can’t wait to be able to enjoy more of your income instead of seeing it swallowed up by debt payments? The good news is that a debt-free retirement is absolutely an achievable goal, especially if you live in Dayton or Southwest, Ohio. Thanks to our extremely affordable cost of living and housing, you have the opportunity to knock out your debt and live comfortably.

In this article, we’ll discuss key concepts and strategies you need to know about retiring debt free.

What Exactly Is a Debt-Free Retirement?

A good way of thinking about debt is acknowledging the reality that you are paying today for yesterday’s wants and needs. When you take out a loan, you are essentially betting that you will be able to pay tomorrow for the item you can’t afford today. For example, you need to buy a new car but don’t have $30,000 sitting in your bank. Instead you take out a loan, hoping you can pay off that $30,000 plus interest in the future.

The problem is that debt payments can really eat into your spending power when you have to live off your own savings in retirement. Many people retire and pay themselves less than they were making when they were working. If you have less income in retirement to begin with, how tight will your spending feel if you still have debts to pay back?

Example: This chart shows the impact of having no debt in retirement compared to a retiree with a mortgage, car payment, and credit card debt.

| Ohio Retiree with Debt | Ohio Retiree with No Debt | |

| Social Security Income | $3,000 | $3,000 |

| Investment Distributions | $5,000 | $5,000 |

| Total Monthly Income | $8,000 | $8,000 |

| Regular Living Expenses | ($5,400) | ($5,400) |

| Mortgage Payment (PITI) | ($1,400) | ($600) |

| Car Loan Payment | ($400) | ($0) |

| Credit Card Payment | ($800) | ($0) |

| Total Monthly Expenses | ($8,000) | ($6,000) |

| Monthly Retirement Freedom | $0 | $2,000/mo or $24,000/yr |

The retiree with no debt has more freedom to spend monthly and they can easily weather a stock market downturn that affects their income.

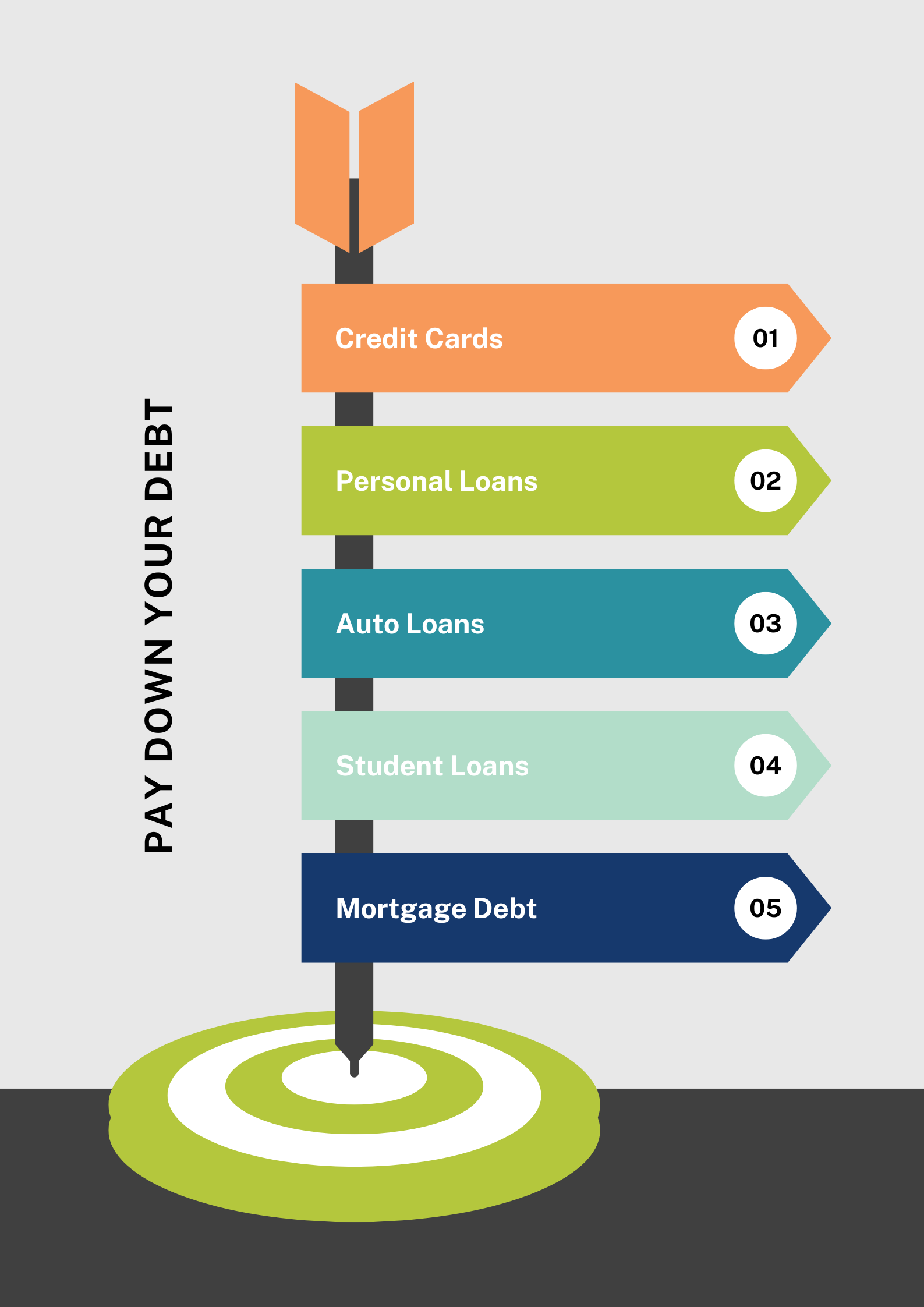

Entering your retirement without the burden of ongoing debt payments like credit cards, personal loans, medical debt, or a mortgage can be a game changer. Less debt in retirement means more peace of mind with your spending and ability to handle unexpected costs.

Why Is Retiring Debt-Free Important for Financial Freedom and Security?

When you retire and begin to live on a fixed income, you will find it easier to manage your expenses without the weight of loans. This is especially true if you have “bad debt or high interest debt like credit cards, medical bills, and personal loans. A 2024 article from The National Council on Aging states that the two biggest areas of debt for seniors and retirees include “bad debt” categories: Credit Cards and Medical Bills.

Key reasons to plan for a debt-free retirement

- Freedom to spend on what matters to you today

- Reduces pressure on your retirement savings, especially in volatile market conditions

- Your ability to tackle unexpected expenses, like house repairs or new cars

Living your ideal retirement lifestyle should mean enjoying your retirement savings by spending freely rather than paying yesterday’s wants.

How to Retire Debt-Free

1. Assess Your Current Debt

The first step is to build a clear picture of your current obligations. From credit card debt to student loan debt, create a list of your loans.

Next to each debt, write down:

- The loan balance

- The interest rate

- The minimum monthly payment

- The amount you are currently paying monthly on the debt.

This list should include ALL of your debts including any lingering car loans, personal loans, or mortgage payments.

Building this list will help you begin to strategize because not all debt has the same impact on your finances and credit. Understanding the distinction between ‘good debt’ and ‘bad debt’ is helpful when creating your debt elimination strategy.

‘Good debt’ usually refers to loans for assets that can build wealth over time or have tax advantages, such as a mortgage (where interest might be tax deductible) or student loans (which are an investment in your future earning potential). Conversely, ‘bad debt’ typically involves high-interest loans and debts on depreciating assets, like credit card balances, personal loans, or medical debt. ‘Bad debts’ can damage your financial health rapidly due to their compounding interest and the fact that they offer no long-term asset value. Prioritizing the elimination of ‘bad debt’ can immediately free up cash flow and reduce your financial stress in retirement.

2. Implement Strategies to Intentionally Pay Off Debt

Once you’ve compiled your debt list, the next step is to develop a plan to pay them off. Some common effective methods include:

Snowball Approach:

This strategy involves paying off your smallest debt first. Beyond the numbers, the snowball approach can offer you a significant mental boost. Eliminating smaller debts quickly can provide you with a much needed sense of accomplishment, motivating you to stay disciplined as you knock out your loans.

- This strategy focuses on paying off your smallest loan first, building momentum as you work toward larger debts.

- Consider paying the minimum amount on all of your debts except the loan with the smallest balance. Pay as much extra as possible on this one.

- Once the smallest loan is paid off, you would then apply everything you were paying to the next smallest loan.

| Debt | Car Loan | Student Loan | Credit Card | Credit Card |

| Balance | ($18,000) | ($21,000) | ($8,000) | ($9,500) |

| Interest Rate | 4.25% | 6.21% | 23.99% | 24.99% |

| Minimum Payment | ($275) | ($400) | ($150) | ($175) |

| Your Payment | ($300) | ($500) | ($200) | ($200) |

| Snowball Approach | ($275) | ($400) | ($350) | ($175) |

| Difference | ($25) | ($100) | $150 | ($25) |

Avalanche Approach:

This strategy involves paying off your highest interest rate first. While the snowball approach focuses on psychological wins, the avalanche approach is the more mathematically optimized strategy. By prioritizing the highest interest rates, you minimize the total interest paid over the life of your debts, leading to additional financial savings. This approach can free up more savings in the long run, although it may take longer to see the first debt completely eliminated.

- This strategy focuses on paying off your highest interest rate first, building momentum as you work toward debts with lower interest rates.

- Consider paying the minimum amount on all of your debts except the loan with the highest interest rate. Pay as much extra as possible on this one.

- Once the highest interest rate loan is paid off, you would then apply everything you were paying to the loan with the next smallest interest rate.

| Debt | Car Loan | Student Loan | Credit Card | Credit Card |

| Balance | ($18,000) | ($21,000) | ($8,000) | ($9,500) |

| Interest Rate | 4.25% | 6.21% | 23.99% | 24.99% |

| Minimum Payment | ($275) | ($400) | ($150) | ($175) |

| Your Payment | ($300) | ($500) | ($200) | ($200) |

| Avalanche

Approach |

($275) | ($400) | ($150) | ($375) |

| Difference | ($25) | ($100) | ($50) | $175 |

Debt Consolidation Loan:

Consider exploring a debt consolidation loan to combine multiple high-interest debts into one.

- There are consequences of consolidating government-sponsored debt such as federal student loans into private consolidation loans. Consolidation can potentially eliminate government benefits that reduce or waive student loans in the future.

- Consolidation isn’t always the answer. Sometimes it’s tempting to use balance transfers or loan consolidations as a way of delaying loan payoff.

While debt consolidation can simplify your payments and potentially reduce your interest rates, it’s important to weigh the benefits against potential drawbacks. For example, consolidating your high-interest credit card debt into a lower-interest personal loan might accelerate your payoff. However, you should be cautious of extended repayment terms as they might lead to paying more interest over time. Also, a consolidated loan may also have different fees or collateral requirements than your original debts.

Be wary of using consolidation as a temporary fix without taking the time to address your underlying spending habits. Debt consolidation is a strategic move best considered with a clear understanding of your financial behavior and long-term goals and with the help of a professional.

Downsizing:

Consider selling your expensive or appreciated home and use the proceeds to pay off your home equity loan or other debts to prepare for a more affordable and debt free retirement. This concept also applies to vehicles or property you’ve outgrown.

While downsizing can free up significant cash flow, consider your emotional attachment to your home and the potential transaction costs involved in selling and buying. For some people, the emotional benefits of staying in their current home outweigh the financial gains of a smaller mortgage.

3. Maximize Your Retirement Savings at the Same Time

While paying off debt is important, you shouldn’t neglect your retirement savings. Make sure to continue contributing to retirement accounts like your 401(k) or IRA to ensure that you have enough saved to sustain you once you’ve paid off all debts.

Some experts recommend paying off all of your debt before you begin investing. The power of compound interest kicks in after you’ve invested for a long period of time. The longer you delay saving, the harder it is for your investments to build momentum later in life.

At the bare minimum, you might consider contributing enough to your 401k to capture your full employer match. This is often considered ‘free money’ that you forgo if you skip retirement contributions.

You might even consider delaying your retirement by a few years. This can be a powerful way to knock out your debt and allow more time to maximize your retirement savings.

4. Avoid New Debt During Retirement

Because having debt can be a vicious cycle, it’s important to limit taking on any new debt in retirement.

Consider keeping credit card usage to a minimum and avoid large purchases that could lead to new monthly payments. If you don’t have the cash in your bank to pay the full balance of your credit card, then try to avoid spending on your card until you do. In the meantime, only spend using your debit cards or with cash.

When you pay off your loans consider setting up an automatic monthly savings of the same amount you were paying on your debts. This will help you create a healthy emergency fund to cover future unexpected costs. This can also help you create a reserve to pay cash for your next car purchase, medical bill, or home repair.

Additionally, you might also consider exploring part-time work, consulting, or monetizing a hobby in retirement if you feel like you need more income. This can help you avoid building unnecessary debt and create more freedom with your ability to spend.

5. Utilize Professional Help

Seeking help from a debt management professional or financial planner can help you optimize your debt repayment plan. These professionals can help you navigate various strategies like exploring unsecured loans or advanced student loan repayment plans.

A CFP® professional, for instance, adheres to rigorous ethical and educational standards. Their comprehensive perspective can be extremely helpful when navigating complex decisions like debt repayment and boosting your retirement savings.

Reputable debt management services for Ohio residents include:

At Stage Ready Financial Planning, our deep understanding of the local economic landscape in Dayton and Southwest Ohio allows us to craft debt repayment and retirement savings strategies that are tailored to your financial environment. We offer local knowledge, combined with our extensive experience in navigating retirement planning.

Consulting with an expert will help you feel confident that you’re making the best choices to create a debt-free retirement.

Navigating Obstacles on Your Path to a Debt-Free Retirement

Achieving a debt-free retirement is absolutely possible, but the path there can come with some challenges. Expect these common hurdles so that you can stay on track when they arise:

- Unexpected Expenses: Life has a way of throwing us curveballs. A sudden medical emergency or a major home repair can derail even the best planned debt repayment schedule. Building your emergency fund alongside your debt payoff efforts is vital to prevent new debt from accumulating.

- Market Volatility and Investment Decisions: Balancing your debt repayment with retirement savings can feel like a tightrope walk. During periods of market uncertainty, you might be tempted to divert your retirement contributions to your debt. However, maintaining a consistent investment strategy, especially when employer matching contributions are available, is really important for benefiting from the power of compound interest.

- Mental Fatigue: Paying off debt can be a long and fatiguing process. Celebrate your small wins! Remind yourself regularly of your ‘big why,’ and periodically review your progress to help you maintain motivation.

- Information Overload and Conflicting Advice: The internet is filled with financial advice, some of it is great and some not so much. It can be hard to discern the best strategies for your particular situation. This is where professional guidance can be really helpful, offering you clarity and a personalized roadmap.

Your Action Plan: Taking the First Steps Towards a Debt-Free Retirement

Ready to take control of your debt? Here’s a summary of the actionable steps to begin your journey towards a debt-free retirement:

- List All Your Debts: Get a clear picture of what you owe, including balances, interest rates, and minimum payments.

- Choose Your Strategy: Decide if the Debt Snowball (for psychological wins) or Debt Avalanche (for maximum financial savings) is right for you. Also explore consolidation and down-sizing.

- Continue Retirement Savings: Keep contributing to your retirement accounts, especially to capture any employer match.

- Build Your Financial Buffer: Establish an emergency fund to handle unexpected costs without incurring new debt.

- Seek Expert Guidance: Consider a financial planner or debt management professional to create your personalized plan.

Get One Step Closer to Retirement with Stage Ready Financial Planning

At Stage Ready Financial Planning, we specialize in helping Dayton & Southwest, Ohio residents who are 50 and older prepare for a debt free and financially secure retirement.

We will assess your current situation and guide you through steps to eliminate your bad debt, boost your retirement savings, and maximize the tax advantages available to you.

We partner with you to ensure you’re ready to retire successfully, invest with confidence, and reduce your tax liabilities. Schedule your intro call today!

FAQs

Can you retire if you are debt-free?

Potentially. Retiring debt-free offers greater financial flexibility and security. Without monthly debt payments or interest payments draining your resources, you can enjoy more of your retirement savings and weather unexpected expenses.

It’s important to note that being debt-free is one part of being prepared for retirement. You must also have enough retirement savings to live comfortably, the ability to pay for retiree healthcare, and be mentally prepared for how you will spend your time to create fulfillment.

What age should you be debt-free?

The sooner you can be debt-free, the better. If possible, you should aim to be debt-free before retirement. The age you choose for when you retire will likely be determined by how soon you can pay off debt, create enough retirement savings, and have the healthcare coverage you need.

If you can’t pay off all of your debt before you retire, consider at least paying off high-interest loans, such as credit card debt, medical bills, personal loans, or car loans.

About the Author

Joseph A. Eck, CFP®, is a financial planner committed to helping people live a debt-free retirement. He understands that where you live significantly affects your overall retirement satisfaction and financial well-being. With extensive experience in retirement planning, Joseph offers personalized guidance and support to clients in Dayton and Southwest Ohio. He empowers retirement savers to achieve their financial goals, eliminate their debt, and build a fulfilling life in their ideal Ohio community. Click here to learn more about Joseph.

Article References

- OhioMeansJobs. Cost of Living. Retrieved from https://www.jobsohio.com/why-ohio/living-here/cost-of-living

- National Council on Aging. Get the Facts on Senior Debt. Retrieved from https://www.ncoa.org/article/get-the-facts-on-senior-debt/

- Ramsey Solutions. How the Debt Snowball Method Works. Retrieved from https://www.ramseysolutions.com/debt/how-the-debt-snowball-method-works?srsltid=AfmBOorsqs56dwFTqoHcnHcJos6L-ltbATQGjHh2bNSBBVXSdXyCjA3k

- CNBC Select. Debt Snowball vs. Debt Avalanche. Retrieved from https://www.cnbc.com/select/debt-snowball-vs-debt-avalanche/

- National Foundation for Credit Counseling (NFCC). Retrieved from https://www.nfcc.org/

- InCharge Debt Solutions. Ohio Debt Relief. Retrieved from https://www.incharge.org/debt-relief/credit-counseling/ohio/

This communication is for informational purposes only and is not intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results.